A small California bank's merger application could force the FDIC to take a firmer stand on marijuana banking.

On June 14, Oakland, Calif.-based Summit Bancshares Inc. received word from the Federal Deposit Insurance Corp.'s San Francisco Regional Office that the regulator would recommend denial of its application for merger with Faciam Holdings Inc., due to the bank's business plan to service marijuana-related businesses, or MRBs, according to a shareholder letter. Marijuana is legal for both recreational and medicinal purposes in California, but it is still illegal under federal law.

The bank plans to continue with the merger anyway.

"The Board of Summit has decided to not withdraw the application and to require the FDIC to go on record to deny the application," Board Chair Shirley Nelson wrote in the letter.

The bank's board believes the matter is important enough to be decided by FDIC leadership, said Gary Findley, a lawyer with Gary Steven Findley & Associates and legal counsel for the bank. "It's a policy decision," he said in an interview.

This is the first time the FDIC has been asked to directly grant or deny a bank access to cannabis banking, according to Findley.

Current guidance from the Financial Crimes Enforcement Network, or FinCEN, requires banks to file a suspicious activity report whenever an MRB opens an account and every 90 days thereafter, even if marijuana is legal under state law.

Banks that provide services to MRBs could be prosecuted for money-laundering or drug trafficking under federal laws, according to Morgan Fox, media relations director for the National Cannabis Industry Association, a trade group for marijuana businesses.

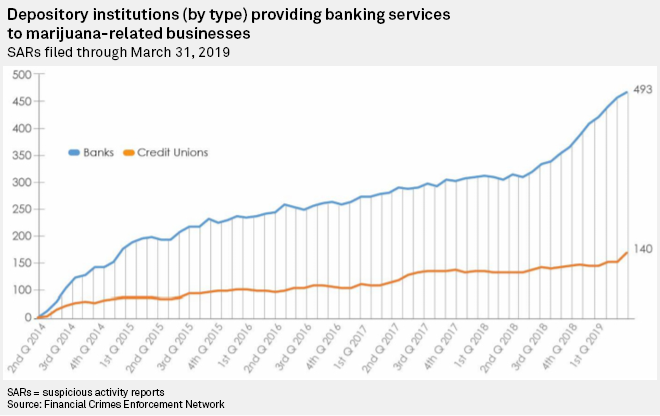

According to a brief published by the National Association of Federally-Insured Credit Unions, FinCEN data showed that 633 depository institutions provided banking services to MRBs as of March 31. This is an increase of 147 depositories from FinCEN's September 2018 data.

In the letter, Nelson wrote that the FDIC said during its conversation with the bank that "the FDIC has not dissuaded" banks from banking MRBs, but that approval would be "problematic."

"[The FDIC is] not saying you can't bank MRBs, it's just that they don't want to approve it," said Findley.

Steven Miller, a lawyer with Miller Nash Graham & Dunn LLP who works in cannabis banking, said regulators are "hamstrung" in this situation, given the difference between FinCEN guidance and federal law. The FDIC declined to comment when reached.

Faciam plans to keep Summit's leadership largely intact, but it would add Sundie Seefried to the bank's board. Seefried is CEO of Arvada, Colo.-based Partner Colorado CU, which provides marijuana banking services. She also educates financial institutions entering cannabis banking on compliance requirements.

Seefried said in an interview that her credit union has faced increased scrutiny over the product line. Partner Colorado has had 12 regulatory exams in the last four and a half years, as opposed to the standard one per year, said Seefried. Examinations are mainly focused on Bank Secrecy Act compliance.

Partner Colorado filed 1,000 SARs in the last month, Seefried said.

"That is a lot of reporting to do ... but it is part of the obligation that comes into getting into cannabis banking," she said.

A congressional bill called the SAFE Banking Act, introduced in March, would give banks safe harbor to serve MRBs. Nash said the bill is unlikely to pass in time, but Senate Banking Committee Chair Sen. Mike Crapo, R-Idaho, has scheduled a hearing in his committee to examine the issue on July 23. The hearing signals that Crapo could adjust his earlier stance that federal law must change before the bill should be considered.

Banks are wary of taking on the risk of marijuana-related banking, sometimes charging very high account fees and refusing to lend money, said Fox, of the National Cannabis Industry Association. "I'm not aware of any banks that are actively participating in lending," he added.

The FDIC's decision on the Summit merger may have widespread implications and may discourage banks interested in mergers from entering cannabis banking.

"If it becomes evident that one of the risks is that you may not be able to do deals ... it's likely to push people out of the market," said Miller.

Seefried and Nash indicated that Summit's business plan would not change whether the merger was approved or denied.

If the FDIC approves the merger, it could open a pathway for banks to feel secure banking MRBs.

"It's going to be a monumental decision for the FDIC," said Seefried. "A precedent-setting moment."