The Toronto-Dominion Bank is the latest example of a Canadian bank seeking to expand in the U.S., where markets are much bigger and the regulatory environment is lax compared to their home countries.

TD acquires Cowen

In early August, TD agreed to buy New York-based broker/dealer Cowen Inc. for $1.32 billion, or $39 per common share, in an all-cash deal.

"The acquisition of Cowen will build TD Security's strong foundation," TD CEO and Group President Bharat Masrani said on a quarterly earnings call. "This combination will further accelerate our growth in the U.S. and position TD Securities as an integrated North American dealer with global reach."

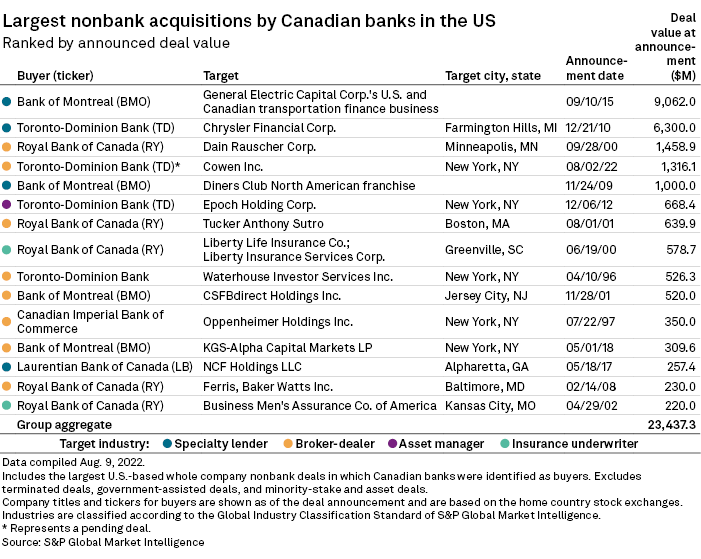

The Cowen deal is the fourth-largest nonbank acquisition by a Canadian bank. It's likely that TD, which has low capital markets exposure relative to other Canadian banks, chose Cowen as an acquisition target due to its robust capital markets business, said Scott Chan, director of financials research at Canadian financial services firm Canaccord Genuity.

"I think in order to compete on a bigger scale in capital markets, TD had to do something inorganically rather than organically," Chan said.

TD's First Horizon deal

TD's acquisition of First Horizon Corp. is the second-largest bank acquisition ever by a Canadian bank at $13.67 billion, according to S&P Global Market Intelligence data.

"It adds scale in a lot of the same markets and areas that TD is in on the southeast side," Chan said. "The culture and retention ... those are kind of what's on the other side of the equation too in terms of making it work long term."

Among the 15 largest U.S. bank acquisitions by Canadian banks, four of them were TD acquisitions, including two of the top three, according to S&P Global Market Intelligence data. Likewise, TD accounts for four of the top 15 U.S. nonbank acquisitions by Canadian banks.

Other Canadian Banks look south

One major reason U.S. markets are attractive to Canadian banks is that Canada's population amounts to only about 10% of the United States', said Daniel Tsai, a business and law professor with banking expertise at Ryerson University. Also, there are only a few major national banks in Canada, and they are subject to greater regulatory scrutiny than U.S. banks, which makes for an especially tight M&A market, Tsai added.

"You can't sneeze here without regulators coming down on you in Canada," Tsai said. "The U.S. is a very fertile market compared to Canada. There's less regulation. There are way more banks there that are available for acquisition."

Canadian banks have been acquisitive in the U.S. for a long time, said Ebrahim Poonawala, the head of North American banks research at Bank of America Securities, adding that Royal Bank of Canada and Canadian Imperial Bank of Commerce are best positioned to make more deals in the U.S.

"RBC presently has the most capital still on hand, so they have a lot more capital flexibility, and CIBC has talked about continuing to look for potential tuck-in deal opportunities," Poonawala said.