This report is the third of three providing a guide to developments we expect for global supply chains in the third quarter of 2020. All three reports can be found here. Supply chain decision-makers' attention has been rightly focused on COVID-19 during the first half of 2020 while the U.S.-China trade war may dominate attention ahead of the U.S. elections. Yet, there are many other trade policy uncertainties that will affect conditions in the remainder of 2020 and in particular as we head into the peak shipping season.

EU-U.S. trade conflict: Carousel trouble now, digital and carbon tax issues later

Relations between the U.S. and EU have deteriorated steadily over the past two years, in large part because of the EU's lack of willingness to engage in the narrow-scope trade talks that the Trump administration has called for, as well as the significant trade deficit held by the U.S. with the EU. Panjiva's data for U.S. merchandise exports and imports show the latter was worth $179.7 billion in the 12 months to May 31 compared to $147.6 billion in 2016. That has repeatedly drawn the attention of President Trump, who has repeatedly stated that Europe is "worse than China."

In the near term, the European Commissioner for trade, Phil Hogan, has recognized that they "could have a turbulent period in the context of the U.S. election," Bloomberg News reports, with a focus on the administration "threatening more tariffs on European products."

There are several tripwires, with U.S. adjustments to tariffs applied to EU imports in relation to EU subsidies for Airbus due to be finalized in August, as discussed in Panjiva's research of June 25. A second stage in that spat may not bubble up until the fourth quarter after a decision by the World Trade Organization to delay a ruling on an EU complaint about U.S. subsidies was delayed until September at the earliest, Reuters reports.

Another challenge may come from U.S. action against EU plans regarding digital services taxes, or DST. As outlined in Panjiva's June 23 report, the U.S. has withdrawn from Organisation for Economic Co-operation and Development talks regarding the imposition of DST and has launched a widespread section 301 review of them. EU states including France have taxes on the books and may face a new round of tariffs.

Looking to later in the year and into 2021, the EU's plans for carbon border taxes under the so-called Green New Deal will likely draw the ire of the Trump administration given they are effectively a form of tariff and given the U.S.' absence from the Paris Agreement on climate change. It may be a different matter under a Biden administration.

USMCA: Off to a tough start

Having been a regular feature since Panjiva's first policy outlook in 2017, the renegotiation and implementation of USMCA as a replacement for NAFTA finally took place July 1. That makes the third quarter the period when the impact of rules of origin, labor costs and dispute settlement rulings will become clearer.

In particular, there is the risk of a wide range of disputes that may be launched under the new rules covering topics as diverse as dairy markets, energy industry regulations, biotechnology investments and labor conditions. The latter may be expressed first in the automotive industry, where Japanese automakers are planning on raising wages in Mexico to meet the rules.

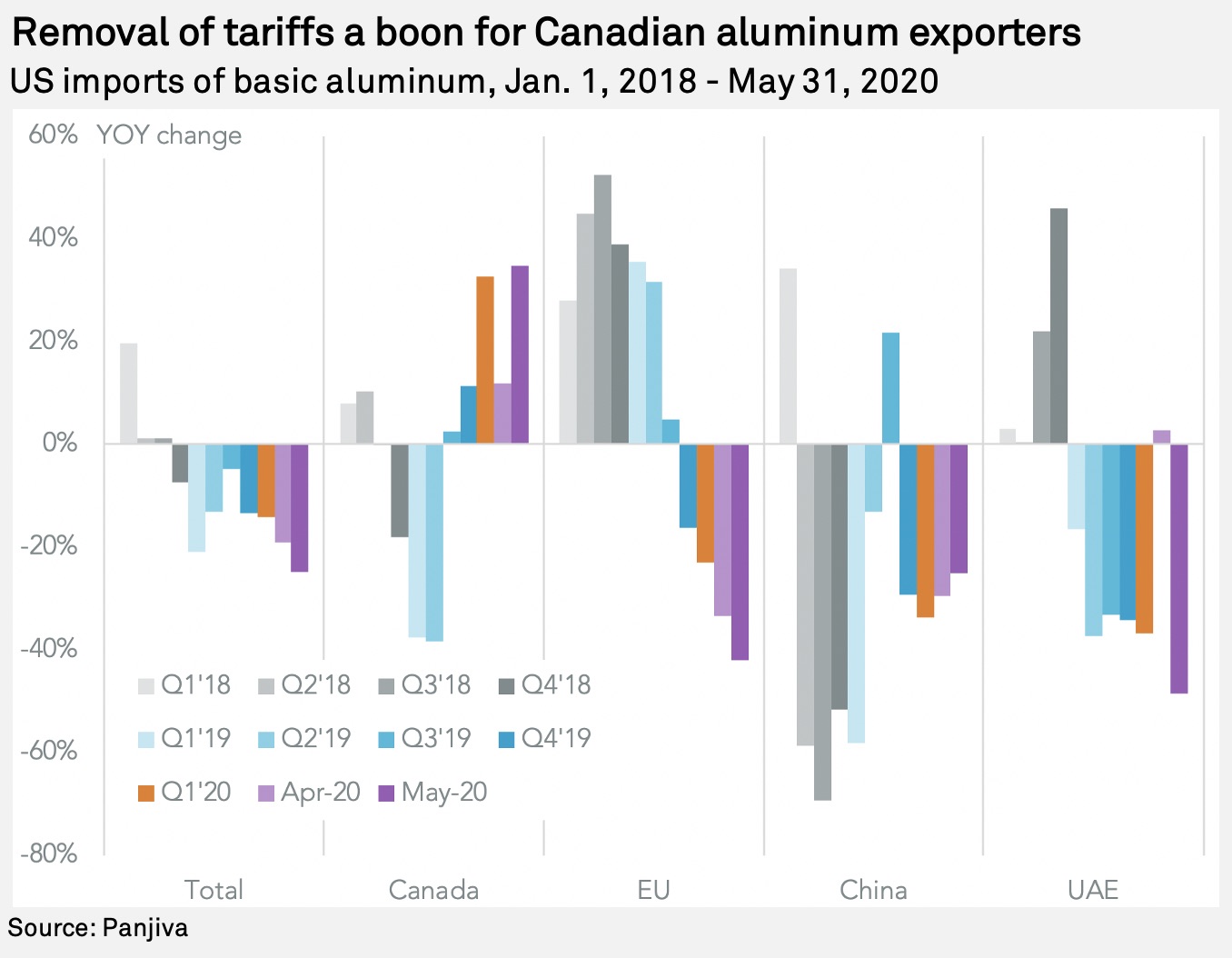

There is also a risk that other U.S. trade policies could disrupt the smooth start of USMCA. Specifically in the aluminum sector, a surge in imports to the U.S. from Canada has raised the prospect of renewed U.S. tariffs. Under the original deal signed between the U.S. and Canada ahead of USMCA's signing, the tariffs previously applied by the U.S. under the section 232 program can easily snap back into place. Canada could only retaliate with tariffs in the metals industry.

Panjiva's data shows that the removal of 10% tariffs on Canadian aluminum has led to a surge in imports, with shipments having risen by 10.3% year over year in the 12 months to May 31, whereas imports from the rest of the world dropped 46.8% lower. There was even a 34.7% jump in shipments in May when most factories were closed due to COVID-19.

Of course, all the potential disputes are optional and outside parties may wait and see the result of the U.S. general election before embarking on a round of complaints.

U.S.-U.K.: No special treatment for the special relationship

Negotiations between the U.S. and U.K. to formulate a long-term trade deal are continuing apace, according to HM Government, with talks already being deep in the details. Yet, little progress has been made on red-line issues including healthcare and agricultural issues. Those issues, as discussed in Panjiva's June 4 report, may need to be set aside in order for a deal to proceed. There are also further tripwires to avoid, including the implementation of digital services taxes (as flagged above).

Furthermore, the British government has said there is "no set deadline" for completing the talks, which are set to continue at the end of July and throughout the third quarter. Given the complexity of forming a full trade deal — rather than simply replicating USMCA, for example — it seems unlikely that there will be a finalized agreement before the U.S. elections in November.

Brexit: The final countdown

Looking outside the U.S., the most pressing trade negotiations globally are the talks between the EU and U.K. to formulate long-term trade relations and customs agreements. The talks do not appear to be proceeding well. The first round of negotiations under the new, accelerated process ended a day earlier than expected. Both sides have underscored the challenges ahead, with the U.K. referring to "significant differences that still remain" and the EU stating "serious divergences remain."

As discussed in Panjiva's research of June 16, it seems unlikely that disagreements over regulatory standards, treatment of state aid, fisheries and dispute settlement can be resolved between now and the effective deadline for a deal in mid-October.

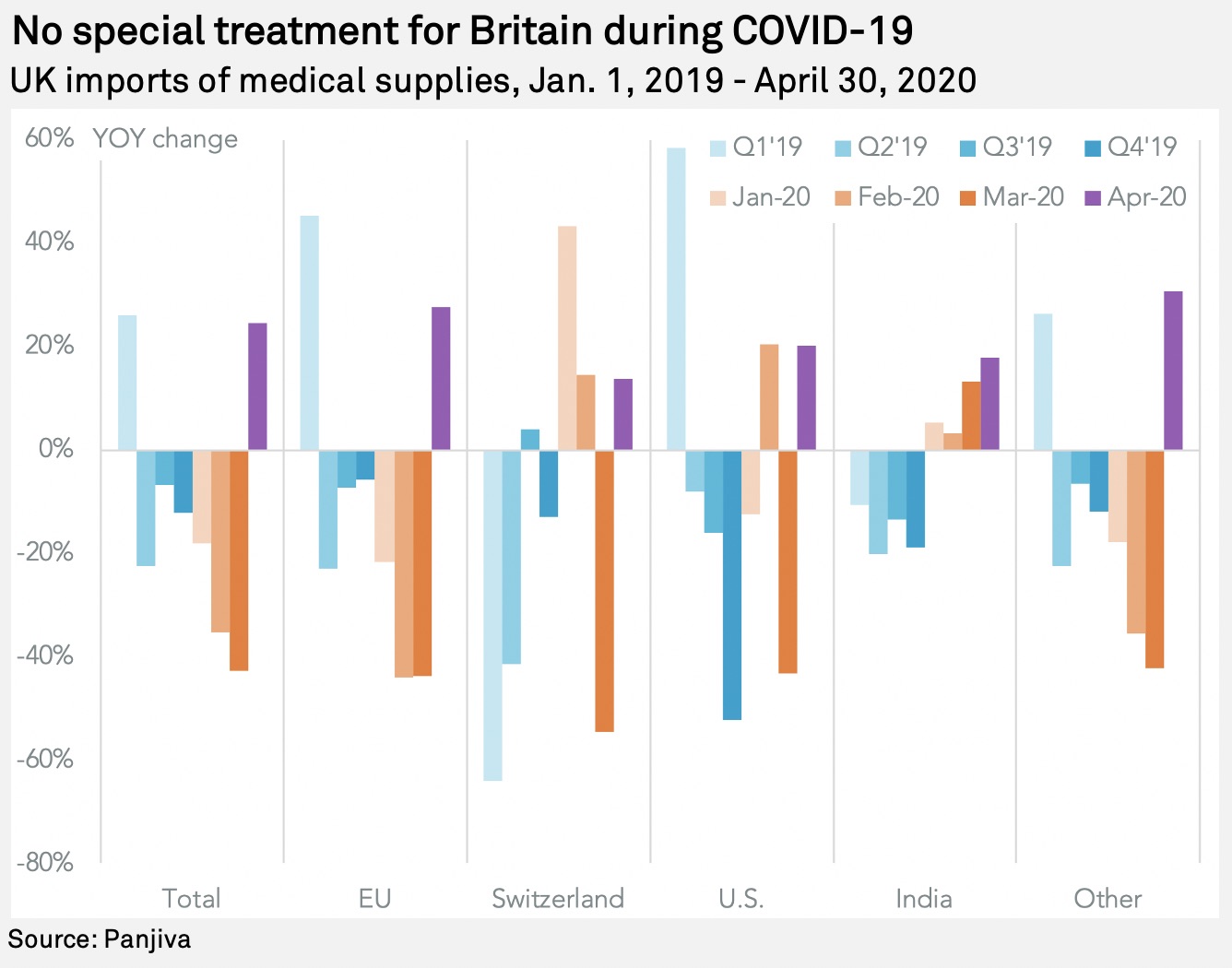

The costs for the U.K. could be significant. Not only will there be disruptions to customs arrangements and higher tariffs for British exports, there will also be the absence from any ad-hoc EU measures designed to deal with future crises. That has been brought into sharp relief by the COVID-19 pandemic and resulting medical protectionism seen globally, including restrictive export rules put into place by the EU.

Panjiva's analysis of official data shows the EU accounted for 79.3% of the U.K.'s £21.4 billion, or $26.7 billion, of medical supply imports. During the depths of the supply shortfall in March there was a 43.7% year over year drop in imports from the EU while shipments from the world ex-EU declined by just 36.2%. In April, there has been a recovery, with imports from the EU having risen by 27.7% while those from the rest of the world increased by 15.5%, including a 20.2% jump in shipments from the U.S.

Food and drug fallout from COVID-19

The restriction on exports of medicines seen in Europe has been repeated globally. While many of the measures — which reached 180 export curbs since January through the end of June, according to Global Trade Alert — have been withdrawn, there is still the question as to whether long-term supplies are sufficient. As outlined in Panjiva's 3Q outlook for COVID-19 specifically, we may only see companies making planning decisions in the fourth quarter. Governments may move sooner.

The ASEAN+3 group may address the topic of securing medical supplies in the coming months via a mutual emergency reserve that could leave other regions and mid-sized countries struggling for supplies.

In the near term, the Chinese government is also restricting the import of food products to allow for random COVID-19-related testing. Whether this is driven by genuine health concerns or is backed by wider political aims is a moot point — food supply chains will likely be disrupted by government policies in the coming months, particularly if there is a resurgence in the pandemic.

Global policy: Brush fires aplenty, but at least one reason to be optimistic

There iss a long tail of global trade policy action that will introduce or continue planning uncertainties for supply chain decision-makers. A few examples include:

- The WTO's dispute settlement process is non-functional after the U.S. blocked a series of key appointments. With a parallel process having been structured for dispute settlement by a group led by the EU and Canada, there is little impetus for early action. The appointment of a new head of the WTO will likely absorb political attention during the third quarter.

- Tensions between India and China have risen as the result of a border dispute. There are already reports of disruptions to trade flows from China to India, while the Indian government has a history of using trade as part of disputes with Pakistan.

- Aside from being a tripwire for U.S.-China relations, the latter's new security laws for Hong Kong are also a source of friction between China and the U.K. The U.K. has stated that the new rules breach the conditions of the 1987 handover of control of Hong Kong and offered Hong Kong residents born before the handover a path to citizenship. China has responded that the U.K. will "bear the consequences that will arise from this." That may involve restrictions to international trade particularly once current EU-based trading rules end.

- A historic dispute between South Korea and Japan that resulted in the bilateral removal of trusted trade status is still simmering and is restricting materials supplies in the technology industry. While being elevated, to the WTO (see above) the specifics of the dispute still need a general rapprochement between the two countries.

- The European Union and Mercosur group have a trade agreement that is all but finished, but may struggle to reach ratification in EU member states due to French concerns about Brazilian environmental policy. While a potential positive if resolved, that is far from guaranteed.

There is one reason to be optimistic though with the Regional Comprehensive Economic Partnership, or RCEP, moving close to a conclusion, probably in the fourth quarter at the earliest, rather than the third quarter.

Continued weakness in exports from the core RCEP members will act as an impetus to signing a deal, though some of the frictions flagged above could prove problematic. Panjiva's data shows exports from the RCEP members that report data dropped by 13.5% year over year in May after falling 9.1% in April and declining steadily since Q1 2019.

Christopher Rogers is a senior researcher at Panjiva, which is a business line of S&P Global Market Intelligence, a division of S&P Global Inc. This content does not constitute investment advice, and the views and opinions expressed in this piece are those of the author and do not necessarily represent the views of S&P Global Market Intelligence. Links are current at the time of publication. S&P Global Market Intelligence is not responsible if those links are unavailable later.