Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

8 Feb, 2021

By Michael O'Connor and Jason Woleben

Democrats in Congress are pushing for federal cannabis reforms as more states pursue legalization and shares of cannabis companies continue to rise.

Democratic leaders in the Senate on Feb. 1 issued a joint statement saying they would soon release draft legislation on comprehensive cannabis reform and would prioritize the effort. Having the Senate majority leader back cannabis reform legislation is unprecedented and the statement is fueling optimism in the industry, Charles Alovisetti, a cannabis lawyer and partner at Vicente Sederberg LLP, said in an email.

The formal commitment to cannabis reform by Senate Democrats suggests there is a strong chance of legalization reaching President Joe Biden's desk, Owen Bennett, a Jefferies analyst, said in a Feb. 1 report.

"Any legislation will also likely allow U.S. cannabis companies to uplist onto a major exchange, get full access to capital markets, and allow institutional money to invest freely, all things prevented to date due to legal status," Bennett said.

The House of Representatives in December 2020 passed the MORE Act, which would remove marijuana from the federal list of controlled substances, and passed in September 2019 the SAFE Banking Act that would allow cannabis companies to access commercial banking services. The hurdle for those bills in the Senate had been Senate Minority Leader Mitch McConnell, R-Ky., when he was majority leader, which is no longer the case, Bennett said.

The U.S. cannabis industry could be a $50 billion market in 2030 even without legalization from new states and federal legalization, while the latter could push the market to $115 billion by 2030, Michael Lavery, a Piper Sandler analyst, said in a report Jan. 26. Lavery estimated that the market value in 2020 was $17.5 billion.

"U.S. cannabis companies are now hitting a level of maturity where real business models are emerging," said Joe Bayern, CEO of cannabis producer and retailer Curaleaf Holdings Inc., in an interview. "There's a tangible business model out there and people can now evaluate that model and see what the growth prospects are."

Other developments benefiting the chances of cannabis reform include widespread bipartisan support, many Republican states already legalizing cannabis, the potential for tax revenue and the possibility some Republicans support federal reform, Bennett said.

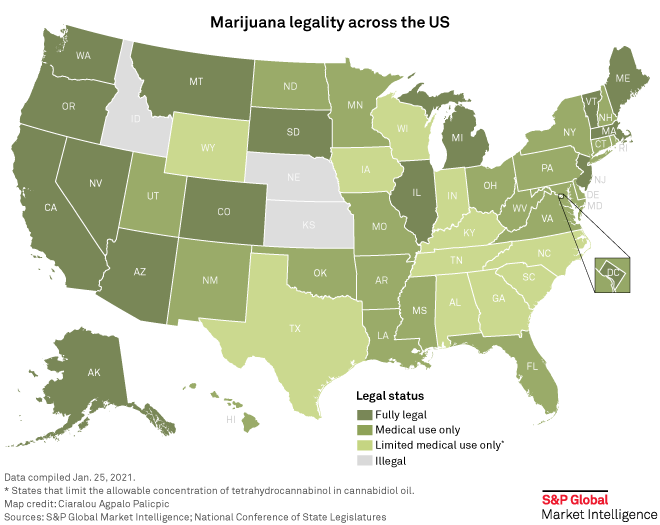

Arizona, Montana, New Jersey and South Dakota voted in 2020 to approve ballot measures to legalize adult-use cannabis. South Dakota's cannabis reforms include provisions for medical cannabis, and voters in Mississippi also backed medical cannabis.

There are now 15 states and three territories where adult-use cannabis is legal and 36 states and four territories where medical cannabis is legal. More states are expected to follow suit, with New York Gov. Andrew Cuomo calling to legalize adult-use and New Mexico Gov. Michelle Lujan Grisham including legalization on her list of 2021 priorities.

"Not only will legalizing and regulating the adult-use cannabis market provide the opportunity to generate much-needed revenue, but it also allows us to directly support the individuals and communities that have been most harmed by decades of cannabis prohibition," Cuomo said in a Jan 6. news release

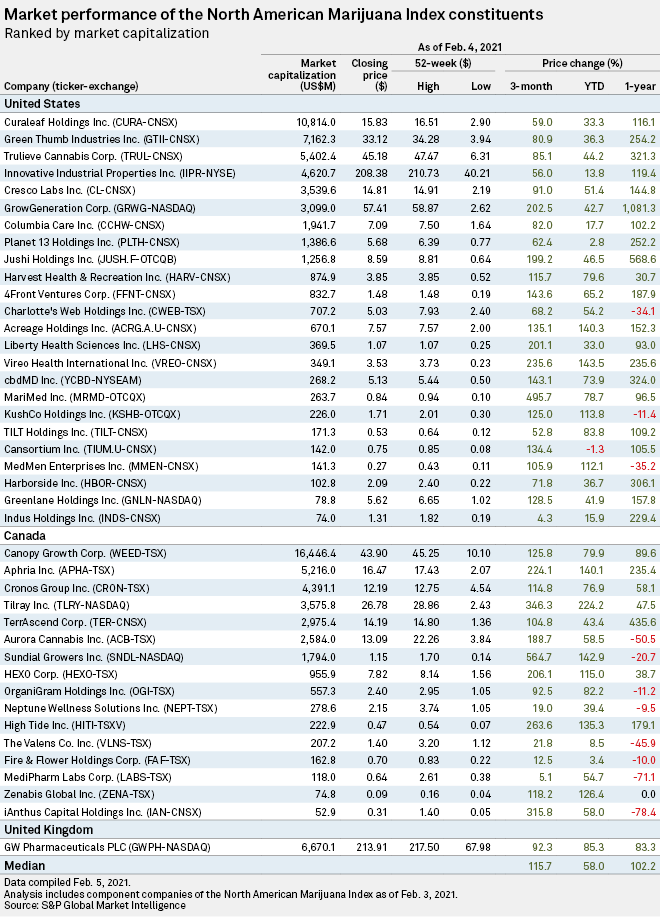

With greater momentum behind reform efforts, shares of cannabis companies are on the rise. The median price change for shares of constituents in the North American Marijuana Index was a 102.2% increase for the year ended Feb. 3, according to S&P Global Market Intelligence.

Shares of GrowGeneration Corp., which owns and operates specialty retail hydroponic and organic gardening stores, rose 1,081.3% to $57.41 in the same period, and shares of the multi-state cannabis company Jushi Holdings Inc. rose 568.6% to $8.59. GrowGeneration and Jushi are based in the U.S.

Some cannabis stocks are faring worse than others. Shares of iAnthus Capital Holdings Inc. fell 78.4% to 31 cents for the year ended Feb. 3, and shares of Aurora Cannabis Inc. were down 50.5% to $13.09 in the same period. Both companies are based in Canada.

Keith Stauffer, CFO of Canadian cannabis producer TerrAscend Corp., in an interview said that unlike previous periods when cannabis stocks were growing, companies like his can now show real revenue growth, profitability and cash generation. TerrAscend reported third-quarter net sales of $51 million, a 90% increase year over year, and adjusted net income of $12.7 million.

"The industry just has very positive fundamentals with or without the political shifts," Stauffer said. "The political shifts now most likely accelerate some of these legislative changes and so forth that had been in the works for some time now."

Experts say institutional investors are becoming increasingly comfortable with the industry. TerrAscend recently closed a C$224 million private placement with 80% coming from four large U.S. institutional investors, the company said. A cannabis-focused commercial mortgage REIT called AFC Gamma announced Feb. 3 the terms of an IPO through which it plans to raise $100 million.

Public cannabis companies raised a combined $1.17 billion in equity and $76.1 million in debt in first four weeks of 2021, according to Viridian Capital Advisors.

"2020 saw the true emergence of the institutional investor in this industry," Scott Greiper, president of Viridian Capital Advisors, said in an interview.

Public companies with rising valuations are likely to continue to fuel a healthy pace of deal-making in the cannabis industry, experts say. Jazz Pharmaceuticals PLC announced Feb. 3 that it plans to acquire GW Pharmaceuticals PLC, which makes marijuana-based medicine, in a $7.2 billion deal.

"We're just seeing a lot of uptick of people looking around and trying to figure out what's going on here, who to buy and how to consolidate," Morgan Paxhia, co-founder of cannabis investment firm Poseidon Asset Management LLC, said in an interview.