Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

22 Nov, 2021

Higher claims severity within the private auto insurance space continues to be an issue for many of the top underwriters in the U.S.

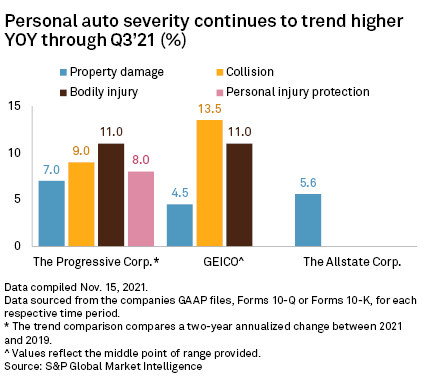

The three publicly listed insurers — Berkshire Hathaway Inc.'s GEICO Corp., The Progressive Corp. and The Allstate Corp. — among the big four auto insurers reported significant increases in claims severity during the first nine months of 2021.

Progressive reported that its total private auto severity increased at a two-year annualized rate of 9% during the first nine months of 2021, when compared to the same period in 2019. On a percentage basis, bodily injury and collision coverage were up 11% and 9%, respectively. Personal injury protection, or PIP, increased 8% and property damage climbed 7%, according to its quarterly filing.

Progressive attributes the worsening severity to a mix of more major accidents and inflationary pressures within the physical damage coverages. Reopened claims, mainly in Florida, contributed to the increase in PIP coverage, the company said.

Kemper Corp. also revealed recent troubles within its PIP coverage in Florida. Due to a recent legal decision, the insurer increased its reserves by $25 million within the PIP line of business during the most recent quarter, which followed a $55 million strengthening in the prior quarter. The Illinois-based insurer reported that its total auto claims severity increased year over year by between 8% and 10% during the third quarter. Social inflation was one cause for the increase, Kemper said.

GEICO experienced a double-digit jump in claims severity within its collision and bodily injury coverage during the first nine months of the year versus the prior year period, while property damage was up between 4% and 5%. Claims severity within collision coverage climbed 13% and 14% during the first three quarters of 2021, an acceleration compared to what the insurer had seen in the first half of the year. GEICO said claims severity in collision rose by between 10% and 11% year over year in the first six months of 2021.

Severity at Allstate has been dramatically impacted by supply chain troubles and inflationary pressures on used cars and parts. During Allstate's most recent earnings call, Glenn Shapiro, president of personal property-liability, said those issues will persist for some time.

The largest U.S. auto insurer, State Farm Mutual Automobile Insurance Co., is not immune to the broader trends within the industry.

While quarterly regulatory statements do not address the specific causes of the increases or provide specific values on severity changes, a preliminary review of the filings shows that State Farm affiliates' direct incurred loss ratio surged to 88.4% within the auto physical damage line of business, while its private-passenger auto liability ratio stood at 70.2% during the third quarter of 2021. Those ratios were higher by 23.5 and 12.5 percentage points, respectively, compared to the prior-year period.