Chinese megabanks will likely report further weakness in net interest margins in their upcoming fourth-quarter 2022 results, though expanding loan books may support steady earnings growth.

Industrial and Commercial Bank of China Ltd. (ICBC), China Construction Bank Corp., Agricultural Bank of China Ltd. and Bank of China Ltd., are set to announce their annual results at the end of March for a year that ended with a wave of COVID-19 infections, disrupting businesses and households in several parts of China.

"The biggest risks for Q4'22 results are contraction in net interest margin and worsening credit quality due to stringent COVID control and subsequent infection wave," said Iris Tan, senior equity analyst at Morningstar.

The pandemic has subsided since and China has removed almost all restrictions. New loans jumped to a record in January and maintained their strong pace in February. Authorities are likely to keep a close watch on the economy even as the central bank continues with its easing cycle, in contrast to most parts of the world where interest rates have been pushed higher over the last few months, led by the US Federal Reserve. The People's Bank of China announced a 25-basis-point cut to the reserve requirement ratio (RRR) on March 17.

Steady income

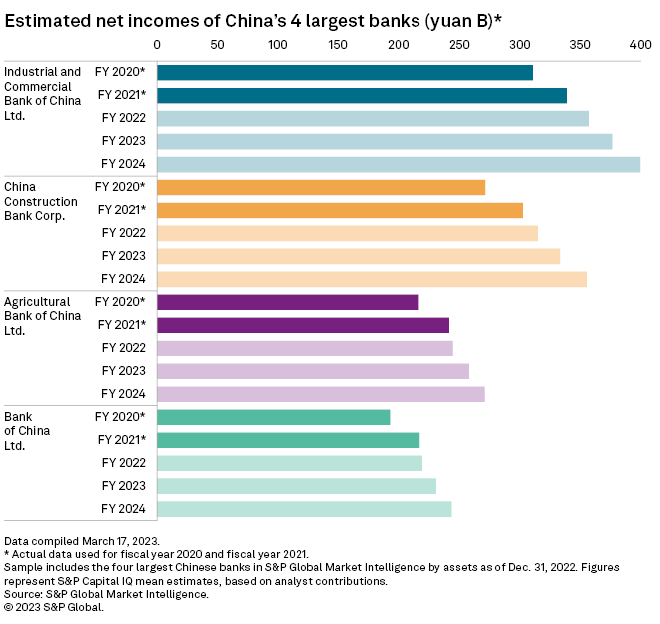

The net profits of ICBC and China Construction Bank for 2022 could grow by 5.4% and 4.1%, respectively, from 2021, according to S&P Global Capital IQ consensus analyst estimates, while those of Agricultural Bank of China and Bank of China could rise about 1%. Net profits grew in a range of 5.5% and 5.9% in the first three quarters of 2022, according to earnings reports by the lenders in late October.

Net interest margins (NIMs), however, could continue to moderate in the coming years, according to Capital IQ estimates. Aggregate NIMs of commercial banks in the world's second-biggest economy fell 14 basis points to 1.90% in the fourth quarter of 2022, the lowest since at least 2017, according to China Banking and Insurance Regulatory Commission data.

NIMs under pressure

Loans getting repriced at lower rates and a shift in the lending to lower yielding state-owned enterprises could exacerbate pressure on NIMs in the first quarter, though credit quality could stabilize — except those from the consumption segment — as the economy recovers, said Michael Zeng, Hong Kong-based banking analyst at Daiwa Capital Markets.

"Pressure on NIM will likely persist amid stubborn cost of deposits and declining return on interest-earning assets," Zeng said.

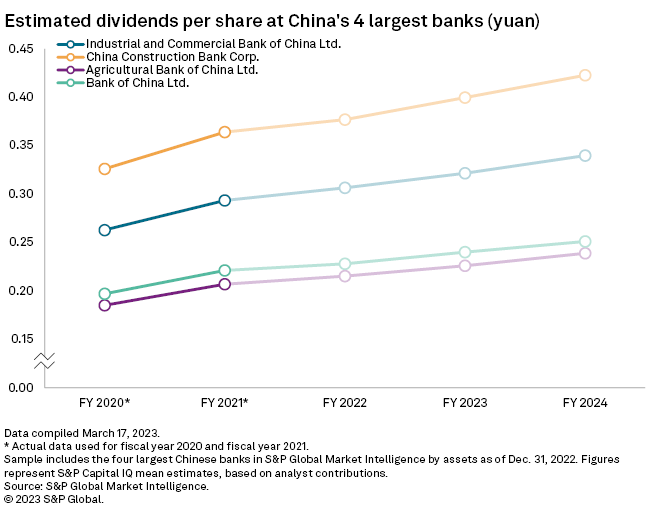

Dividend payouts from the big four banks will likely be static, Zeng added, as they have little motive to alter their payout policy given the need to balance between contributing to national fiscal revenue and saving resources for rainy days.

The latest cut in RRR, together with falling interbank lending rates, could ease the pressure on margins, according to a J.P. Morgan note dated March 17. The earlier-than-expected cut in RRR serves as a policy signal from the central bank that monetary policy remains accommodative and "supporting growth" continues to be a key policy goal, J.P. Morgan said.

As of March 24, US$1 was equivalent to 6.87 Chinese yuan.