Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

10 May, 2022

By Bill Holland

A shareholder proposal that would have required ConocoPhillips to set carbon emissions goals in compliance with the Paris Agreement on climate change failed, receiving 39% of shareholder votes May 10.

The proposal, sponsored by Dutch climate group Follow This, received fewer votes at this year's ConocoPhillips annual meeting than the 58% majority a milder proposal received in a poll in 2021. Global oil and natural gas prices have risen dramatically in 2022, partly due to Russia's invasion of Ukraine on Feb. 24 and related trade sanctions.

|

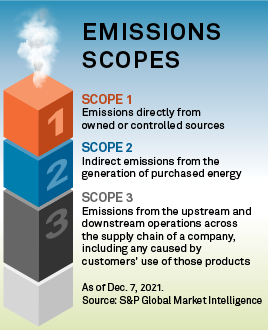

The 2022 ConocoPhillips emissions proposal called for the company to align itself with the Paris climate agreement, which has a target of limiting global warming to 1.5 degrees C, and to set specific goals to be net-zero in carbon emissions by 2050 across Scopes 1, 2 and 3.

Last year's proposal by Follow This called for the company to set emissions reduction targets. ConocoPhillips set targets following the 2021 vote for Scope 1 emissions, which are emissions from its own operations, and Scope 2 emissions, which are emissions linked to the purchase of electricity, heat and cooling, but the company did not set Scope 3 targets. Scope 3 covers emissions from the use or consumption of a company's products and other indirect emissions from the company's value chain.

Follow This blamed the lower vote for the recent proposal on its specific nature, which moved the goal line from a general emissions reduction to Paris-compliant goals. The activists also said the oil company's investor base may have fewer climate-conscious shareholders because of disinvestment and said Conoco may have succeeded in convincing shareholders that exploration and production companies, or E&Ps, should not be subject to Scope 3 emissions goals.

The companies that make up the upstream U.S. oil and gas industry are almost unanimous in their stance that regulatory and fiscal moves are critical to lowering carbon emissions. The sector endorses a carbon tax to make consumers pay for their carbon emissions, not the manufacturer.

In contrast, almost all European and Canadian producers have pledged to achieve net-zero emissions across all scopes by 2050.

"A significant 39% of shareholders urges ConocoPhillips to set meaningful targets for all emissions," Follow This founder Mark van Baal said in a statement. "Without a target to decrease the emissions of its products (Scope 3) Conoco is further from Paris-alignment than any oil major, except [Exxon Mobil Corp.]."

"While we recognize many stockholders are concerned about Scope 3 end-use emissions, the vote supports our view that setting a Scope 3 target is not the right solution for an E&P company with transition-oriented portfolio and production," ConocoPhillips spokesperson Dennis Nuss said in an email.

S&P Global Commodity Insights produces content for distribution on S&P Capital IQ Pro.