Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

4 Oct, 2022

By Drew Wilson and Annie Sabater

High inflation, the decline in public markets and expectations of a recession are the likely factors pressuring consumer discretionary, which was the highest risk sector for the second consecutive quarter, according to risk measurement data from S&P Global Market Intelligence.

Public sector risk can be particularly important to private equity because risk tends to move valuations, affecting timing for IPO exits and take-private deals as well as identifying buying opportunities and anticipating pressure on portfolio companies.

In the third quarter, private equity was involved in 22 deals in the consumer discretionary sector in the U.S., compared to 452 deals when looking at overall M&A in the sector, according to Market Intelligence data. The largest disclosed private equity transaction in the third quarter was Kennedy Lewis Investment Management LLC's proposal to acquire 85.4% of F45 Training Holdings Inc. for about $340 million.

Sector risk measurement

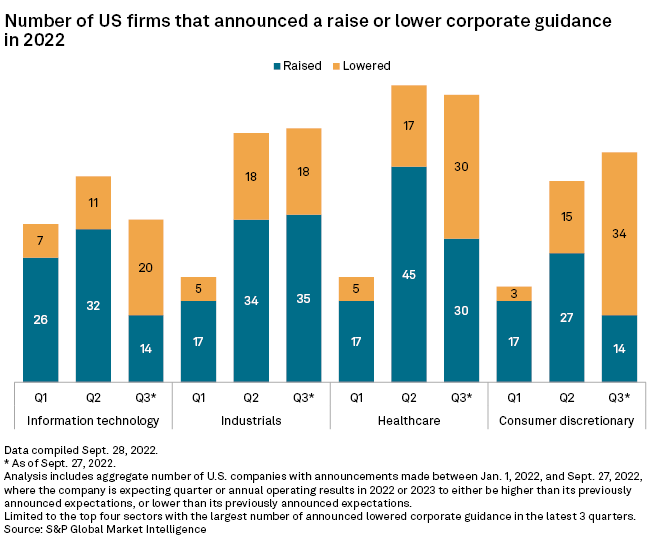

Market Intelligence used three risk criteria — corporate guidance, short interest and probability of default — to look across 11 sectors representing 4,238 companies and filter out the four with the highest potential investment risk.

Consumer discretionary, which comprises industries with strong sensitivity to economic cycles, scored the highest on two out of three risk factors — the proportion of lowered corporate guidance and the rise in short interest. Companies in the sector that lowered corporate guidance more than doubled quarter over quarter to 34 and soared 10 times compared to the first quarter.

Average short interest in consumer discretionary remains high above all measured sectors for the last five quarters, indicating ongoing bearish sentiment.

Healthcare ranked as the sector with the highest median probability of default, as it has for about 12 months.

The data calculates a one-year probability of default by measuring credit risk based on market-derived signals like stock price movements and asset volatility from an individual company's perspective.

Consumer discretionary ranked as the fourth riskiest using this metric, though it also shows an increasing 12-month trend.

Real estate had the highest median probability of default trend when measuring the quarter ended Sept. 26 against the previous quarter.