Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

7 Sep, 2022

| As the world's thirst for lithium grows with battery and electric vehicle demand, mining operations are popping up in some of the world's driest places. |

Global efforts to address climate change are driving an increased appetite for lithium, but extracting the material could pose a risk to water-sensitive regions where the metal is abundant.

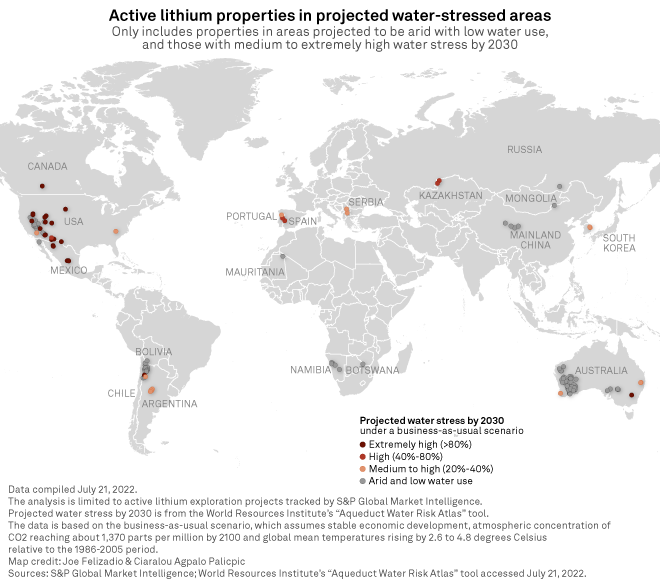

Out of 435 active lithium-containing mining projects analyzed by S&P Global Market Intelligence, 189 are in areas that are either projected to face medium to high water stress by 2030 or are in arid regions of low water use, as defined by the World Resources Institute. There are 23 projects in areas expected to face extremely high water stress by the end of the decade, including areas of the Western U.S., South America and Australia.

Lithium, which is essential for the rechargeable batteries that form the backbone of zero-emission vehicles, is generally obtained either by mining spodumene ore or by extracting a salty liquid from the earth and processing lithium from the brine. Underground brines with a high lithium concentration are often found in desert regions, raising questions about the potential to contaminate drinking water and the consequences of evaporating brine from an ecosystem with little water to spare.

"We are living on borrowed time in terms of using aquifers in many places," said Jennifer Krill, executive director of Earthworks, an environmental group focused on extractive industries. "Businesses have to be preparing for that."

The growing appetite for electric vehicles is driving up lithium demand, pushing prices upward and encouraging further development of lithium resources worldwide, Alice Yu, a senior analyst at S&P Global Commodity Insights, said in a July 2022 report. While lithium levels are enough to meet demand until 2024, Yu wrote, there could be a lithium deficit in 2025. Commodity Insights projects total lithium carbonate equivalent chemical demand to be 1.2 million tonnes by 2025, with demand for use in passenger plug-in electric vehicles accounting for about 68% of the demand.

South America's 'Lithium Triangle'

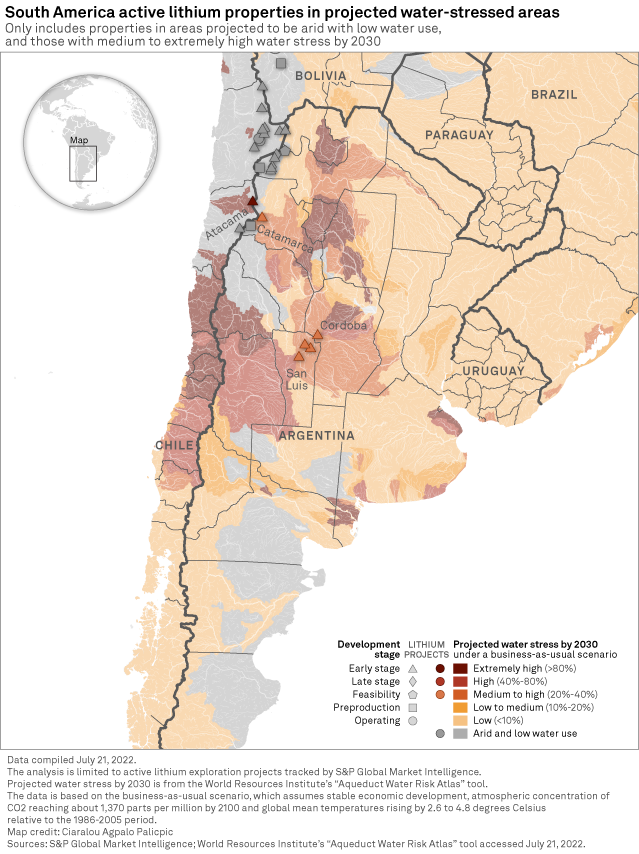

Much of the early study into lithium mining and its impact on the water focuses on the "Lithium Triangle" region around Argentina, Bolivia and Chile. The region is home to some of the largest global lithium reserves, including operations in the Salar de Atacama, one of the driest areas in the world.

Several mines in the region are in an area classified by the World Resources Institute as either "arid and low water use" or facing a potential for high levels of water stress. But researchers do not agree on how fresh groundwater in the region interacts with the lithium-containing brine.

"The amount of water consumed by lithium mining is relatively small; however, any amount of water extracted at Atacama is significant," Guzman said.

In an April report, the Natural Resources Defense Council said communities in the Lithium Triangle displayed "strong discontent" over mining's impacts on unique wetlands and wildlife. Brine evaporation places certain microbes and bacteria at risk of extinction, and residents are concerned about the potential knock-on effects, the report said.

The unclear link

Claims of water impact from mining cannot be verified without further monitoring, said Tim Werner, a research fellow at the University of Melbourne. Regulations on what mining companies must disclose also vary considerably between countries.

"These impacts are often invisible to consumers, and if people are being harmed, we all deserve to know and ought to be able to find ways to minimize these impacts," Werner said.

For brine-based lithium resources, researchers do not completely understand how different groundwater systems are connected, Werner said. Monitoring some of the remote sites can be challenging and expensive.

"Science can also be a slow process that doesn't deliver ideal and clear results in a timely manner, particularly when people are being impacted now," Werner said.

In the meantime, more costly desalinated ocean water has been proposed as a solution to reducing local water use in drier regions.

Companies aim to reduce water use

Sociedad Química y Minera de Chile SA, or SQM, and Albemarle Corp. both extract lithium from the Salar de Atacama and have taken steps to reduce water impacts at their operations. However, in 2019, the Institution of Engineering and Technology collaborated with satellite analytics firm SpaceKnow and found a "strong inverse relationship" between water levels at SQM's ponds and the lagoons found across the salt flats. SQM did not respond to a request for comment.

Ellen Lenny-Pessagno, Albermarle's global vice president of government and community affairs, said the company has little impact on water in the region but does study and monitor potential impacts.

"The resource that we're using is something that can't be used for anything else," Lenny-Pessagno said. "You couldn't use it for human consumption; you wouldn't use it for agribusiness."

Albemarle pledged to reduce freshwater usage intensity by 25% by 2030 in areas of high and extremely high water risk. It also has multiple community agreements from engagement with local stakeholders at Salar de Atacama.

Activist investors are pushing companies to improve even more. As You Sow, a nonprofit shareholder group that advocates for environmental and social responsibility issues, announced Aug. 8 that 63.7% of Tesla Inc.'s independent shareholders voted to support a water risk reduction proposal for the electric-vehicle maker's environmental footprint.

"We don't want to go from one bad solution to another bad solution," As You Sow President Danielle Fugere said in an interview.

Mining and water outside of the triangle

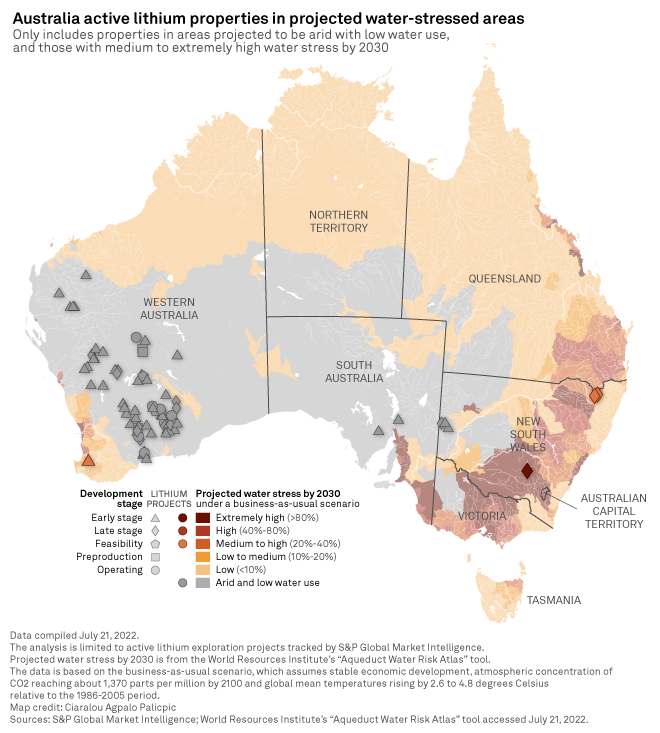

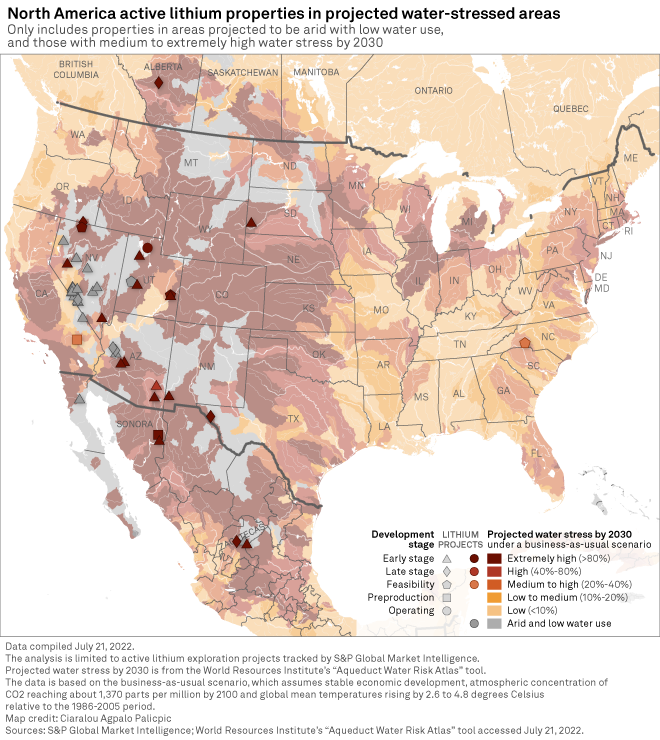

Officials and companies in North America and Australia are also working to make more lithium and other battery materials. Some of those projects will mine spodumene deposits in areas where water scarcity is not a major issue. But others, such as Lithium Americas Corp., look to conduct mining operations in places like the desert of Humboldt County, Nev. Lithium America's Thacker Pass project will extract lithium from processed clay using relatively small amounts of water that is currently being used for alfalfa irrigation.

Even though extracting lithium from spodumene tends to be done in areas of greater water abundance, Lenny-Pessagno said Albemarle is still careful about its water consumption in such regions. For example, the company owns a 49% stake in the Greenbushes operation in Australia that uses and recycles rainwater.

Lithium from the Greenbushes mine is processed by Tianqi Lithium Energy Australia Pty. Ltd., a joint venture of China's Tianqi Lithium Corp. and Australia's IGO Ltd., which announced the first production of battery-grade lithium from its plant south of Perth earlier in 2022. It was the largest plant in the world to be built and operated outside of China, a dominant force in the processing of lithium.

Piedmont Lithium Inc. is constructing a lithium project in North Carolina. While water scarcity is not a major concern at the site, Austin Devaney, Piedmont's senior vice president and chief commercial officer, said that as the industry expands, it is more likely to go to regions where it will be more challenging to reduce the impact.

"As the lithium market grows, it will be incumbent upon the industry to find ways to reduce their water consumption," Devaney said.

Though lithium may be extracted in environmentally sensitive places, experts said it still leaves a smaller footprint than fossil fuel extraction.

"I would certainly choose a lithium mine over a coal mine any day," Werner said. "However, that will be little consolation to those whose lives are upended by a lithium mine, and the idea that simply because the end use is a good one, we shouldn't apply any scrutiny to the mining, is a bad [idea]."

S&P Global Commodity Insights and S&P Global Market Intelligence are owned by S&P Global Inc.

S&P Global Commodity Insights produces content for distribution on S&P Capital IQ Pro.