A pair of sports betting ballot issues in California are drawing more political ad spending during this U.S. midterm election cycle than key Senate races.

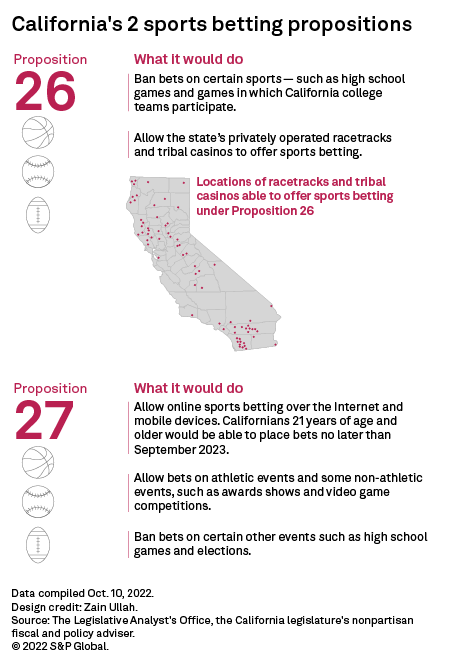

California's Proposition 26 would allow for more gaming activity and online/mobile sports betting at Native American casinos in the state, while Proposition 27 would allow online and mobile sports betting across the state. Together, ad spending for the two measures have totaled some $400 million across various media as of Oct. 5, according to estimates from Kantar Media Intelligences Inc.

"That is more than the biggest Senate races, those in Georgia, Arizona, Pennsylvania, Wisconsin, any place," said Steve Passwaiter, Kantar's vice president and general manager for North America.

|

California is not only the country's most populous state, it is also home to 15 sports teams from the NFL, NBA, MLB and NHL. At stake is millions of dollars in tax revenues for California derived from those interested in wagering legally.

Record-setting windfalls

Sports betting issue spending is a boon to TV stations and other media outlets in California, where political ad spending can be more muted, said Peter Leitzinger, an analyst at Kagan and a California resident. Kagan is a media research group within S&P Global Market Intelligence.

"It seems as if every commercial pod includes a sports betting ballot ad," Leitzinger said of today's California TV landscape.

Though technically two separate ballot measures, Kantar's Passwaiter said spending on Prop 26 and Prop 27 should be viewed as interrelated. "Together, this one is soaking up so much money, it's setting records," Passwaiter said.

Media outlets in Los Angeles have been the primary beneficiary of the ballot spending with a total of $180 million, according to Kantar. San Francisco outlets follow with $66 million, while those in Sacramento and San Diego had seen estimated outlays of $50 million and $36 million, respectively, as of Oct. 5.

"Clearly, we are benefiting from the huge spend on ballot measures," said Steve Lanzano, president and CEO of the Television Bureau Of Advertising Inc., the trade organization for the local U.S. broadcast TV industry.

Moving past the election cycle, the state stands to benefit from tax revenue on expanded sports betting, should the two ballot proposals pass.

Currently proposed at a 10% rate, tax revenues from the new betting activities would be earmarked by California to support homelessness programs, the enforcement of gambling laws and programs to help people suffering from gambling addiction. Monies would also go toward tribes not involved in online betting.

"Many other states now have sports betting and it seems to be working with tax revenues. California has not yet gotten the windfall from marijuana taxes it expected," said Leitzinger.

Jennifer Witte, senior vice president of investment at Horizon Next whose client base includes sports book operator FanDuel Inc., said at current levels, California's tax rate is attractive. "Right now, the tax rate is at 10%. If it stays that way, it could be extremely profitable for us and other sports books," Witte said, speaking at a TVB conference last month.

A 10% rate would be neither the highest nor lowest tax rate seen in the more than 30 states that have legalized sports betting. Iowa and Nevada tie for the lowest rates at 6.75%, while New York, Rhode Island and New Hampshire have the highest rates at 51%.

Ad spending implications

Although New York's 51% level has enabled the state to quickly collect record tax revenue from online sports wagering, the high tax rate has not been as kind to sports books, which are losing money there, Witte said.

That has influenced FanDuel's game plan, which Witte said includes wanting to maintain "a winning share of voice" in select markets where the operator has launched sports betting. New York has experienced wild swings with ad outlays, Witte said, but added that it is just not profitable to conduct year-round sports book advertising throughout the state. FanDuel is prioritizing dollars in larger, more populated markets like New York City and Buffalo, while skipping over smaller areas like Watertown.

Such considerations have prompted Horizon to assess whether to secure national ad placements on a case-by-case basis, with such buys coming at the expense of local schedules.

If California's Proposition 27 is approved, Witte cautioned TV stations and other media vehicles not to expect sports betting advertising to materialize immediately, noting there is always some lag time between legislative approbation and enactment as states work out regulatory and licensing issues.

In the meantime, California TV stations will continue to enjoy record political ad spending around the propositions. "Considering that 40% of political ad spending generally happens in October, there is more coming," said Kantar's Passwaiter.