Although bond defaults by Chinese state-linked companies may continue into 2021, experts say systemic risk will likely remain limited as the government appears to be reducing implicit guarantees only for highly leveraged and ill-managed issuers.

A spate of bond defaults by prominent state-backed companies since November, including chipmaker Tsinghua Unigroup Co. Ltd. and Yongcheng Coal & Electricity Co Ltd, has rocked the onshore corporate bond market. As investors are repricing the risks of bonds issued by state-owned enterprises, or SOEs, the average coupon rate of new issuances has risen, with some SOEs reportedly halting their debt plans, according to financial data provider East Money. Meanwhile, the higher-rated bonds issued by state-backed or private entities have been relatively stable.

Beijing's selective bailout of debt-ridden SOEs, while the economy is recovering from the pandemic, suggests the government is reviving its efforts to manage the nation's growing debt more aggressively and give the market a bigger role in weeding out the weak companies that survive primarily on government support, according to a Dec. 2 report by S&P Global Ratings.

"In strategic sectors or firms with large employment, government support may still be seen to prevent bond defaults," said Gary Ng, an Asia-Pacific sectoral research economist at Natixis. "The wave of defaults clearly points to higher credit risks, but still limited for systemic risk as economic growth continues to pick up and saving rates are high in China."

This time is different

The current wave of bond defaults is dominated by SOEs, unlike in the past years when mostly private companies were unable to make principal or interest payments.

One notable bond default case is that of Tsinghua Unigroup, a prominent chipmaker in China that has piled up debt in recent years for takeovers and investments. The company failed to make payments on a $450 million bond after it defaulted on a 1.3 billion yuan local bond in the previous month, according to a Dec. 9 filing with the Hong Kong stock exchange.

"Tsinghua Unigroup's default has shown that the massive industrial policy supporting the [integrated circuit] industry has caused emotional exuberance in the sector," said Shirley Ze Yu, a political economist and a fellow at Harvard Kennedy School's Ash Center. "There will be further credit stress in this sector, from both SOEs and private companies."

However, some analysts argued that the government unlikely has a list of industries or geographies that it would or would not save.

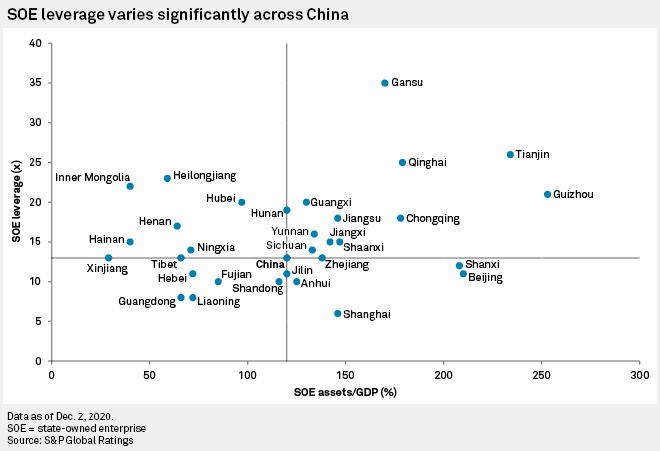

"It is my view that one of the key factors might be the SOE's financial health and it may not matter much which sector, industry or location the troubled SOEs might be in," said Jay Lee, a partner at law firm Simmons & Simmons.

Natixis's Ng added: "The reasons could be economic related to the financial health, such as the ability for the provincial government to provide support or the pressure on corporate profits, or political depending on individual firms."

"Still, most of the [defaulted] firms share the same characteristics with high leverage with severe pressure on revenue stream," he added.

Timely policy window

On Sept. 17, the Chinese government announced a three-year reform plan for SOEs to create a more "level playing field for private firms." Tolerating some defaults from the weaker public firms default might just play into this strategy, analysts said.

"In our opinion, these defaults may be in line with the government's SOE reform plan's general directions, as these defaults may allow the government to build a financially healthier SOE ecosystem in the long term, although there may be some level of defaults in the short term," Lee said.

"The government may be willing to allow certain defaults as the economy seems to be recovering relatively well, and it may help reduce debt levels in the economy, allowing for some credit differentiation once stronger firms can be distinguished from weaker ones," he added.

The tolerance of defaults might also play into the government's 14th five-year plan set for 2021-2025, Harvard's Yu added.

"The government will encourage mixed-ownership to enhance the operating efficiencies of SOEs," Yu said. "Better efficiency and higher returns are the core solutions to the SOE debt issue."

Are implicit guarantees gone?

"There was the widely held belief among Chinese bond investors that state-backed companies enjoyed an implicit backing from the local governments," Simmons & Simmons' Lee said. "We understand the investors' previous relatively popular faith that local governments will bail out SOEs may have been shaken to some extent. Investors appear to be turning more conservative and playing safe, as well as asking for higher interest rates."

Even so, there is a split between investors in lower-rated names and higher-rated names, Natixis' Ng said. Onshore credit spread has widened, but the higher-rated corporates have only seen a mild increase in the spread but have not reached levels in April 2020, Ng said.

"It is clear that investors have become more risk-averse and have switched to safer names," he said. "Unless the [People's Bank of China] injects more liquidity into the market or there is a massive improvement in corporate revenue, the divergence is likely to continue and widen."

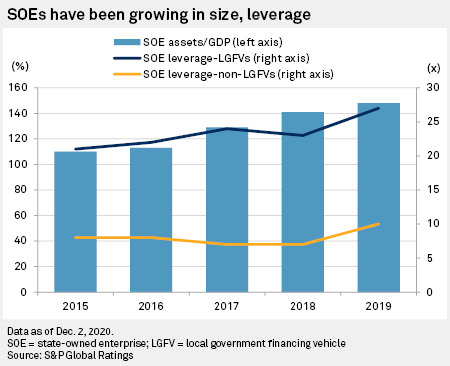

The SOE reform, however, is likely to extend to the subsector of local government financing vehicles, or LGFVs, given that some local governments are struggling with their own finances. These vehicles are a type of SOE that is less commercial and fulfills public services with critical policy and development roles such as funding infrastructure projects.

"Ongoing SOE reform is feeding through to the LGFV subsector," the S&P Global Ratings report read. "We believe that over the long term, off-budget risks will be better controlled as LGFV borrowers become more disciplined, for example, by improving debt coverage by growing their own revenues."

As of Dec. 17, US$1 was equivalent to 6.53 Chinese yuan.