The asset quality of China's city and rural commercial banks is likely to worsen in the coming quarters due to the delayed recognition of bad loans and their exposure to commodity-related sectors, even as the country's economy recovers from the pandemic-driven crisis, analysts say.

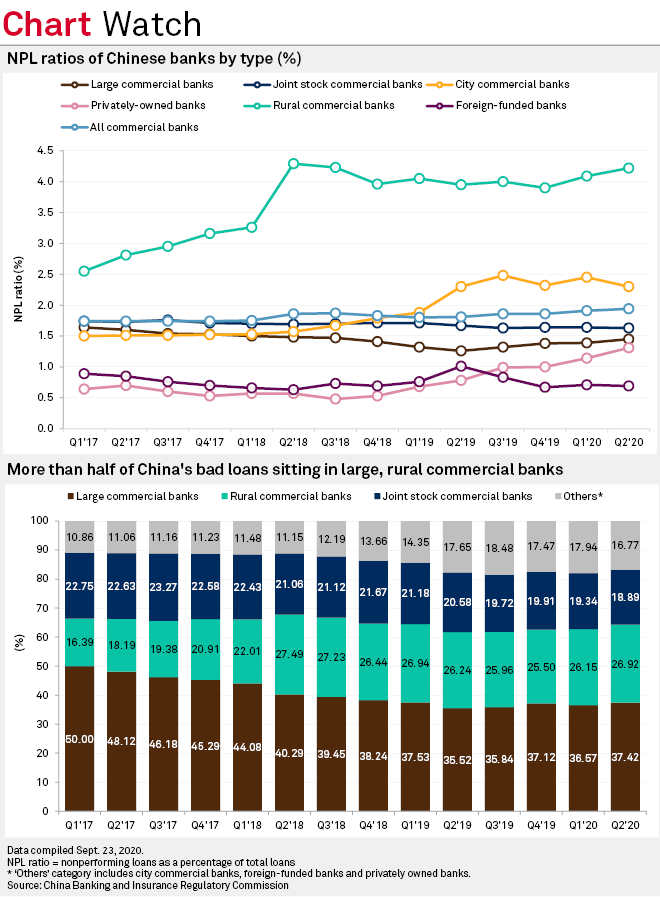

In the quarter ended June 30, rural and city commercial banks logged average nonperforming loan ratios of 4.22% and 2.30%, respectively, the highest among all bank types since the fourth quarter of 2018, according to data from the China Banking and Insurance Regulatory Commission. In the year-ago period, rural commercial banks' aggregate NPL ratio was 3.95%, while that of the city commercial banks was around the same level.

Bad loans reported by city and rural commercial banks more than doubled at the end of June from their 2017 levels. Nonperforming loan balances at rural commercial banks surged to 736.5 billion yuan, up 147% from 297.6 billion yuan in the second quarter of 2017, while city commercial banks posted a 159% increase to 441.0 billion yuan from 170.1 billion yuan.

China appears to be the first major economy to have exited the COVID-19 crisis, with the virus spread in check and business activity back to near normal. The world's second-largest economy expanded by 3.2% year over year in the second quarter, reversing a 6.8% contraction in the March quarter. Economists at HSBC expect growth to accelerate to 5.4% year over year in the third quarter and 6.2% in the fourth quarter, with full-year growth arriving at 2.4%, contingent on further policy easing.

Rory Green, an economist for China and North Asia at TS Lombard, said he expects city and rural commercial banks' NPL ratios to worsen over the next six months before they improve in line with economic recovery in the second half of 2021. "Asset quality is improving after the pandemic lockdown, but there are still balance sheet risks arising from the weakness in industrial prices," Green told S&P Global Market Intelligence in an email.

Small and midsize banks tend to have higher exposure to commodity-related sectors and have high geographic concentration in regions heavily hit by the pandemic. Despite a substantial improvement in demand, the impact of the pandemic on commodity prices is still a concern, Green said.

Shengbo Tang, head of Hong Kong and China financials research for Asia ex-Japan at Nomura, said city and rural commercial banks' reported NPL ratios will continue to rise in the coming months, but added that Chinese banks' underlying asset quality in general should improve along with the economic recovery following COVID-19. "The worst seems behind us at this point," said Tang.

Green and Tang also expect China's government to proactively inject capital into troubled banks to maintain market confidence instead of waiting for signs of distress to emerge. "Local governments will more likely issue bonds in the coming quarters to raise money and inject it as capital to the corresponding stressed banks so that those banks can survive and enjoy the benefits of economic recovery afterwards," Tang said.

Among all bank types, privately owned banks and large commercial lenders logged the highest year-over-year increases in NPL ratios. Large commercial banks logged a 19-basis-point increase in their NPL ratio to 1.45% from 1.26%, while that of privately owned banks climbed to 1.31% from 0.78%.

As of Sept. 28, US$1 was equivalent to 6.81 Chinese yuan.