Chinese megabanks' net interest margins may level off after a third-quarter decline due to government stimulus measures lowering credit costs and potentially spurring economic growth.

Net interest margins (NIMs) are likely to "gradually stabilize" as policies such as a lower reserve requirement ratio, interest rate cuts and the reduction of deposit rates will let margins overcome "short-term downward pressure," Zhang Yiwei, banking analyst at China Galaxy Securities, said in a Nov. 7 note. Citi Research similarly expects NIM contraction to slow in 2025.

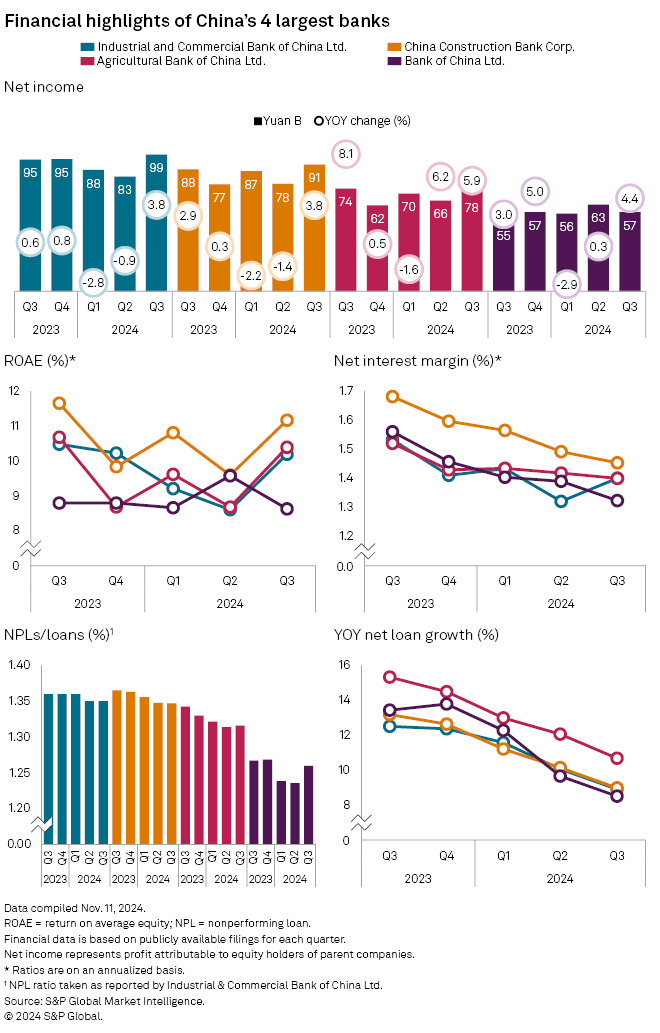

China Construction Bank Corp., Agricultural Bank of China Ltd. (AgriBank) and Bank of China Ltd. suffered NIM declines of between 2 basis points and 7 bps in the third quarter versus the previous three months, with only Industrial and Commercial Bank of China Ltd. (ICBC) bucking the trend with an 8-bps increase to 1.40%, according to S&P Global Market Intelligence data. The decline may cool off due to lower funding costs for lenders including the abolition of bonus rates for depositors, a potential rebound in economic growth and a stock market pickup prompting investors to want cash on hand for share purchases.

"Retail customers prefer to hold more demand deposits to get ready/prepare for potential A-share market investment," Citi Research, a division of Citigroup Global Markets, said in a Nov. 4 note. "This is NIM positive."

China's benchmark CSI 300 stock index has surged 30% from a five-year low in February, aided by government efforts to revive growth in the world's second-biggest economy. Expansion was just 4.6% in the third quarter, falling short of this year's official target of around 5%. Stimulus measures include efforts to revive the moribund real estate market, such as making it easier to buy new homes or renegotiate existing mortgages. Some of these measures, such as potentially lower mortgage rates, would weigh on bank margins.

Lenders' margins have been aided by the suspension of so-called manual interest supplements, an unwritten practice of subsidizing depositors by paying them higher-than-normal interest rates, China Galaxy's Zhang said. Regulating these payments has saved the banking sector 80 billion yuan in interest costs, the People's Bank of China said in its Third Quarter China Monetary Policy Execution Report. The central bank also urged lenders to refrain from issuing loans with after-tax interest rates lower than the yield on government bonds of the same term.

Asset quality

The nonperforming loan ratios at ICBC and China Construction Bank were unchanged from the previous quarter at 1.35%. AgriBank's ratio rose 1 bps to 1.32% and Bank of China's climbed 2 bps to 1.26%.

Large state-owned banks have solid assets and sufficient provisions for bad loans, and risk tolerance will likely increase once the government implements a planned capital injection, according to China Galaxy. The government has said it will add funds to the four megabanks, Postal Savings Bank of China Co. Ltd. and Bank of Communications Co. Ltd. All six are state-owned.

As of Nov. 14, US$1 was equivalent to 7.23 Chinese yuan.