Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

27 Sep, 2021

By Asad Jafri and Rehan Ahmad

Germany's large banks are among the least efficient in Europe, data from S&P Global Market Intelligence shows.

|

In a sample of the continent's 50 largest banks by assets, the four with the highest cost-to-income ratios at the end of the second quarter included three German lenders.

Commerzbank AG reported a ratio of 107.09%, up more than 30 percentage points from 70.75% a year ago, and the highest among European peers. The bank said the rise was caused by restructuring-related costs of €976 million. Under its "Strategy 2024," Commerzbank aims to achieve an operating profit of €2.7 billion and a roughly 5% return on equity in 2024 via aggressive reorganization, which includes an 80% headcount reduction and the closure of 190 branches by the end of 2023.

Fellow German lender Norddeutsche Landesbank Girozentrale had the third-highest efficiency ratio of 85.71% at the end of June, while Deutsche Bank AG's ratio saw a 544 basis point improvement on an annual basis but was still the fourth-highest. The cost-to-income ratio measures the cost of running a business as a proportion of operating income, and lower ratios indicate a more profitable business.

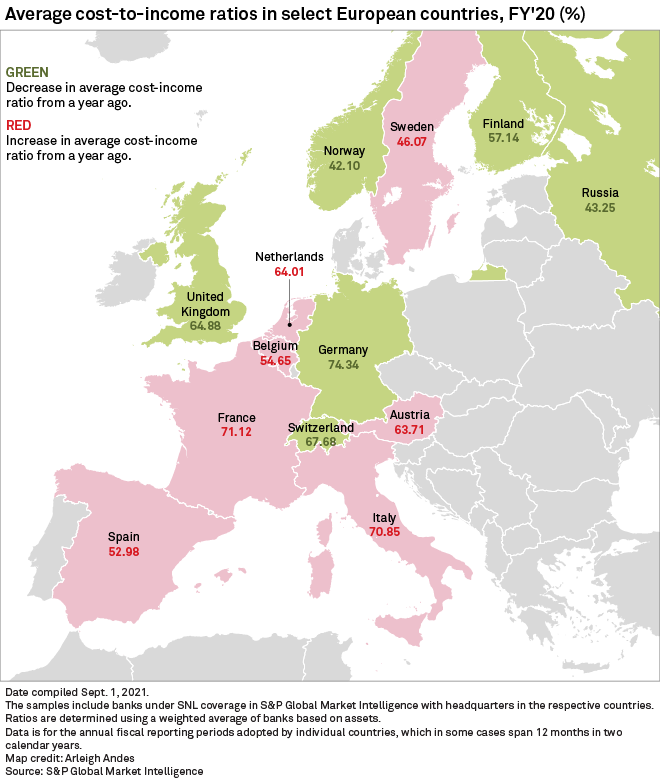

On an aggregate basis, German banks also had the highest average cost-to-income ratio among select European countries at the end of 2020, at 74.34%. Norway reported the lowest average efficiency ratio in the sample, of 42.10%.

European banks' efficiency ratios vary greatly across the region and are dependent on various factors such as market competitiveness, labor laws, population densities and the speed of digital banking adoption, according to S&P Global Ratings research.

Swedish banks Skandinaviska Enskilda Banken AB (publ) and Swedbank AS had among the lowest ratios in the sample. But Russia's Sberbank of Russia and VTB Bank PJSC had the lowest, at 31.52% and 36.11%, respectively. Overall, Russian banks' average cost-to-income ratio stood at 43.25% at the end of 2020 and was the second-lowest in Europe.

Sber posted record profits in the first half, and it attributed its success partly to its artificial intelligence-driven approach to cost-efficiency and digitalization. A little under 70% of its 100 million customers use its online services at least once a month and the lender plans to leverage this to expand into areas outside banking, such as e-commerce.

Denmark's Nykredit A/S was the third most efficient European bank in 2020 with a ratio of 39.36%, despite an almost 10 percentage point rise on an annual basis from 29.04%.

Credit Suisse Group was the second least efficient bank on the list, with a cost-to-income ratio of 88.98%. The Swiss lender is contending with the fallout from its involvement with stricken firms Archegos and Greensill, and booked substantial losses and provisions as a result.