Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

21 Oct, 2021

By Sydney Price

As cable operators and telcos increasingly compete for the same customers, analysts expect the battle to hinge on two things: pricing and subsidies.

MoffettNathanson analysts are calling the interaction between cable companies and telcos a "convergence apocalypse." Cable operators are cutting prices on their mobile offerings, hoping to lure wireless customers away from carriers. Telcos, meanwhile, are using phone subsidies to keep wireless customers, all while deploying more fiber, hoping to win broadband customers away from cable companies.

"Customers, according to this thesis, will increasingly want all of their services from a single provider, and the cost structure for providing those services will increasingly demand a converged fixed/wireless network," MoffettNathanson analyst Craig Moffett wrote in a research note. "In this dystopian converged future, there are no winners. There is only mutually assured destruction."

Pricing vs. subsidies

Following a similar move from Comcast Corp. earlier this year, Charter Communications Inc. recently cut the price of its Spectrum Mobile phone plan. Customers with at least two mobile lines can now get unlimited service starting at $29.99 per month, per line. Previously, every line of unlimited service costs $45 per month. Charter's pricing is lower than entry level plans from AT&T Inc. and Verizon Communications Inc.

"We’d expect more of the pressure to be felt by the incumbents (AT&T and Verizon, whose pricing seems increasingly uncompelling) than T-Mobile US Inc.," New Street Research analyst Jonathan Chaplin wrote in a note.

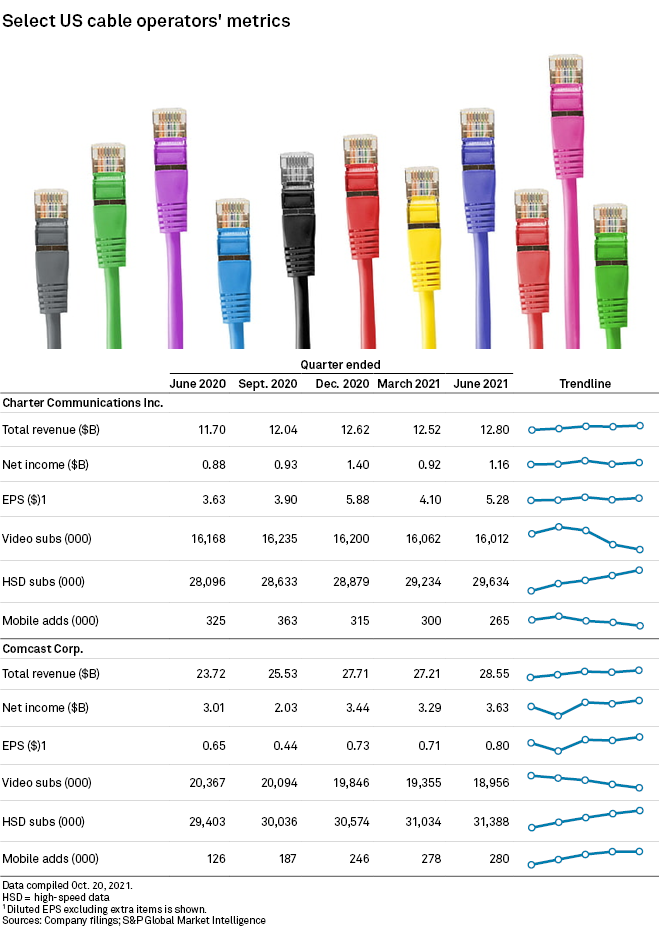

Comcast in April added a multi-line discount for unlimited plans. The company added 280,000 mobile lines in the second quarter, up from 126,000 net additions in the prior-year period.

Despite price cuts, companies like Charter and Comcast do not offer device subsidy deals of the same caliber of wireless competitors, wrote Chaplin.

New promotions

Wave7 analyst Jeffrey Moore said wireless companies used customers' anticipation of the latest iPhone 13 to create new promotions and hold onto customers who may have otherwise switched carriers.

"The carriers are basically subsidizing phones and making up for it by reducing churn and by getting more service revenues,” Moore said. “AT&T launched full-board into it last October, and AT&T executives have been joyfully commenting about the positive results of doing that."

AT&T recorded 928,000 postpaid phone net adds during the third quarter, the highest in more than 10 years.

"Those that have participated in our promotional offers have a higher [lifetime value], a better churn and a higher satisfaction score than those that have not," Jeff McElfresh, CEO of AT&T Communications, said during an Oct. 21 earnings call. "So it's not just that we are adding more customers; we know, based on these metrics that we see, that we're adding high-value customers."

Moore says Verizon and T-Mobile have followed in the footsteps of AT&T’s competitive pricing, but AT&T continues to outpace competitors. T-Mobile on Oct. 21 said it would pay off what customers owe to other carriers for eligible smartphones, with the offer capped at $1,000. Verizon’s best upgrade deals require premium unlimited and high-end devices.

Verizon on Oct. 20 posted a net gain of 429,000 postpaid retail phone connections, representing the sharpest growth since 2019. Speaking during an earnings call, Verizon CEO Hans Vestberg said the company has "been going back and forth on our promos" because the company is interested in attracting high quality, long-term customers.

"There is, of course, a little bit more competitive landscape right now," the CEO said. "But ... if you look at our numbers, we are competing extremely effectively. We're gaining the high-quality customers regardless of the type of competition we have."

Moore noted that effects of the semiconductor shortage are impacting phone supply, which could over time impact upgrade numbers as popular devices take longer to restock.

Comcast is set to report September-quarter results Oct. 28, while Charter will report Oct. 29.