Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

26 Jan, 2021

By Casey Egan and Stefen Joshua Rasay

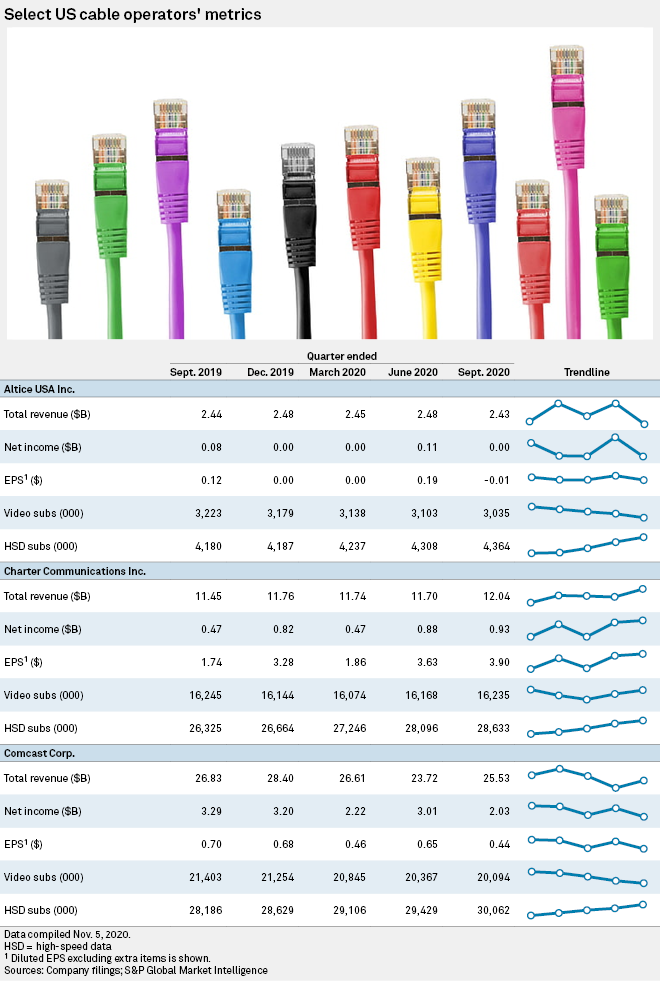

Broadband subscriber growth will continue to power the major cable operators in the fourth quarter of 2020, and momentum could carry over into 2021, according to industry analysts.

The coronavirus pandemic saw many American households working, learning and shopping from home, making fixed broadband connections more of an essential service than ever. And while cable operators have already seen strong growth in earlier quarters, analysts say companies will continue to see year-over-year growth in their subscriber additions, especially as customers that connected as part of a pandemic promotion or special offer convert into regular paying subscribers.

"Broadband net adds should remain strong in 4Q20 driven by robust demand for connectivity, an expanding market, and conversion of some non-paying subs," wrote Philip Cusick, a managing director at J.P. Morgan covering U.S. telecommunications services, in a Dec. 15 report.

Comcast

For the fourth quarter of 2020, Cusick expects broadband net additions at Comcast Corp. to total 510,000, which would be up from 442,000 in the year-ago period.

For full year 2020, Cusick expects net broadband additions to total 1.9 million, which would be an increase from the 1.4 million the company experienced in 2019.

Cusick projects Comcast will report a net loss of 275,000 video subscribers for the fourth quarter of 2020, an increase from the 149,000 the company reported in the fourth quarter of 2019.

For the full year, Cusick expects Comcast to experience a total of 1.4 million net video losses, nearly double the 733,000 net losses the company reported for full year 2019.

Turning to 2021, Cusick sees upside for the company's broadband and video businesses as price increases implemented at the start of 2021 raise Comcast's average revenue per user.

After the rate increase, Cusick said video ARPU could rise 6% year over year on a reported basis for full year 2021, and broadband ARPU could rise 5% over the same period.

Altice

Turning to Altice USA Inc., James Ratcliffe — a managing director and analyst with Evercore ISI's telecom, cable and satellite research team — said in a Jan. 7 research report that he sees subscriber growth opportunities in the company's Suddenlink markets.

Altice USA — one of the largest cable operators in the U.S. — established itself in the U.S. through back-to-back acquisitions of Suddenlink Communications in 2015 and Cablevision Systems Corp. in 2016.

"While the company's Optimum [Cablevision] footprint's high penetration and tough competitive environment make subscriber-driven growth more challenging, we see better opportunities in the legacy Suddenlink markets," wrote Ratcliffe.

The reason, Ratcliffe wrote, is because the Suddenlink footprint has "both lower penetration and less competition than in the Optimum markets."

"The company has highlighted the opportunity to expand its footprint with edge-out builds into adjacent areas," he added.

For the fourth quarter of 2020, Ratcliffe projects that the company will report high-speed internet additions of 15,000 which would be an increase from the 7,000 the company reported in the year-ago period.

Charter

Jonathan Chaplin — who leads the U.S. communications services research team for New Street Research — wrote in a Jan. 21 note to investors that he is revising his estimate for share repurchases for Charter for the fourth quarter of 2020.

He now expects Charter repurchased $4.7 billion in shares in the fourth quarter of 2020, up from a previous estimate of $4 billion. Share buybacks are often viewed as a signal of corporate health and a sign from company managers that shares are under-valued.

Matthew Harrigan, equity research analyst at The Benchmark Co., projected in a Dec. 27, 2020, research report that Charter's 2020 revenue for fourth quarter 2020 and the full year will exceed its performance in 2019.

Specifically, Harrigan projects the company will report revenue of $12.57 billion for the fourth quarter of 2020, which would be up from the $11.76 billion the company reported in the year-ago period.

For full year 2020, Harrigan estimates that the company will report revenue of $48 billion, which would be an increase from the $45.76 billion the company reported in full year 2019.

Net neutrality

Taking into account some expected policy changes from the new presidential administration, Evercore ISI's Ratcliffe also does not think that reintroduction of net neutrality would materially affect business.

While the Federal Communications Commission is currently split 2-2 along party lines, President Joe Biden is expected to nominate a third Democratic member to the commission soon.

Industry observers believe a Democratic-led FCC would likely act quickly to take up net neutrality protections. In 2018, under Republican leadership, the FCC reclassified broadband as a Title I information service. The move eliminated the FCC's authority to impose net neutrality rules that prohibited broadband service providers from blocking or throttling legal internet traffic or prioritizing certain traffic for payment.

A Biden FCC is widely expected to reclassify broadband as a Title II telecommunications service, restoring more regulatory authority to the agency over broadband service providers like Comcast, Verizon Communications Inc., AT&T Inc. and Charter.

"It's very likely the FCC will move to reclassify broadband under Title II and re-implement net neutrality provisions, but real impact is likely very limited; net neutrality rules don't materially impinge on the broadband business, and we don't see an appetite for [broadband] rate regulation," wrote Ratcliffe.