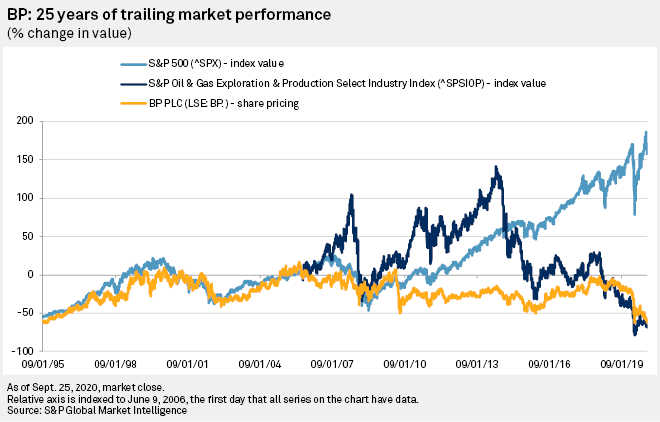

Long-awaited details on how BP PLC will pivot into the energy transition by hiking renewable energy spending while shrinking its legacy oil business were met by a less-than-warm reaction by investors as the company stock price has hit a fresh 25-year low.

BP executives spent three days in mid-September explaining how the oil major will make itself over by expanding into renewable energy without sacrificing value on returns. This includes a plan to boost returns from green power to above 10% by tapping into structured financing, using its trading arm to optimize output and selling off stakes in projects.

However, the unveiling of the strategy left investors nonplussed, with many skeptics unsure that oil companies like BP will be able to realize returns on renewable energy that can compete with historical results from its traditional business.

"Renewables remain a 'show me' story, and we await evidence of delivery," RBC Capital Markets analyst Biraj Borkhataria said in a Sept. 17 report to clients.

On Sept. 24, BP's share price sank to its lowest level since October 1995 to close at 2.32 pence on the London Stock Exchange, the primary market for the company's ordinary shares. European stocks and U.S. equities were also under pressure during the session by fresh concerns over the pace of the U.S. economic recovery and a sharp uptick in COVID-19 cases in Europe.

Investors have been pushing hard for large energy companies to take stances on climate change and reduce emissions. Many of the largest, particularly those based in Europe, have responded by starting to diversify and decarbonize their portfolios by turning to natural gas, electricity and renewable energy to meet self-imposed emissions reductions ambitions.

BP's stock price initially shot higher Aug. 4 after CEO Bernard Looney announced that the major would speed up its move to become a broader company by slashing oil production by 40% in the next 10 years.

Bernstein analyst Oswald Clint said that while BP's business plan for 2021 through 2025 does highlight attractive growth and returns, the proof will be in the actual figures.

"Investors need to see the earnings mix tilt and that starts with new divisional reporting in 1Q 2021, which we see as a critical turning point for the stock while helping to link up fractured market views out there," Clint said in a Sept. 17 note to clients.

BP will need to amplify upstream divestitures as it sheds its most carbon-intensive assets and accelerates its transition into an integrated energy company, company executives admitted in August. But selling upstream oil and natural gas asset sales will remain a challenge in the currently depressed oil price environment, analysts believe.

"At its core, BP's investment case is a de-leveraging story, the pace at which is determined by commodity prices," Borkhataria said.

In the past 12 months, BP's stock price has lost nearly 55%, having first breached levels seen after the Deepwater Horizon explosion and spill in the Gulf of Mexico in 2010 in March, when oil prices began to crumble in the face of waning petroleum demand resulting from shelter-in-place orders due to COVID-19.

"At the moment BP's leaning in most to the transition and becomes the sector playbook," Clint said.