Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

9 Nov, 2022

By John Wu and Rehan Ahmad

China's megabanks expect to keep their credit quality steady and step up lending as top regulators indicate the worst may be over for the nation's troubled property sector.

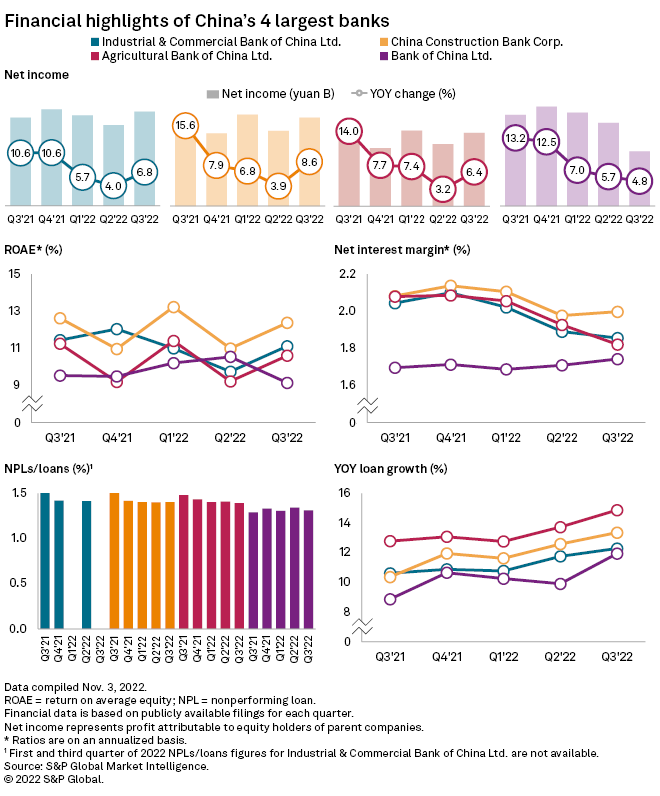

The ratio of nonperforming loans, or NPL, at most large banks stayed on a stabilizing trend in the third quarter, recently released earnings reports showed. For instance, the NPL ratio at Industrial and Commercial Bank of China Ltd. fell to 1.4% in the July-to-September quarter from 1.52% in the same period a year ago. Bank of China Ltd. reported an NPL ratio of 1.31% in the September quarter, compared with 1.29% a year ago.

The asset quality of listed banks is relatively resilient, said Wang Hongxing, banking analyst at Jiangsu-based Donghai Securities. The overall NPL ratio and provision coverage ratio improved slightly despite rising bad loans in the real estate sector, Wang said in a Nov. 8 note.

Up to the third quarter, the sectorwide NPL ratio has declined for eight consecutive quarters, according to a Haitong Securities research note dated Nov. 3. Only three of the 42 listed banks had an increase in the key metric to measure bad loans, as China steps up efforts to boost economic growth and help the property sector recover, the note said. The government has relaxed purchase restrictions and offered tax breaks to homebuyers. It has also sought to ensure there is enough funding for cash-strapped developers to complete ongoing projects.

Speaking at the Global Financial Leaders' Investment Summit in Hong Kong on Nov. 2, Banking and Insurance Regulatory Commission Vice Chairman Xiao Yuanqi said the property sector was an area of concern, but risks remain manageable. At the same forum, People's Bank of China Governor Yi Gang said the housing market could achieve a "soft landing."

Faster loan growth

All four Chinese megabanks — Industrial and Commercial Bank of China, Bank of China, China Construction Bank Corp., and Agricultural Bank of China Ltd. —

"[The] property sector, along with its upstream manufacturing, remains the major source of future NPL formation as the country's housing market has yet to recover," said Lawrence Chen, Hong Kong-based banking analyst at CCB International Securities. This is followed by retail exposure including consumer loans and credit cards, Chen said.

But new NPL formation in the third quarter, which remained contained in what was a difficult operating environment, signals the determination of the government and banks to curtail risk, Chen wrote in a Nov. 3 note.

Property sector still sluggish

The property market remained sluggish, with private developers struggling with liquidity and weak home sales. The banks have maintained their provision coverage ratio, a broad measure of the buffer set aside against potential bad loans, at elevated levels to guard against any potential build of NPLs.

Property sales and lending to the real estate sector have seen marginal improvement recently, the People's Bank of China's Yi told delegates at the Hong Kong banking summit.

Echoing the central banker's comments, Bank of China President Liu Jin said the property market is recovering, even as some developers are still tangled in liquidity problems. The government's enhanced oversight over the sector will help address the risks related to property development, Liu said.

China's government and banks see property as an important sector because of its key role in the economy, Liu said at the Hong Kong summit. The property sector, including its supply chain, accounts for 30% of China's gross domestic product, according to the World Bank's China Economic Update dated June 8.

Provision coverage ratios at the big four banks were stable at between 207% and 303% in the third quarter of 2022. China Merchants Bank Co. Ltd., which historically has the highest coverage ratio among large lenders due to higher retail and credit card exposure, reported coverage of 456% in the third quarter.