| CaixaBank CFO Javier Pano said the increase in eurozone interest rates will be a "very powerful driver" of profitability. |

CaixaBank SA, Spain's largest domestic lender, is well positioned to deliver on its projected boost to profitability in the coming years because of its loan book's sensitivity to rising interest rates.

CaixaBank is among the eurozone banks set to benefit from rising rates as its revenue is derived mainly from lending to homeowners, consumers and businesses. This lending is predominantly at floating rate, meaning that borrowers must pay more as interest rates rise. Record low interest rates in recent years have squeezed CaixaBank's net interest income — the difference between the revenue generated from a bank's assets and the expenses associated with paying on its interest-bearing liabilities — which it has looked to offset through growth in fee income and other sources of revenue.

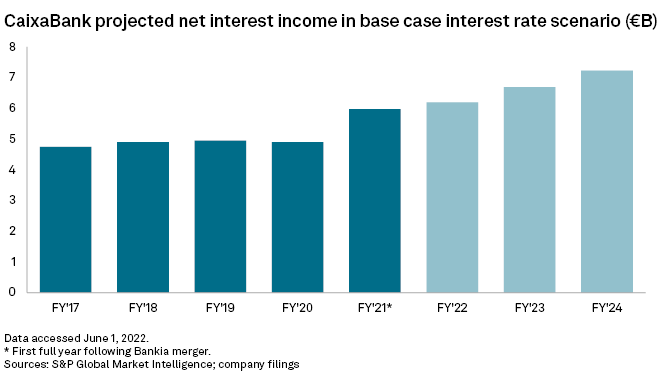

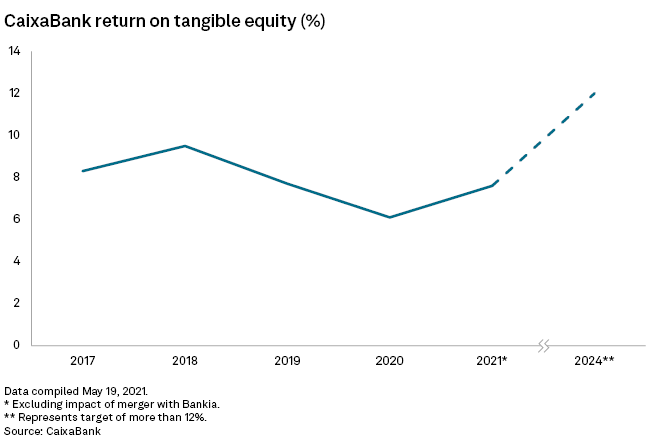

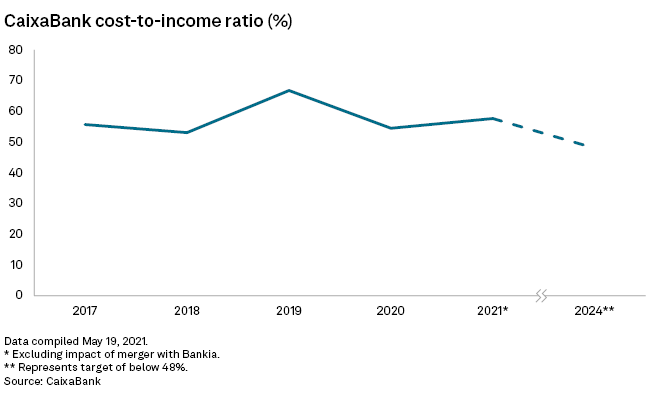

The bank forecasts an 8% compound annual growth rate in net interest income between 2022 and 2024 in a base case scenario for rising rates, according to a recent strategy announcement. In this scenario, the bank would generate an extra €2 billion in net interest income, or NII, over the three years. This in turn would help raise its return on tangible equity to 12% in 2024 from 7.6% in 2021.

"The NII target it has laid out highlights how sensitive to rising interest rates it is and the really big impact that can have on profitability in the near term," Benjie Creelan-Sandford, bank equity analyst at Jefferies, said in an interview.

A rise in eurozone interest rates, which have been negative since 2014, looks imminent. This comes as pressure mounts on the European Central Bank to tighten monetary policy earlier and faster than planned, as inflation data continues to exceed forecasts. The bank's first rate hike since 2016 could take place in July, with some economists suggesting the first rise could be by as much as 50 basis points.

The ECB's return to positive rates will be a "very powerful driver of our profitability," CaixaBank CFO Javier Pano said during a May 17 strategy presentation.

The structure of CaixaBank's balance sheet means it is well-set to benefit from higher rates. The volume of the bank's assets set at a floating interest rate vastly exceeds its liabilities on a floating rate. In a base case scenario of excess liquidity and forward interest rates of 1% to 2% for 2023, CaixaBank estimates that 30% to 35% of its deposits will generate a cost through 2024.

"As rates go up, we will have to start paying some interest to some of those deposits," said Pano. "But [there] is a very large part of it that actually will have zero cost."

CaixaBank's position as the largest domestic lender in Spain — Banco Santander SA is much larger but operates primarily outside Spain — also gives it room to maximize gains from higher rates.

"They are the market leaders in Spain," said Pablo Manzano, deputy vice president, financial institutions at credit rating agency Morningstar. "If they want to benefit from higher interest rates, they have the market power to do that."

CaixaBank completed a merger with Bankia SA in 2021, growing the lender's balance sheet by almost half to more than €450 billion, according to S&P Global Market Intelligence data. The tie-up helped boost CaixaBank's NII by around 22% in 2021, the data shows.

The gains from higher rates will help enable CaixaBank to distribute around €9 billion to shareholders between 2022 and 2024. This includes a €1.8 billion share buyback announced as part of its strategy presentation.

The confirmation of CaixaBank's €1.8 billion buyback bodes well for any similar moves in the future, said Creelan-Sandford. "The fact that the regulator is happy signing off on some of these larger buyback programs is a relatively positive signal about how the regulator thinks about the health of banks' balance sheets and the outlook going forward," Creelan-Sandford said.

Credit analysts are less enthusiastic about CaixaBank's plans to return any capital above the 12% CET1 threshold, said Manzano. "From a credit point of view, it's not good that they are reducing their capital ratio," Manzano said.

As a bank reduces its capital ratio, it becomes less able to cover its creditors in the event of a crisis, which leads to credit analysts viewing it as a greater risk for anyone lending to that bank.

CaixaBank did not respond to a request for comment.

S&P Global Ratings said the boost to profitability projected by CaixaBank's strategy was "unlikely to drive positive ratings actions," but should help close the profitability gap between the bank and its peers. CaixaBank had a ROTE of 7.6% in 2021, compared to 12.7% for Santander

Lower-than-expected fee growth in CaixaBank's projections is also tempering investors' reaction to the strategy, said Creelan-Sandford.

"The fee outlook is not as bright as it was last year," said Creelan-Sandford. "There are potentially some headwinds from slightly lower activity levels and, in the case of CaixaBank, there is the likelihood of corporate deposit charges dropping out of the fee income line, as well, as interest rates rise."