Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

29 Mar, 2021

By Kip Keen and J. Holzman

As Canada grapples with policies to boost domestic supply of critical metals and minerals, industry experts say the country will require more funding to compete with China in producing key metals such as rare earths.

The Canadian government recently outlined a list of 31 critical minerals including rare earths, cobalt and graphite, and it subsequently refined takeover guidelines, saying acquisitions of critical mineral companies and bids by state-owned companies could lead to national security reviews.

"China continues to maintain a strong advantage because many of their operations are supported with government subsidies," rare earths expert Michael Thomsen told S&P Global Market Intelligence. "That is not the case in the West. Our operations must be economic from a business standpoint or they will not be developed. So possibly Western government intervention and investment may be necessary to compete with the Chinese."

Thomsen has been in the mining industry for about 40 years, including roles with Newmont Corp. and Freeport-McMoRan Inc., and is chair and a founding director of recently formed North American Strategic Minerals Inc., which is focused on rare earths exploration in the U.S. Thomsen is also chair of privately held Taiex Ltd., which is focused on gold and copper exploration in Taiwan.

|

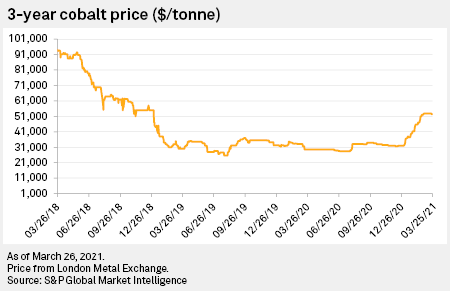

Canadian officials' doubling down on critical mineral policy arrives at a time of heightened cooperation with the U.S. and other allies to combat China's influence over mineral supply chains. On cobalt and rare earths alone, China represented 77.1% and 31.5% of total imports in 2019, according to data from Panjiva, while cobalt prices have surged in recent trading alongside demand for electric vehicles.

Canadian Prime Minister Justin Trudeau has refashioned relations with the U.S. through this lens. During the tenure of former U.S. President Donald Trump, the two countries found compromise on mining issues and pursued bilateral talks on strengthening cooperation on critical minerals.

When Trudeau first spoke with President Joe Biden following the inauguration in early 2021, the leaders agreed to work together to bolster a regional battery metals supply chain. The U.S. has since reportedly encouraged its mining companies to expand to Canada.

The U.S. will need to work with friendly nations such as Canada that have "significant mining experience and active mining" operations to adequately challenge China, Ernest Moniz, who was U.S. energy secretary under the Obama administration, recently told a U.S. House committee.

"We need to work to diversify these sources of minerals and their processing," Moniz told U.S. lawmakers March 22. "What we really need to do is work with our allies."

Likewise, Canadian Minister of Natural Resources Seamus O'Regan has stressed that the country needs to fortify supply chains in sectors such as electrical vehicle manufacturing, where batteries depend on a suite of metals and minerals including lithium, graphite and cobalt.

"Canada is and will continue to be a reliable global supplier. We're one of the only Western nations that has an abundance of cobalt, graphite, lithium and nickel, all essential to creating the batteries of the future," O'Regan said March 8 during the opening of the annual Prospectors & Developers Association of Canada conference.

Canada has yet to define major policies attached with funding to boost the production of critical minerals, but it has cast domestic mining as crucial to developing a greener economy driven by increasing electrification. Among recent modest-sized initiatives, the Canadian government announced it would provide half the funding for a C$10 million plan by First Cobalt Corp. to develop a cobalt refinery in northern Ontario.

Whether Canada pursues major new funding initiatives will soon become more clear, with the federal government planning to unveil its first budget in over two years April 19. Mining Association of Canada President and CEO Pierre Gratton is looking for a suite of policy measures in the budget targeting the mining sector, the executive told Market Intelligence.

These policy measures include funding for research and development in rare earths to tackle processing challenges, funds to boost rare earths and battery supply chains, and support for remote mines, which cannot easily access grid power as Canada moves away from carbon-intensive energy.

On rare earths, Thomsen said Canada faces stiff challenges, particularly in processing, as it looks to compete with China and partner with the U.S. on securing supply chains.

"The problem is that the metallurgy of 95% of these so-called [rare earth element] deposits will never have the rare earth metals extracted because the metallurgical recovery characteristics are too complex and too costly," Thomsen said.

Panjiva is a business line of S&P Global Market Intelligence, a division of S&P Global Inc.