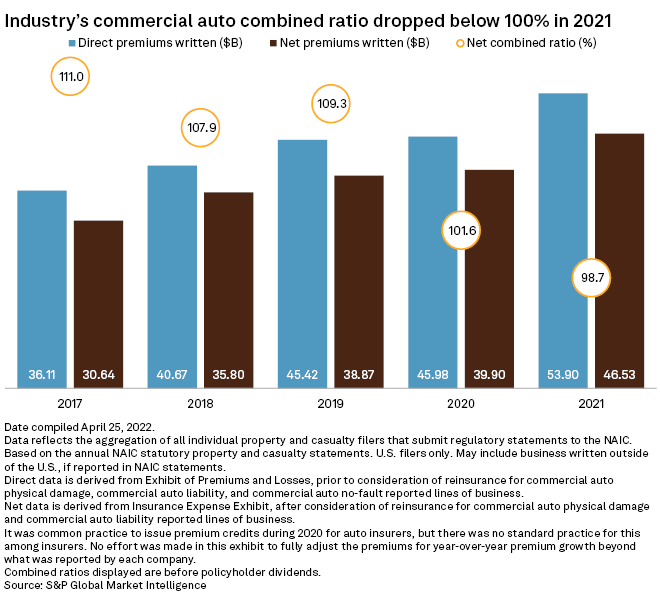

The largest commercial auto insurers posted the lowest average combined ratio and the highest combined direct premiums written and net premiums written in 2021 in the last five years, according to an S&P Global Market Intelligence analysis.

Premiums jump, combined ratios improve for many big names

Direct premiums written for the companies included in this analysis jumped to $53.90 billion; net premiums written increased to $46.53 billion. This represented a steady rise over the previous five years, from $36.11 billion for direct premiums written and $30.64 billion for net premiums written in 2017.

Momentum continued in the first quarter of 2022, with The Travelers Cos. Inc.'s net written premiums rising 11% year over year to $8.37 billion from $7.51 billion. The company's business insurance segment recorded net written premiums of $4.50 billion, up 9% from $4.13 billion a year earlier, which Travelers said reflected strong renewal premium change and retention, as well as higher levels of new business.

UBS analyst Brian Meredith views the strong premium growth at Travelers as a positive for other commercial lines writers, including Arch Capital Group Ltd., Axis Capital Holdings Ltd., The Hartford Financial Services Group Inc. and W. R. Berkley Corp.

W. R. Berkley on April 25 reported net premiums written of $2.41 billion for the first quarter, climbing from $2.05 billion a year earlier.

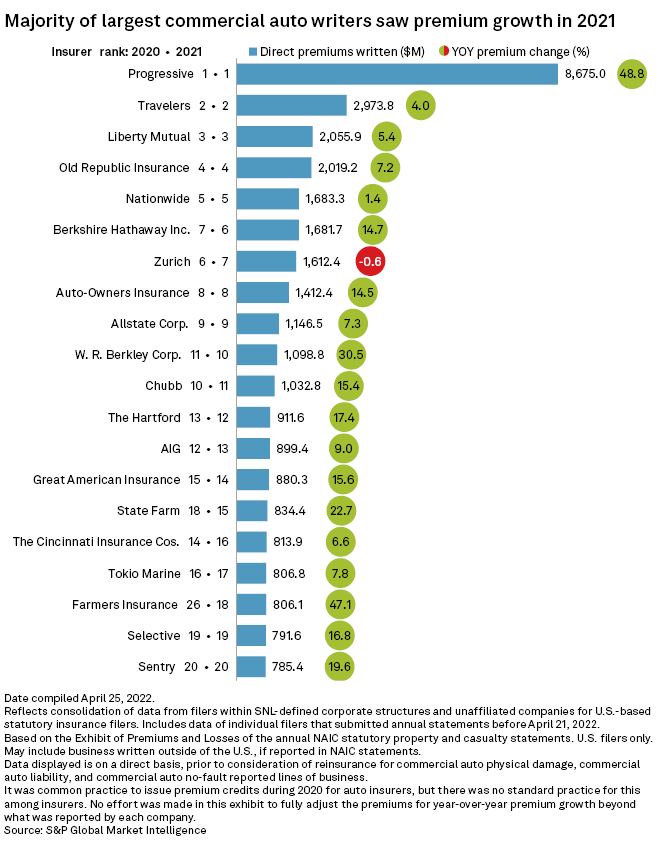

Farmers Insurance Group of Cos. posted the highest loss ratio and combined ratio of all the commercial auto insurers in this analysis. State Farm Mutual Automobile Insurance Co. logged the second-worst combined ratio at 118.1%, with The Allstate Corp. close behind at 117.3%.

Industry's combined ratio under 100% for 1st time in at least 5 years

The average combined ratio for commercial auto improved stood at 98.7% in 2021, with over half of the largest commercial auto underwriters recording profitability in the segment as they had ratios below 100%.

Despite commercial pricing trends moderating somewhat in the latest quarter, the hard market in most lines and the underlying commercial lines margin improvement are continuing, Meredith wrote in a research note. The UBS analyst expects most commercial lines insurers to continue to see expense ratio improvement driven through 2022 and 2023.

Progressive's big premium lead

Almost all of the insurers in this analysis recorded year-over-year increases in direct premiums written in 2021, with more than half seeing a growth of double-digit percentage points.

The Progressive Corp. remains the dominant player in commercial auto with the highest premiums and growth rate, to go along with the second-lowest combined ratio among the largest insurers. Its net premiums written for the segment surged 51% to $8.02 billion in 2021 from $5.32 billion a year earlier.

CEO Tricia Griffith in a letter to shareholders said the commercial segment's 2021 premium growth alone was nearly equal to the second-biggest commercial auto insurer, based on 2020 statutory results.