Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

22 Oct, 2021

|

|

On Oct. 13, Chile's mining ministry announced plans to open up more land to lithium exploration and development through a bidding process. A photograph of the Salar de Atacama, the epicenter of lithium production in Chile, is pictured above. Source: agustavop/iStock/Getty Images Plus via Getty News |

The Chilean government is making a play to expand its influence on the global lithium market and bring more money into public coffers by inviting more companies to

Chile announced plans on

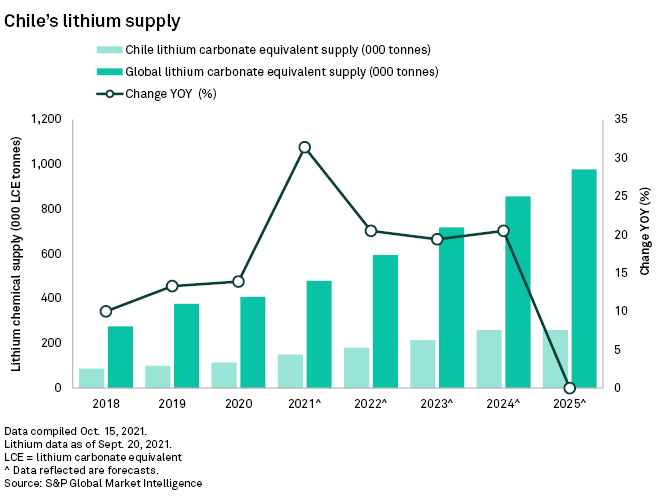

"All projections show that global lithium demand will grow significantly in the coming years," Sergio Espinosa Valenzuela, the top spokesperson for Chile's Ministry of Mining, told Market Intelligence in a statement. "Chile has the world's largest lithium reserves and the lowest production costs, but despite these advantages, we have been systematically losing market share."

The Chilean mining authority will offer a limited amount of special operating contracts to winning bidders, allowing recipients to explore, study and develop a lithium project "without a specific geographic location" over the course of seven years, with a possible two-year extension. Selected companies would then have 20 years to produce a set amount of lithium, capped through quotas, according to the mining ministry's announcement. The additional 100,000 tonnes of LCE from Chile would be dwarfed by the 950,000-tonne LCE shortfall in 2030 forecast by Benchmark Mineral Intelligence.

"It's not a massive increase in [global] supply, but the significance is that this means the country is opening up other salars to be developed and explored, which is good news for the lithium industry," said José Antonio Merino — a partner at iLiMarkets, a Chile-based financial consulting firm focused on lithium — who formerly worked at Chile-based lithium producer Sociedad Química y Minera de Chile SA. "These projects probably could be ready by the end of this decade."

Cashing in on royalties

The decision by the Chilean government to boost lithium production comes in response to the recent jolt in demand for the metal and impending shortage, according to the mining agency. The anticipated shortage has sent prices sky high: Benchmark Mineral Intelligence's price assessment for EXW China battery-grade lithium carbonate reached an average $28,675 per tonne in the first two weeks of October, an approximately 322.5% year-over-year price hike.

"When the government is encouraging more explorers and developers in the country, that's very good news for the EV supply chain," said Siddharth Rajeev, vice president and head of research at Fundamental Research Corp., which provides investment analysis, including for lithium companies operating in Chile. "Additional resources have to be discovered or extracted economically to make sure that there's enough supply out there."

In 2020, almost three-fifths of the globe's processed lithium exports came from South America, with the majority of this volume recovered in Chile, according to Panjiva data. For the Chilean government, the incentives are clear. Chile brings in US$900 million annually from its lithium industry, the mining ministry said.

As part of the new contracts, the Chilean state would reap the benefit of royalties and other payments from projects, at a time when the country faces growing pressure to capture more revenue from the mining industry and to rectify widening economic inequalities. The country also needs extra cash to pay for pandemic-related social programs.

The Chilean Senate in August delayed its vote on a bill to force mining companies to pay more for mining after BHP Group, Anglo America Ltd and Lundin Mining Corp. expressed concerns, according to published reports. The bill, which would add a progressive royalty to lithium and copper sales, approved the lower house in May.

A welcome expansion

"In a fast-moving world, we have to make efforts on different fronts," Valenzuela, the mining ministry spokesperson, said. "Now we seek to invite new actors in order to, hopefully, take advantage of our resources and make a bigger contribution to supply the lithium the world will need to be carbon-neutral."

Valenzuela added that the mines "will remain state-owned."

"It's common for South American and African countries to have a stake in the [mining] projects they have," Fundamental Research Corp.'s Rajeev said.