Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

4 Mar, 2021

By Shreya Tyagi and Tayyeba Irum

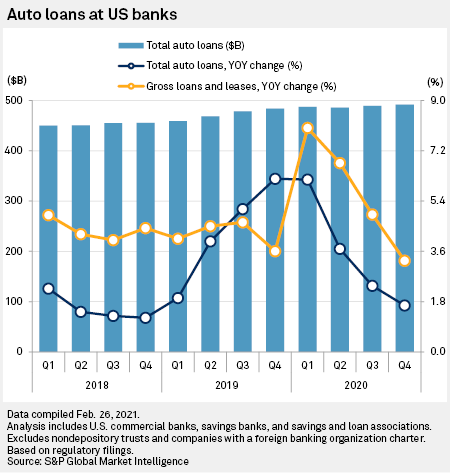

Auto loan books of the largest U.S. banks rose sequentially and year over year in the fourth quarter of 2020, with lenders confident demand would remain strong throughout the year ahead.

In the 2020 fourth quarter, banks' total auto loans rose to $491.72 billion, up from $489.16 billion in the third quarter and $483.68 billion in the year-ago period. Lenders are optimistic about auto sales this year owing to government stimulus, economic recovery and high saving rates. Lenders also mentioned supply constraints from a global shortage in semiconductors, which should support used car pricing and lenders' margins.

Capital One Financial Corp. most recently booked its two highest quarters of auto loan originations ever, said CFO Andrew Young at a recent investor conference. In the 2020 fourth quarter, the bank posted a 0.6% sequential increase, leapfrogging Ally Financial Inc. for the largest auto loan book in the U.S. banking industry.

On a year-over-year basis, Capital One posted an 8.9% increase in total auto loans as of the 2020 fourth quarter, compared to 2.0% year-over-year growth for Ally. Young said the company's growth in auto has been aided by its technology capabilities, including a tool called Auto Navigator.

"We like the underwriting choices that we're making and the capabilities that we have," Young said.

Still, Ally's auto loan book is not far behind in size at $65.47 billion of auto loans in the 2020 fourth quarter, compared to $65.76 billion for Capital One. And with a much smaller total asset base, Ally's concentration in auto loans remains significantly higher than Capital One's. Ally reported a sequential decline of 0.3% in total auto loans. Calling it a winning sector, the company's CFO Jennifer LaClair said there was "ample" opportunity to continue to originate at strong pricing and risk-adjusted returns rather than focus on volume.

LaClair said the outlook for 2021 remained robust, in part because of supply constraints due to a chip shortage following plant shutdowns last year.

"The supply constraints have led to margin expansion as well as high pricing on the used vehicle side," LaClair said.

At the same time, bankers at both Ally and Capital One said they were seeing increased competition in the auto loan space, which LaClair said should continue throughout 2021. "We are seeing competition heat up, but mostly kind of at the two ends of the spectrum, in the super prime and in the subprime space a bit," LaClair said.

Capital One's Young offered a similar take, saying the subprime asset-backed securities market has reemerged recently and some prime lenders are eager to put excess deposits to work.

"In auto, our growth has decelerated lately given the rising competition, but we still feel like we've got some technology-driven competitive advantages," said Capital One's head of investor relations Jeff Norris.

Overall, auto loans were a bright spot for banks in 2020 as the coronavirus pandemic encouraged consumer interest in personal ownership of vehicles to avoid the risk of contamination when using public transport, according to consultancy LMC Automotive's recent report.

Despite current inventory challenges, LMC Automotive said U.S. light vehicle sales will surpass 16 million units in 2021, with potential to rise further if supply-related issues subside in the second half of the year.

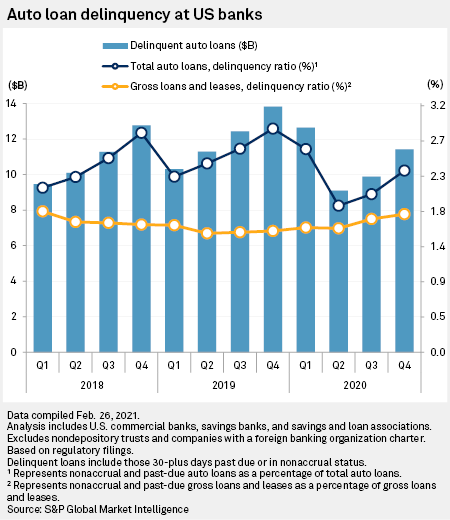

On the delinquency front, of all bank-owned auto loans, 2.32% were delinquent in the fourth quarter, up from 2.02% in the third quarter but down from 2.86% in the year-ago period.

Click here for an industry document detailing auto loan holdings.