The growth of bank loans in China will likely strengthen in 2023 after a record January as the country emerges from the pandemic, analysts said as a key political meeting that will set the tone for the economy gets underway.

New loans in China rose 17.3% year over year to 4.93 trillion yuan in January, the first full month after most COVID-19 restrictions were lifted, according to People's Bank of China, or PBOC, data. The more than 2.4-fold jump from December, typically a seasonally weaker period for economic activity, was followed by local media reports that the central bank is guiding lenders to exercise caution about unbridled credit expansion that could destabilize the economy.

Any advice to banks to dial back on credit growth is likely only temporary and the focus will be on making sure loans are disbursed sustainably, said Angus Lam, senior economist for global intelligence and analytics at S&P Global Market Intelligence. "As always, the Chinese authorities will likely see stability as paramount," Lam said.

Premier Li Keqiang announced a target of around 5% growth in gross domestic product in 2023 as the annual National People's Congress, commonly known as "Two Sessions," started on March 4. China's GDP grew 3.0% in 2022, missing the 5.5% aim announced at the same event last year. Analysts are watching GDP growth and other economic targets that would indicate how much lending could grow.

The two sessions will finalize key government appointments and spending plans. It may also spell out policy on reviving the real estate sector that dragged China's economy in 2022, along with a leadership reshuffle and the approval of the local government borrowing limit, which will be spent largely on infrastructure projects.

Seasonal spike

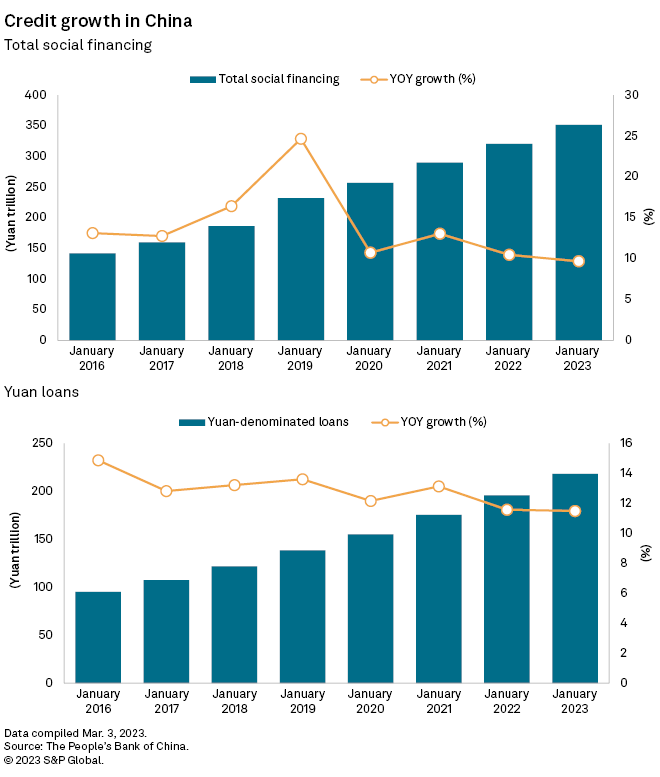

The first quarter is seasonally a busy period for bank lending as new projects get announced and seek funding. Overall credit may grow about 13% in 2023 as China seeks to support economic growth and ensure that real estate projects are completed as a way to improve confidence in the sector, Lam said. That compares with a 9.6% expansion in 2022, according to the PBOC's "China Monetary Policy Execution Report" published Feb. 24.

Nomura analysts said their analysis of one-year state-owned bank bill rediscount yields shows that the leading indicator of credit demand remains strong. Those yields "have stayed high since mid-January" at about 2%, versus below 1% in August 2022, Nomura said in a Feb. 22 note.

Rediscounting a promissory note refers to commercial banks getting financing from the central bank that provides liquidity against the paper.

In contrast to surging bank loans, total social financing — a broad measure of credit and liquidity into the economy — grew by 5.980 trillion yuan in January, less than the 6.175 trillion yuan in the prior-year period.

"This shows that bank loans were the main channel and perhaps provided a cheaper way of raising funds than in the credit market compared to 2022," said Iris Pang, chief economist for Greater China at ING.

China will aim for GDP growth of 5% or better, and they need the domestic economy, particularly the consumer sector, to do well and housing to stabilize, said Andrew Tilton, chief Asia-Pacific economist at Goldman Sachs. "That would be very hard if interest rates go higher or policy tightens materially," Tilton said.

In February, home sales by the country's 100 largest developers rose 14.9% year over year to 461.60 billion yuan, signaling the first such increase since June 2021, according to preliminary data from consultancy firm China Real Estate Information Corp.

Loan mix

Among new yuan loans in January, mid- to long-term corporate loans amounted to 3.5 trillion yuan, or an increase of 1.4 trillion yuan year over year, according to UBS, while mid- to long-term household loans slumped 70% to 223.1 billion yuan.

"[January] loan mix showed the increase remained mainly driven by policy support on the supply side," said Mary Xia, China rates strategist at UBS Securities, in a Feb 13 email, and "a rebound on the demand side remains to be verified."

The strength in corporate loans reflects regulators' efforts in urging banks to expand new bank loans, including developer financing, and policy banks' continued credit support for infrastructure projects, Xia added, while mid- to long-term household loans remained subdued, mainly driven by weak property sales with early repayments of mortgage also likely playing a role.

While an increase in lending usually results in raising bad debts, asset quality remains unalarming to analysts. The aggregate nonperforming loan ratio of commercial banks in China further declined to 1.63% at the end of fourth quarter of 2022, according to the China Banking and Insurance Regulatory Commission, while the buffer against loan losses remained above 200%.

"We anticipate gradual improvement in credit quality in 2023 given the likelihood corporate solvency improves due to a pickup in sales from revived economic activity," said Lawrence Chen, Hong Kong-based banking analyst at CCB International Securities Ltd., in a Feb. 22 note.

As of March 3, US$1 was equivalent to 6.91 Chinese yuan.