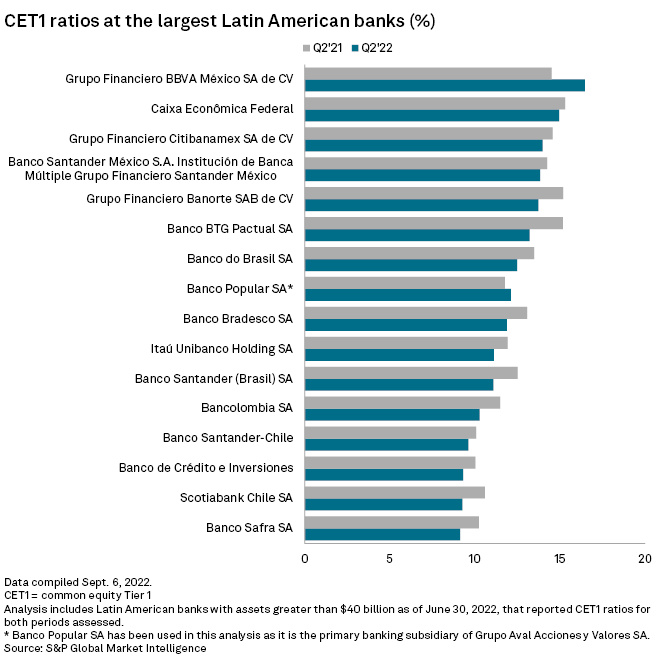

Common equity Tier 1 ratios, which compare banks' capital against their risk-weighted assets, dropped for the majority of the largest banks across Latin America in the second quarter of 2022, S&P Global Market Intelligence data shows.

Only two of the 16 banks with assets above $40 billion had higher CET1 ratios in the recent quarter than in the year-ago period — Grupo Financiero BBVA México SA de CV and Grupo Aval's Banco Popular SA. BBVA México also posted the highest CET1 ratio among regional banks at 16.5%, up from 14.5% a year ago.

Brazil's Caixa Econômica Federal, which posted the second-highest CET1 ratio at 15.0%, saw a slight contraction in its capitalization metric, down from 15.3% a year ago. Meanwhile, Bogotá, Colombia-based Banco Popular's ratio ticked to 12.1%, up from 11.8% a year ago.

Key capitalization metrics had risen for nearly all major banks in the region during the pandemic. Analysts attributed last year's bulked-up metrics to a flight to quality by savers, a conservative strategy by companies amid the economic downturn, and a lull in credit portfolios. The relative normalization of economies in 2022 is now leading banks to release some of that excess capital, as they attempt to grow their portfolios and seek profitability.

Analysts had forecast that capitalization ratios would decrease, as banks were able to give up liquidity in exchange for rebuilding their profits. In the long-term outlook, returns on loans are more attractive than returns on cash investments.

Liquidity ratios, which reflect how much cash and other assets a bank has to cover expected losses, also decreased for most banks in the sample, although all of them show levels that are at least at 100% of potential loan defaults. However, these results were mixed and the trend was not as clear as in the CET1 ratios.

Banco de Chile saw the sharpest increase in its liquidity coverage ratio among the sampled banks. "We have a very high capital ratio, the highest in the industry, strong level and we're quite comfortable with that level to implement Basel III in Chile," said Pablo Mejía Ricci, head of investor relations at the bank, which piled up additional provisions in the recent quarter given persistent uncertainties on the economic and political front.

Higher returns for banking activity seen in Brazil and Mexico, Latin America's two largest markets, helped to consolidate capitalization metrics in the second quarter.

Grupo Financiero BBVA México, Grupo Financiero Banorte SAB de CV and Grupo Financiero Inbursa SAB de CV together saw their combined net interest income grow nearly 24% annually in the second quarter, to 77.08 billion pesos.

In Brazil, Itaú Unibanco Holding SA, Banco Bradesco SA and Banco do Brasil SA continued to grow their loan books at a fast pace, driven by higher rates, the inertia of inflation and a renewed demand for credit as the economy continues to transition out of the pandemic.

Core Tier 1 ratios in Latin America's banking systems have either remained flat or ticked up in recent years, as financial institutions approach the implementation of Basel III accords. While Argentina and Brazil are farther along in the full implementation process, which requires higher CET1 ratios than Basel I and Basel II, banks in Chile and Mexico experienced notable upticks in their capitalization metrics in 2020 and 2021.

As of Sept. 14, US$1 was equivalent to 19.99 Mexican pesos.