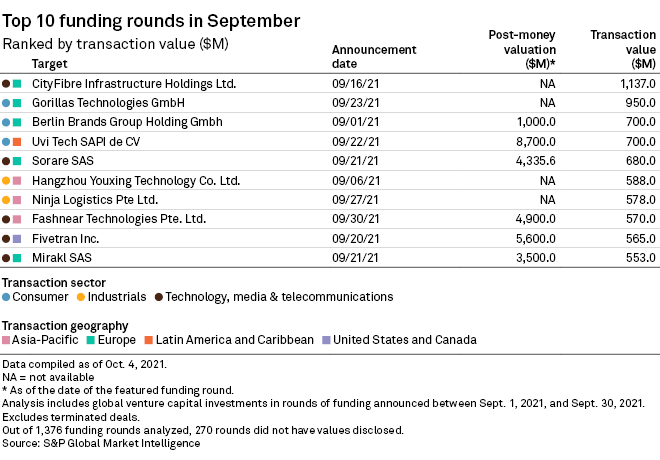

U.K. digital infrastructure platform CityFibre Infrastructure Holdings had the largest funding round in September, pulling in $1.14 billion and securing the technology, media and telecommunications, or TMT, sector as the top choice for venture capital investment for two months in a row, according to S&P Global Market Intelligence data.

CityFibre's funding round saw participation from new investors Mubadala Investment Co. PJSC and Interogo Holding AG, who joined existing investors Antin Infrastructure Partners and Goldman Sachs Asset Management LP. It was followed by German food delivery startup Gorillas Technologies GmbH, which received $950 million in series C financing.

Global e-commerce company Berlin Brands Group Holding Gmbh secured $700 million in a mature round from Bain Capital Pvt. Equity LP at a post-money valuation of $1.00 billion. Mexico-based used-car online platform Uvi Tech SAPI de CV closed a General Catalyst Group Management LLC-led $700 million series E round at a post-money valuation of $8.70 billion. French blockchain-based fantasy European soccer game platform Sorare SAS rounds up the list with a $680 million series B funding round, giving it a post-money valuation of about $4.34 billion.

Global venture capital deployed in September reached a three-year high of $48.03 billion, representing a 54.6% increase from $19.25 billion in 2019. North America snagged $20.06 billion from investors across 605 deals in September, making it the top recipient of capital, followed by Europe, which received $10.88 billion from 384 venture capital transactions. Investors also dispensed $15.06 billion into Asia-Pacific companies across 583 deals.

Global venture capital investments totaling 49.4% were allocated to TMT businesses last month. The consumer space received 14.6% of funding, followed by healthcare, on which 14.5% of the investments were deployed. Energy and utilities, real estate and the materials markets remain the sectors that received the least investment.