Cohen & Steers Inc.'s first-quarter

Cohen & Steers also increased its position in Columbia Property Trust Inc. by more than four-fold during the quarter, bringing its total stake in the office REIT to approximately 4.8 million shares at quarter-end, an investment worth about $108.6 million. Cohen & Steers added the office landlord to its REIT portfolio in the quarter prior.

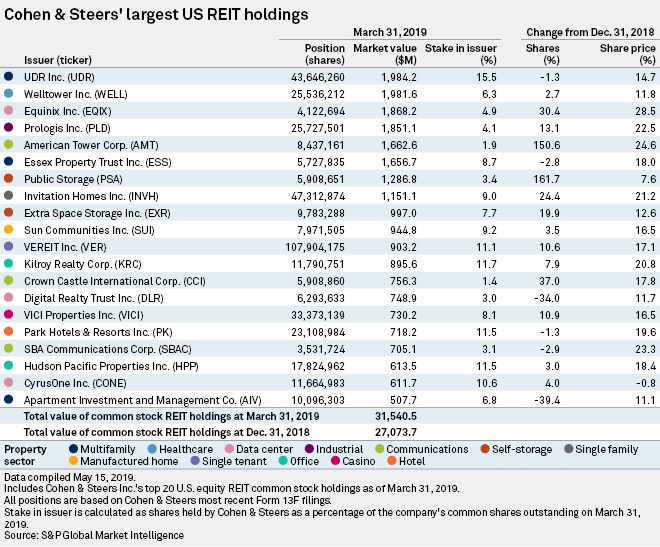

The investment firm more than doubled its share count in communications REIT American Tower Corp., purchasing more than 5 million shares of the REIT during the quarter and bringing the position to Cohen & Steers' fifth-largest REIT holding by market value, at about $1.66 billion.

Cohen & Steers also purchased approximately 3.7 million shares in self-storage REIT Public Storage during the three-month period, boosting it to the firm's seventh-largest REIT holding, valued at $1.29 billion.

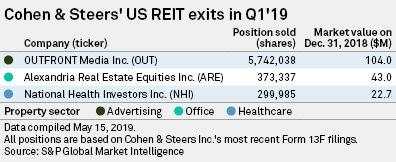

Cohen & Steers exited its stake in three REITs during the quarter, with its largest sale being in advertising REIT OUTFRONT Media Inc., a stake valued at $104 million at 2018-end. Other REIT dispositions by the firm included office-focused Alexandria Real Estate Equities Inc. and healthcare REIT National Health Investors Inc.

Cohen & Steers also sold more than 11.8 million shares of its stake in hotel REIT RLJ Lodging Trust during the quarter, dropping its share count 87.1% to about $30.7 million at quarter-end.

The investment firm also sold the majority of its stake in Ventas Inc., ending the quarter with a market value of $64.8 million. Ventas was

Cohen & Steers held common shares in 75 U.S. REITs on March 31, valued at more than $31.54 billion in total. Multifamily-focused UDR Inc. and healthcare REIT Welltower Inc. remained the firm's largest positions by market value, at about $1.98 billion each.

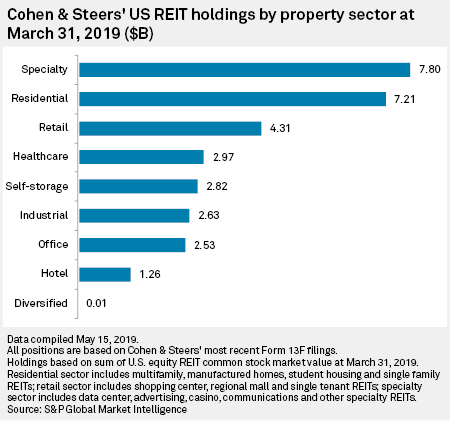

By property sector, Cohen & Steers held the largest exposure by market value to specialty REITs — consisting of advertising, casino, communications, data center and other specialty REITs — with investments in the sector summing to $7.80 billion at quarter-end. The firm added to its share counts in data-center focused Equinix Inc. and communications REIT Crown Castle International Corp. by about 30% each during the three-month period.

Did you enjoy this analysis? Click here to set email alerts for future Data Dispatch articles. Click here to view more information on Cohen & Steers Capital Management Inc.'s REIT holdings, and click here to view more information on Cohen & Steers UK Ltd.'s holdings. Both are subsidiaries of Cohen & Steers Inc. Company filings, including the Form 13F, can be found through the filings archive tab on a company's briefing book page. |