Challenger banks have grown rapidly, but their long-established rivals still dominate the U.K. market, and newcomers look vulnerable as Brexit looms.

Plenty of consumers have opened bank accounts with the new providers — U.K.-based Monzo Bank Ltd. claims 2 million customers, and Berlin-based N26 Bank GmbH now has 3.5 million across Europe — but very few have switched their main current account away from a traditional bank to a challenger bank, Richard Little, head of challenger banks at KPMG, said.

"There is more choice, but does that mean there is more competition? Arguably not," Little said. "Challenger banks have encouraged innovation and that has forced the big banks to change their ways, to interact with their customers differently. But for mortgages, current accounts and savings the Big Six are still the dominant players by far."

He counts the Big Six long-established banks and building societies that dominate the U.K. market as Lloyds Banking Group PLC, Royal Bank of Scotland Group PLC, Barclays PLC, HSBC Holdings PLC, Banco Santander SA and Nationwide Building Society.

David and Goliath

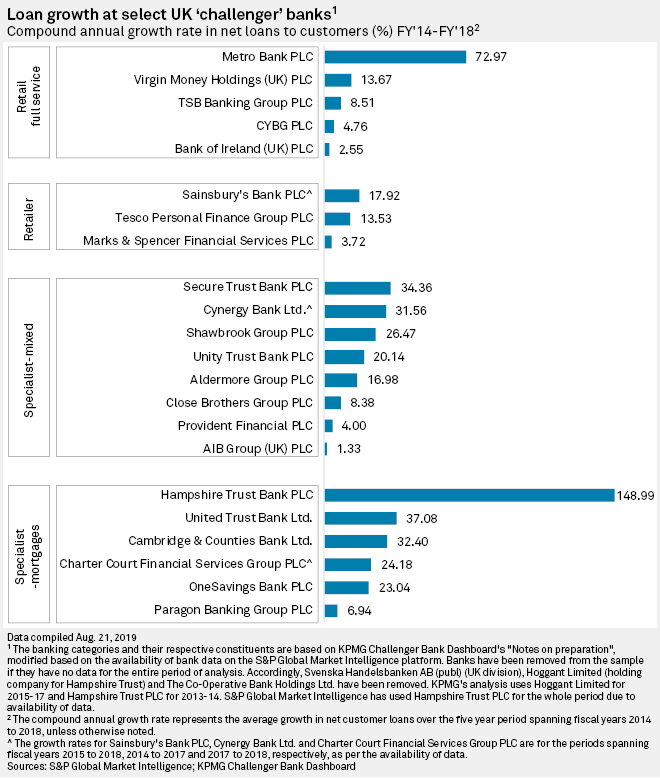

S&P Global Market Intelligence data shows that despite rapid loan growth at some of the challenger banks, such as full-service provider Metro Bank PLC and specialist mortgage provider Hampshire Trust Bank PLC, the sector's net customer loans stood at just £240 billion, compared with £1.6 trillion, more than six times that sum, for traditional banks.

Mark Mullen, chief executive of Atom Bank PLC and former boss of well-established lender First Direct, accepted that the newcomers are up against giants in the sector.

"What we can do must be underpinned by our risk-weighted capital. We have £1.8 billion in deposits, we've lent £2.4 billion as residential mortgages and £200 million in personal lending. While these numbers are big for us, in the context of the U.K. banking market they are tiny," Mullen said.

"If the expectation was that there would be a TSB Banking Group PLC or CYBG PLC springing up, then we need to look at the reality, which is that none of those banks are young, none appeared in a ray of light one day," he added. "It took them years to build their business. But there are new banks, some concentrating on specific areas like SME lending, that are not interested in becoming huge but against their business plan they are doing extremely well."

Post-crisis changes add to challenge

The so-called challenger banks sprang up in the wake of the financial crisis as governments in the U.K. and elsewhere sought to boost competition by obliging the dominant banks to give third-party providers direct access to information relating to consenting customers' payment accounts.

So far, the Bank of England has granted 21 licenses to startup banks since 2019, though other banks operate in the U.K. under European licenses, and not all financial technology providers are banks, which accept deposits.

Other changes in the wake of the financial crisis have weighed on challenger banks. Regulators forced British banks to legally separate, or ring-fence, their retail operations from investment banking.

"Ring-fencing topped up liquidity in some of the biggest banks in the world, let alone the U.K. It has helped them enormously. I don't think that has created a benign environment for challenger banks," Mullen said.

Incumbents head online as well

And the Big Six are getting in on the digital act as well.

RBS is about to launch Bo, its own digital bank, on a cloud-based system. Its main focus will be on the 17 million U.K. residents who have less than £100 in savings. It is also launching Mettle, an online business bank.

Standard Chartered PLC has a license for a new online-only bank in Hong Kong, and Santander has outlined plans to expand its branchless Openbank from Spain to 10 new countries.

KPMG's Little said the existing newcomers are in for a fight.

"I think the challengers will continue to grow but not as fast as they have done," he said. "They will increasingly be facing competition of real scale from the big banks. The challengers have the advantage of not having legacy systems or payment protection insurance compensation claims to pay, but they cannot get the same cheapness of funding that a massive organization can. Nationwide's technology budget runs into the billions for the years ahead, for instance, but as a new entrant that's very difficult to compete against."

KPMG said the challenger banks as a whole reported an increased cost of funding in 2018, reflecting the end of the Bank of England's Term Funding Scheme. This provided banks with £127 billion of cheap loans as part of the Bank's post-Brexit referendum rescue package. U.K. banks will have to refinance funding from the scheme in 2020-2022.

Atom Bank's Mullen agreed, saying, "The Term Funding Scheme changed pricing dynamics and the key beneficiaries are the big banks because it was a way to ensure the systemically important banks could keep lending."

Brexit risk

KPMG also warned of the dangers of a no-deal Brexit. The U.K. is due to leave the EU on Oct. 31, and Prime Minister Boris Johnson has vowed that the country will exit with or without a withdrawal agreement with the EU.

"A disorderly Brexit represents the single-biggest risk to the benign credit environment currently being experienced by the challenger bank sector," KPMG said.

Prolonged uncertainty over Brexit has led many companies to delay investment, and some fintech lenders have already been affected.

Some challenger banks have experienced funding problems in the run-up to Brexit, following rapid growth. Metro Bank PLC is being investigated by regulators after it misclassified large swaths of loans as less risky than they actually were, and its share price has plummeted by more than 85% in a year. It subsequently raised £375 million and is now reportedly on the brink of selling a £500 million mortgage portfolio to a U.S. hedge fund.

Not all have struggled, however. Atom Bank recently raised a further £50 million from investors, while Monzo raised £113 million earlier in 2019, and Starling Bank Ltd. has brought in £175 million in investment in the past year. Berlin-based N26 just hit a valuation of $3.5 billion and has raised more than $670 million in total; it has 3.5 million customers, more than 200,000 of whom are in the U.K.