Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

27 May, 2022

U.S. banks' business lending activity continued to pick up during the first three months of 2022, but the industry's period-end commercial and industrial loan balance remains lower than the total one year ago.

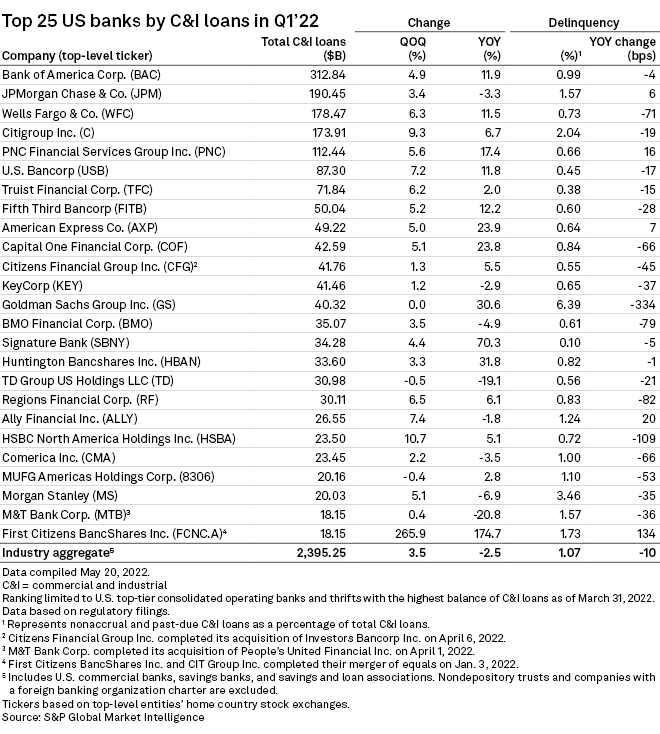

The industry's aggregate commercial and industrial, or C&I, loan balance as of March 31 was $2.395 trillion, up 3.5% from the end of the previous quarter and down 2.5% from the year-ago total, according to an analysis by S&P Global Market Intelligence. As a percentage of gross loans and leases, C&I loans were at 21.1% of the portfolio as of March 31, up from 20.6% at the end of December 2021 and down from 22.7% a year ago.

Among the 25 banks with the highest C&I loan balances at the end of the first quarter, 23 reported sequential increases and 17 recorded year-over-year growth.

Demand for C&I loans growing

The Federal Reserve's April 2022 senior loan officer opinion survey on bank lending practices showed stronger demand for C&I loans, with several banks reporting a higher number of inquiries from potential borrowers regarding the availability and terms of new credit lines or increases in existing lines. Among the reasons mentioned for strengthening demand were increased customer needs to finance inventory and accounts receivable, as well as higher customer investment in plant or equipment.

In recent earnings calls, banks also reported stronger demand for C&I loans, and a number cited strong new loan production and increased line utilization as well as slowing prepayments as reasons for growth during the first quarter.

At Wells Fargo & Co., loan demand was driven by larger clients that are increasing borrowing due to the impact of inflation on material and transportation costs and to support inventory growth, CFO Michael Santomassimo said during the institution's first-quarter earnings call.

"We're also seeing new demand from some clients who are catching up from underinvestment in projects and capital expenditures over the past couple of years," the executive added.

A number of banks are optimistic they will see their C&I loan portfolios continue to grow over the course of 2022.

During Bank of America Corp.'s first-quarter earnings call, Chairman and CEO Brian Moynihan said that BofA has room on the consumer and commercial sides for further loan growth as people "sort of normalize their behaviors and activities."

Meanwhile, Truist Financial Corp. continues to be positive about the prospects for further overall loan growth in light of current economic conditions and its pipelines and other factors.

"At the same time though, we've got to acknowledge the increased uncertainty presented by a range of geopolitical and economic risks, which could cause loan growth to deviate from our outlook," Chairman, CEO and President William Rogers Jr. said during the institution's first-quarter earnings call.

C&I loan delinquency rates down

Nonaccrual and past-due C&I loans amounted to $25.53 billion as of March 31, up from $25.15 billion at the end of December 2021 and down from $28.67 billion at March 31, 2021. However, the delinquency rate declined 2 basis points quarter over quarter and 10 basis points year over year to nearly 1.07%.

Goldman Sachs Group Inc. had the highest C&I loan delinquency rate, with nonaccrual and past-due loans accounting for approximately 6.39% of the portfolio.