Large mainland Chinese banks led their Asia-Pacific peers in reporting year-over-year improvements in key Basel III capital, liquidity and leverage ratios in the quarter ended June 30, according to data compiled by S&P Global Market Intelligence.

Most of the mainland Chinese banks covered in the sample posted year-over-year increments in their fully loaded common equity Tier 1 ratios in the June quarter, with Chongqing Rural Commercial Bank Co. Ltd. and Bank of China Ltd. leading the pack with increases of 83 basis points and 53 bps, respectively.

Meanwhile, Singapore's Oversea-Chinese Banking Corp. Ltd. and China's Bank of Tianjin Co. Ltd. logged the biggest declines in their CET1 ratios at 113 bps and 103 bps, respectively.

Both the Japanese banks that appear on the list — The Shizuoka Bank Ltd. and The Chiba Bank Ltd. — reported declines in their CET1 ratios.

The sample included Asia-Pacific banks covered by Market Intelligence that reported fully loaded CET1 ratios for the time periods assessed and had assets greater than $100 billion as of June 30.

Banks across the world are treading cautiously, maintaining strong capital buffers and managing prudent leverage, as they face slowing global economic growth on the back of rising inflation and geopolitical risks. Led by the U.S. Federal Reserve, most global central banks have tightened monetary policy to counter a surge in energy and commodity prices after Russia's invasion of Ukraine in February.

Prior monetary easing during the COVID-19 pandemic, when most central banks stepped up support for their economies in 2020 and 2021 by releasing liquidity, allowed lenders to strengthen their capital buffers and reduce risk exposures.

Leverage ratio

Most large Asia-Pacific banks posted year-over-year improvements in their Basel III leverage ratios in the June quarter, again with mainland Chinese banks leading the pack. In a sample of 62 banks, 44 reported a negative change in their ratios, while 17 showed an improvement. The ratio of South Korea's KB Financial remained flat year over year. The leverage ratio measures CET1 and additional Tier 1 capital as a percent of total leverage exposure.

Japan's The Norinchukin Bank and China's Zhongyuan Bank Co. Ltd. reported the largest drop during the quarter, with their ratios sliding 200 bps and 139 bps, respectively. However,

Bank Rakyat Indonesia, which sat atop the list with a leverage ratio of 16.75% as of June 30, and South Korea's Hana Financial Group Inc. reported the biggest increases in their ratios, at 360 bps and 214 bps, respectively. Japan's Mizuho Financial Group Inc. and India's Punjab National Bank reported the lowest leverage ratios at 4.22% and 4.60%, respectively, as of June 30.

Liquidity coverage ratio

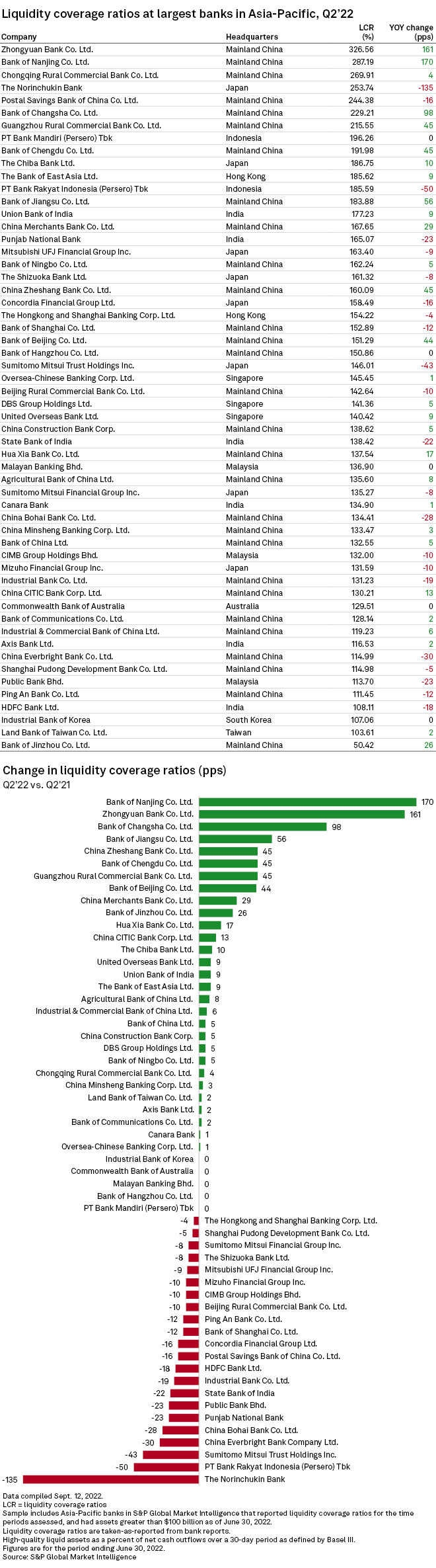

Nearly all of the Japanese banks included in the sample saw year-over-year declines in their liquidity coverage ratios during the quarter ended June 30, with Norinchukin Bank reporting a 135-percentage-point decline in its ratio to 253.74%, according to Market Intelligence data. Bank Rakyat Indonesia and Japan's Sumitomo Mitsui Trust Holdings Inc. saw declines of 50 percentage points and 43 percentage points, respectively, in the quarter.

In the sample recorded, 20 of the 29 mainland Chinese banks posted year-over-year increases in their liquidity coverage ratios, led by Bank of Nanjing Co. Ltd. with a 170-percentage-point rise. Six Indian banks also showed up on the list, with three each logging increases and decreases.

The liquidity coverage ratio measures the ability of banks to withstand significant cash outflows and is calculated by dividing a bank's high-quality liquid assets by total net cash outflows over 30 calendar days. Basel III rules require banks to hold a minimum liquidity coverage ratio of 100%.