Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

28 Feb, 2021

By Yuzo Yamaguchi and Rehan Ahmad

China's energy transition roadmap for 2021-2025 and beyond, widely expected to be unveiled early

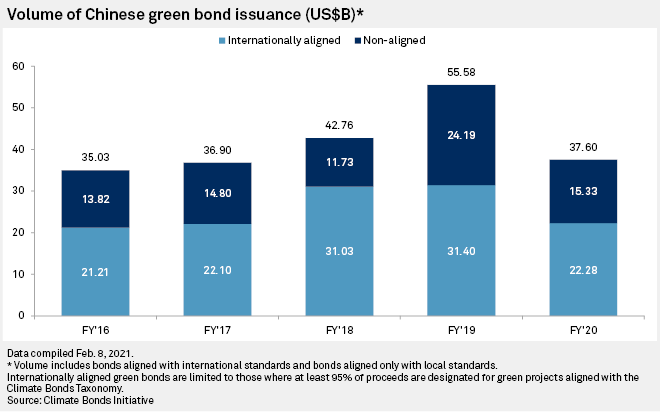

In 2020, the world's second-largest economy issued $37.6 billion worth of green debt, down from a record volume of $55.58 billion in 2019, according to Climate Bonds Initiative. Green bonds that were only aligned with domestic green bond principles, which allow issuers to allocate up to 50% of proceeds to repay loans or invest in general working capital, totaled $15.33 billion, or 41% of the total volume in 2020. That was down from $24.19 billion, or 44% of total issuance, in 2019.

The market is awaiting Beijing's top-level policy blueprint, which will include the 14th five-year plan for 2021-2025 and long-range objectives through 2035, scheduled to be released during the annual session of China's legislature early March. The blueprint will, among other things, give clear directions of how China, the world's largest emitter, plans to achieve peak carbon before 2030 and carbon neutrality by 2060. The policy details will likely unleash demand to fund new green projects, experts say.

Edris Boey, head of ESG research at Maitri Asset Management, said some prospective green bond issuers in China might have put their issuance on hold pending details of the blueprint. “The final word on this front is anticipated to be addressed” in the upcoming plan, Boey said.

China President Xi Jinping said in September of 2020 that the country aims to reduce greenhouse gas emissions to net-zero by 2060, and that it is on track to reach its current goal of peak carbon emissions by 2030 under the Paris Agreement. That was followed by Japan and South Korea, which made a similar promise to achieve by 2050.

Accelerating green efforts

As U.S. President Joe Biden brought the country back to the global accord to tackle climate change in February, experts believe China will likely respond by accelerating its green efforts.

Mana Nakazora, ESG strategist at BNP Paribas in Japan, expects China's 2021 issuance to exceed its latest record in 2019, citing pent-up demand from issuers who stayed at the sidelines last year while waiting for the market to recover from the coronavirus crisis.

Arthur Lau, co-head of emerging markets fixed income and head of Asia excluding Japan fixed income at PineBridge Investments, also expects China's issuance of green bonds this year will at least return to pre-2019 levels. Activity is likely coming from key sectors leading the zero-emissions efforts, such as energy, banking, construction and transportation.

“China’s pivot to renewable energy has already created opportunities in fixed income and with the potential increase in supply of China’s issuance of green bonds in the near future, we see this opportunity set growing,” Lau said.

The nation's faster-than-expected economic recovery from COVID-19 is also likely to restore the momentum of green bond issuance seen before the pandemic. China’s economy, which grew 2.3% in 2020, will likely show a further growth of about 8% for this year, according to an estimate by Daiwa Institute of Research Group.

“Post COVID-19, we believe more emphasis will be put on ESG [environmental, social and governance] issuances and hence, more supply in green bonds,” Lau said.

Policy support

As part of the effort to broaden the appeal of Chinese green bonds to international investors, and potentially to increase issuance over the longer term, China proposed last year it would stop recognizing clean coal, which ranges from coal washing to carbon capture, as projects qualified for green bonds.

The gap between the standards acceptable in China and elsewhere has been one of the reasons why some international institutional investors have been staying away from green debt issued by Chinese issuers, as well as the faster growth of locally compliant green bonds targeting mostly onshore investors in China.

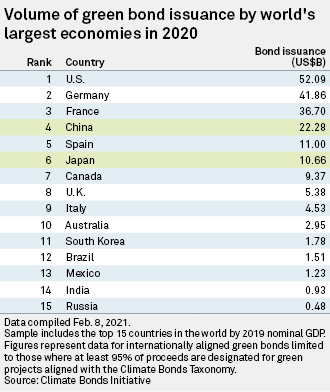

Despite the overall volume decline and the popularity of locally compliant green bonds in 2020, China was still the world's most active green bond issuing country. It was the world's fourth-largest issuer if only internationally aligned bonds are included, and it would be the third and surpassed France if locally compliant bonds were counted.

“The world will be going green and Chinese industries will probably need to issue more green bonds [than in previous years] in response to global investors and customers when they [the industries] raise funds for green projects,” Tamami Ota, a researcher at Daiwa Institute of Research, said.