Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

12 Aug, 2022

By Sydney Price and Darakhshan Nazir

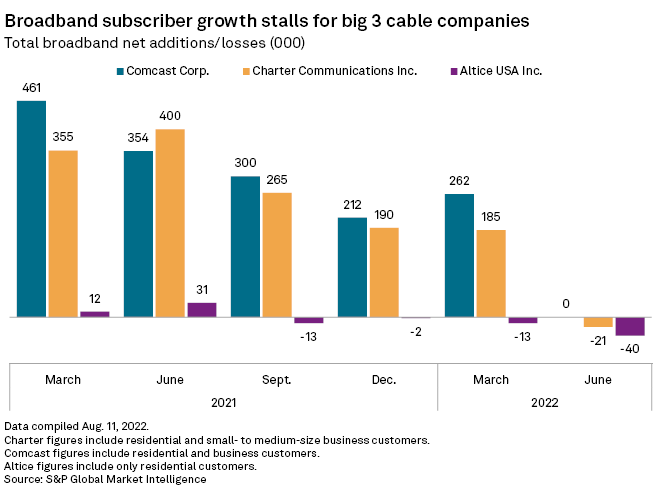

As cable broadband growth stalls this year, analysts are declaring the end of an era for the industry.

The three largest U.S. cable companies all recently reported residential broadband subscriber net losses for the second quarter. When business customers were added in, Comcast Corp. managed to eke out zero net additions. Its peers were not so lucky. Charter Communications Inc. lost 21,000 broadband customers during the quarter, its first second-quarter customer losses since 2013. Altice USA Inc., meanwhile, lost about 39,600 residential broadband customers in the period, marking its fourth consecutive quarter of losses.

The downward trend partially reflects the type of seasonality previously seen before the pandemic, as hordes of college students typically disconnect subscriptions at the end of a school year. But this year's numbers also reflect a number of new trends related to homebuying patterns, government subsidy losses and fixed wireless competition, analysts and executives said.

"Where do expectations go from here?" wrote New Street Research analyst Jonathan Chaplin. "The short answer: down."

Mobility matters

Analysts and executives cited three primary pressure points for the cable broadband business. First, household formation and moves between houses remain low.

"Broadband additions, of course, are basically a function of churn and connect activity," said Comcast CEO Brian Roberts during the company's second-quarter earnings call. "While churn remains well below 2019, connect activity was also lower than what we generally see in the second quarter."

The big picture on moves is mixed, however. Fewer moves hurt Comcast in the 60% of the markets where they compete against slower DSL networks, but it helps in areas where the company would face greater competition from high-speed fiber, Chaplin said. In those more competitive areas, fewer moves mean less risk of Comcast losing a customer to a rival network.

"If moves recover, it will help Comcast's broadband adds, but it won't be transformative," the analyst said.

Pandemic impact

The second pressure point for broadband service providers is moving past the substantial subscriber growth that occurred during the pandemic as many Americans suddenly relied on high-speed internet to learn and work from home.

During the first year of the pandemic, Comcast added roughly 600,000 more customers than its prior annual average growth. Pandemic-related selling opportunities have since waned, Roberts said.

The second quarter also saw an impact from the March 1 cessation of the Emergency Broadband Benefit program, which provided a $50-a-month credit to eligible households for internet and mobile expenses. Some — but not all — of those subscribers were transitioned to the Affordable Connectivity Program, which generally provides a discount of up to $30 per month toward internet service for eligible households.

Charter CFO Jessica Fischer said the company organically would have added 38,000 internet customers but instead lost 59,000 due to customers who were unable or unwilling to transfer from the Emergency Broadband Benefit Program to the Affordable Connectivity Program. Many of those customers did not meet the requirement of using the service in each 30-day period.

"Looking forward, we expect that zero-usage ACP customers will have a smaller impact in our quarterly results than what we saw this quarter," said Fischer.

Fixed wireless threat

The third factor pressuring the cable industry's internet subscriber growth is competition from fiber and fixed wireless broadband.

"Fixed wireless is a new entrant in the marketplace," said Comcast's Roberts. "While there are likely to be significant long-term limitations, today's excess capacity in wireless networks is creating what we believe to be a temporary opportunity targeted at value-oriented customers."

Notably, analysts expect cable will prevail in the long term, as telcos like Verizon Communications Inc. and T-Mobile US Inc. that are offering fixed-wireless broadband face more capacity constraints.

"Verizon and T-Mobile have pegged their capacity limit at 10MM subs each in the past," Chaplin said. "Our analysis suggests that subs will fall well short of the limit, when you overlay capacity with demand by market. We estimate 11MM FWB subs between the two, with 7MM of these drawn from Cable markets."

Also, while telcos are competing for fixed wireless customers, cable operators are competing for mobile subscribers through offerings like Xfinity Mobile and Spectrum Mobile. Comcast reported 317,000 net wireless line additions in the second quarter, while Charter added 344,000 lines.

"The TelCos' runway in [fixed wireless] is capacity constrained. Cable's runway in wireless is not," MoffettNathanson analyst Craig Moffett said in a research note. "Charter's wireless business already accounts for more than 5% of total revenues; Verizon's and T-Mobile's [fixed wireless] businesses, while admittedly newer, are barely measurable."

Staying the course

Both Moffett and Chaplin believe that cable operators should not give into the temptation to cut broadband prices to compete with fixed wireless.

"The deceleration in broadband looks to us to be primarily a function of encroaching saturation, exacerbated by slow growth in new household formation, and not share loss to fiber and fixed wireless," Moffett said.

Since cable and fiber control 90% of market and fixed wireless broadband only captures 10%, price cuts are unnecessary, Chaplin said.

"Investors will tolerate much lower broadband growth as long as broadband pricing power remains intact," he said.

Shares in Comcast are down 21.7% year to date as of market close Aug. 11. Shares in Charter and Altice are down 28.5% and 32.3% over the same period.