|

The Mariana lithium brine project in Argentina, in which Ganfeng Lithium owns a 83% stake. Source: Ganfeng Lithium |

China's top lithium producers may slow their overseas M&A as they digest newly acquired assets from the most recent bout of deal-making activity, analysts said.

Major Chinese producers of lithium, including Tianqi Lithium Corp. and Ganfeng Lithium Co. Ltd., have in recent years secured a string of high profile transactions in Australia and South America, as China targets to quadruple the sales volume of electric vehicles by 2025.

They include Tianqi Lithium buying a 24% stake in SQM for US$4.1 billion in 2018. In May, Ganfeng Lithium struck a deal to pay £14.4 million for a 30% stake in UK-based Bacanora Lithium PLC, which is developing the Sonora claystone lithium deposit in Mexico. In 2018, the Chinese company also bought Sociedad Quimica y Minera de Chile SA's 37.5% stake in the Cauchari-Olaroz brine project in Argentina for US$87.5 million and increased its holding in the Mount Marion mine in Australia to 50%

Jamie Wang, a research analyst of Greater China Industrials & Materials at Nomura International, said in an interview that he expects M&A by major Chinese lithium producers to slow in the next couple of years as their bolstered resources and reserves are expected to be able to meet growth in demand well into 2021.

Wang expected the latest round of ramp-up of the major Chinese lithium companies to finish by 2021, adding their active M&As in the previous two years also showed they expected to acquire assets before the prices bounce back. Spot lithium carbonate prices in China decreased from US$21,000 per tonne at the beginning of 2018 to about US$12,000 per ton in the third quarter owing to worldwide lithium production exceeding worldwide lithium consumption.

"Their current assets are enough to supply the demand for their ramp up until 2021. For some of them, it will take a couple of years for them to recover from debt pressures," said Wang.

Since Tianqi's purchase of the SQM stake in 2018, the company has yet to announce further deals. It has also suspended a planned 2018 initial public offering In Hong Kong, but has been raising money in the A-share market to pay off the debt it used on the SQM transaction.

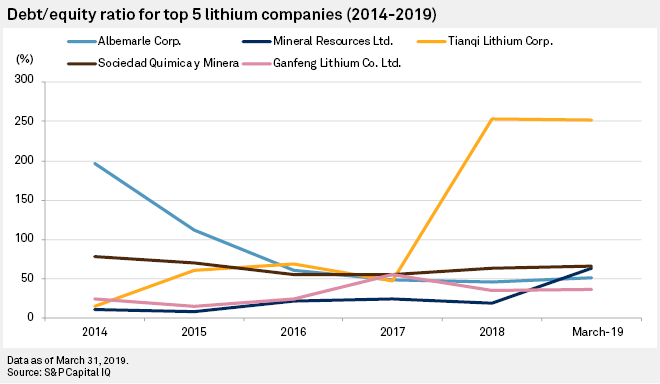

According to S&P Capital IQ, Tianqi's debt-to-equity ratio surged to 253.4% in 2018 from 47.3% in 2017 while Ganfeng's fell to 34.8% in 2018 from 54.4% in 2017, but was still higher than 24.1% in 2014. In contrast, that of Mineral Resources Ltd., the world's second largest lithium producer behind Tianqi, decreased to 18.3% of 2018 from 24.3% of 2017.

After the SQM transaction, Wang expected Tianqi to focus on lowering its debt pressure and expects its profit will be hurt this year by an increase in financial costs, with interest payments estimated at about 1 billion Chinese yuan. "It represents more than half of their gross profit," Wang added.

However, analysts believe Chinese lithium producers will still be eyeing overseas opportunities to secure sufficient supply as the domestic production will be insufficient to meet the country's demand.

Xu Ruoxu, a commodity analyst with brokerage firm Shenwan Hongyuan Securities, also said the top priority for the lithium companies is to digest their previous transactions, but he expected overseas lithium assets will still be the main supply of Chinese lithium production.

"China wants to secure more lithium assets to increase its dominance in lithium. That means lithium producers have easier access to financing compared to other mining companies when they are making transactions. However, it will still take some time for them to pay off their most recent loans before they can acquire more assets," Xu said.

Xu also said the grade of lithium mines in China is too low to produce sufficient resources. "So far, mining from overseas operations and shipping the resources back to China for smelting is still the most effective model to reduce costs. They will still be looking overseas assets in the longer term," Xu added.

Going forward, Nomura's Wang expected Chinese producers to be more interested in brine operations in South American countries like Chile, Argentina, and Bolivia, in contrast to their previous focus on Australian pegmatite mining operations.

As of July 1, US$1 was equivalent to 6.85 Chinese yuan.