Investors are set to jump into credit default swap indices again in 2023 after a lagging bond market drove record trading volume last year.

Some $30 trillion in volume was traded across CDS markets in 2022, the highest since at least 2009, as rising interest rates and related jumps in borrowing costs led to a drop off in corporate bond issuance. The lack of new bonds drained liquidity from the market, pushing investors into the more liquid credit default swaps indices, which are used as a bet on the likelihood of a credit default.

|

As rates rise further and potentially hold at their peak in 2023, bond issuers are less likely to draw new debt and more likely to default. Market watchers expect strong trading volume again during the year for CDS indices, which are used as a hedge against credit exposure and, secondly, as a tool for speculation on the direction of the bond market.

"If you take a position in a corporate credit, because there was a shortage of bonds and a lot of existing bonds are quite closely held and hard to source, in that situation many investors will turn to the CDS market as a synthetic hedge," said Gavan Nolan, executive director, fixed income pricing and research, at S&P Global Market Intelligence.

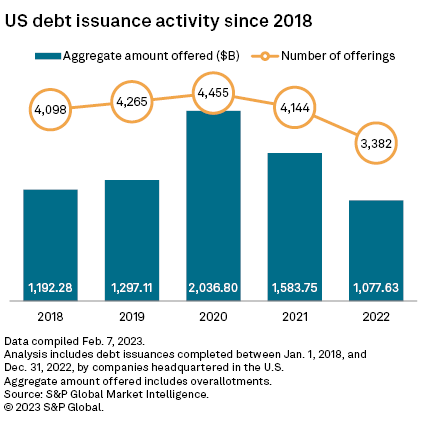

Corporate bond issuance in the U.S. fell 32.0% in 2022 to $1.078 trillion, while in developed Europe the total was down 14.7% to $994.23 billion, according to data from S&P Global Market Intelligence.

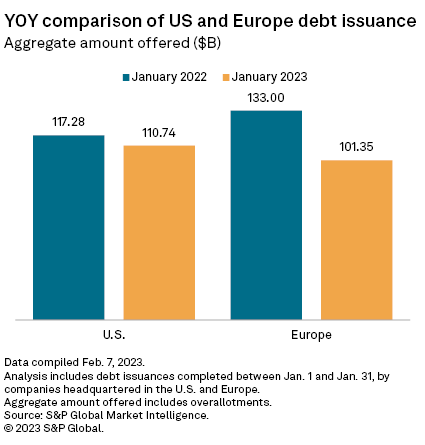

That has recovered somewhat at the start of 2023 as companies looked to raise cash ahead of further interest rate hikes, though January totals were still down year-over-year in both the U.S. and Europe.

The slowing pace of inflation has resulted in the cost of borrowing falling as investors price in fewer rate hikes. But while corporate bond spreads have narrowed from their peak, companies are, in the aggregate, still likely to avoid bonds if they can.

"We are unlikely to see issuance on a scale similar to the years prior to 2022 and rising default rates mean it should still be another good year for CDS volumes," Nolan said.

|

Corporate bond markets are inherently less liquid than sovereign bond markets as tens of thousands of differently rated securities compete for buying and selling interest. While top-rated AAA bonds may trade frequently, that is not the case for many bonds given that liquidity fades the further the credit rating falls. The lack of issuance makes it harder for investors

"There will probably be subdued issuance this year as well because of the high borrowing costs," said Greg Venizelos, senior credit strategist at AXA Investment Managers. "As some issuance starts to come through, this [CDS] position will start to be wound down to some extent."

The yield on the S&P U.S. investment grade corporate bond index has fallen to 4.95% from a peak of 6.03% in late October, making it less expensive for companies to borrow, yet that is still significantly higher than the 2.3% yield at the start of 2022 before the Federal Reserve started hiking rates.

"Caution is warranted in 2023," said Tom Hanson, head of European high-yield at Aegon Asset Management. "Challenging economic conditions are setting the stage for an interesting year ahead. Volatility will likely remain elevated as the market grapples with macro headwinds."

Index trading

In Europe, the iTraxx Europe Main index tracks 125 of the most liquid, investment-grade-rated European companies, while the CDX covers an equivalent bucket of North American credit default swaps. The more expensive an index becomes, the higher the expectation of defaults.

"You can use it as a long and as a short, especially in Europe where shorting ETFs is harder than in the U.S.," AXA's Venizelos said.

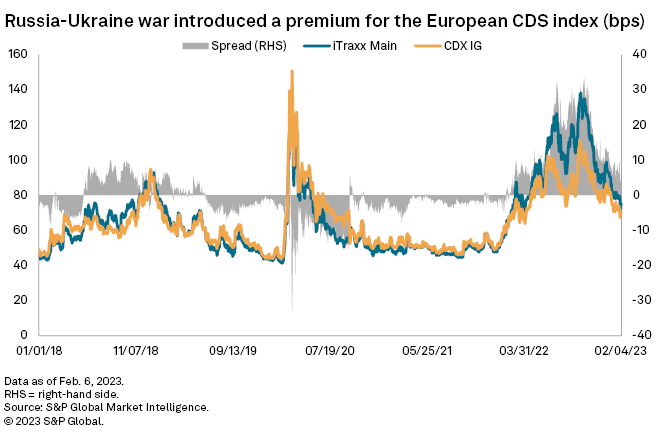

One of the most common trades in the CDS market is to short the iTraxx Europe and go long on the CDX as a proxy bet on the U.S. economy outperforming the European economy.

The risk premium between the iTraxx and CDX ballooned following Russia's invasion of Ukraine. The heightened exposure of European companies to imports of Russian oil and gas and the resulting higher energy costs caused the iTraxx to open up a 30-basis-point premium over the CDX.

The European industrial sector saw a disproportionate spread widening with companies like Volkswagen AG and energy-intensive chemicals company BASF SE, key players in the iTraxx Main, driving underperformance.

"Investors need to consider likely state intervention in key industries when the credit fundamentals appear overwhelmingly negative," Nolan said.