Consumer discretionary stocks are the worst-performing sector of the S&P 500 index this year, amid soaring inflation, strained global supply chains and plummeting consumer sentiment.

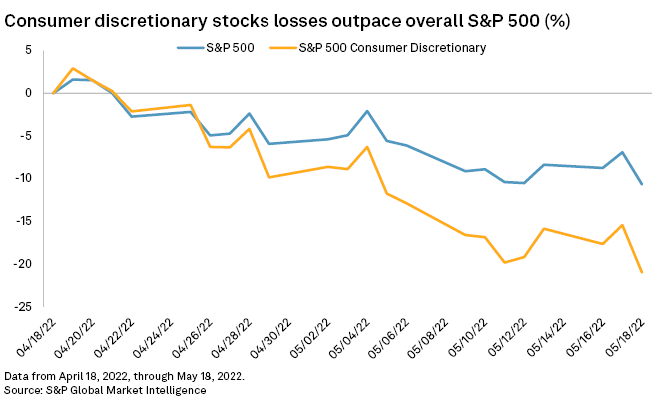

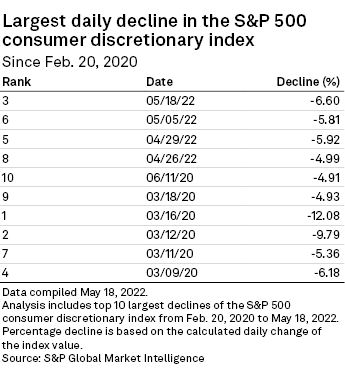

The sector fell 6.6% on May 18, the largest decline since mid-March 2020, when fears of COVID-19 impacts created a sell-off. The S&P 500 consumer discretionary index has tumbled 30.8% since the start of the year, compared to 17.7% for the larger S&P 500. Over the past month, the consumer discretionary sector has fallen 21%, compared to the 10.7% decline the broad index has seen.

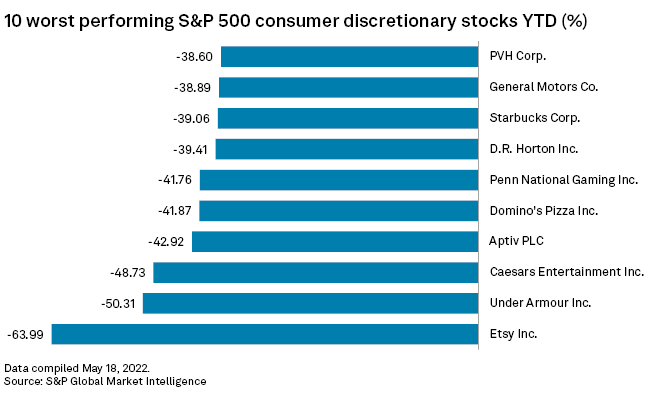

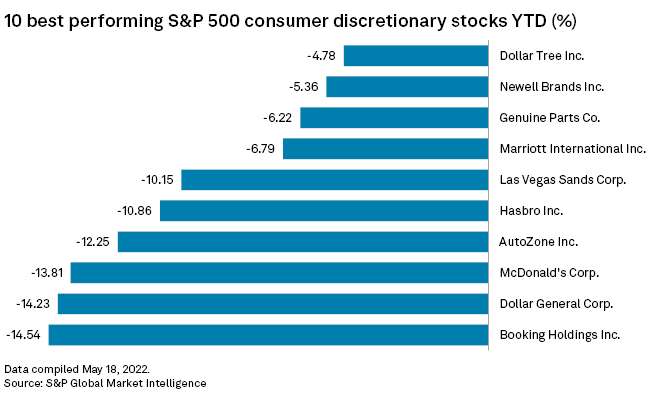

All of the consumer discretionary sector's stocks have lost ground since the start of 2022, with Etsy Inc., Under Armour Inc. and Caesars Entertainment Inc. falling the most.

Amazon.com Inc. and Tesla Inc., the sector's two largest companies by market cap, have declined 35.8% and 32.8%, respectively, since the start of the year.

"These stocks are just getting beat up brutally," said John Stoltzfus, chief investment strategist with Oppenheimer Asset Management, in an interview.

Supply distortions, exacerbated by China's ongoing zero-COVID policy and the war in Ukraine, have particularly hurt the consumer discretionary sector, Stoltzfus said, adding that the sector will likely remain under heavy selling pressure until the Federal Reserve's shift in monetary policy begins to curb inflation.

Consumer discretionary comprises companies that manufacture goods or provide services that consumers want but do not necessarily need. The sector has been a growing target for short sellers, who bet climbing inflation would eat into demand for nonessential spending.

With its 30.8% slump this year, the sector outpaces declines of 27% for communication services and 24.5% for information technology. Energy, the best performing sector this year, is up 46.2% thanks to rising commodity prices.

Target Corp. this week laid out the challenges facing the consumer discretionary sector. The retailer highlighted higher wages and rising freight costs as well as a glut of inventory caused by consumers contending with higher prices for food and other essential items. Walmart Inc., in the consumer staples sector, voiced similar concerns.

"Consumers are starting to tighten their belts and switch from discretionary items to staples such as food," said Tom Essaye, a trader and editor of the Sevens Report.

Target lost 34.3% in the month through May 18, while Walmart was down 22.3%.

"It looks like Wall Street was a little too optimistic about the U.S. consumer and with the peak of inflation," said Edward Moya, a senior market analyst with OANDA. "Growth concerns will dominate the focus for the next several weeks and that will continue to weigh on consumer discretionary stocks."