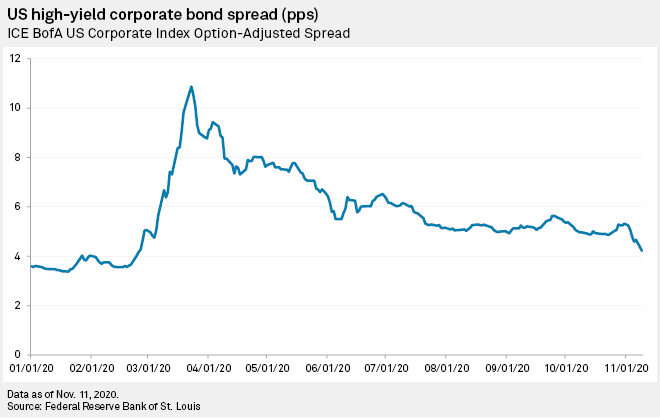

Investor expectations that the Federal Reserve will have to act to support the economy are resulting in tightening credit spreads, most notably for companies with lower credit ratings.

After unwinding much of the widening experienced during the coronavirus-induced financial market panic in March, corporate spreads stalled in October. But since the start of November, the yield on the ICE Bank of America U.S. high-yield corporate bond index fell dramatically, shedding 110 basis points between Oct. 31 and the close of Nov. 9 to 422 bps, the lowest level since Feb. 25.

Investors had largely expected the Democratic Party to sweep the U.S. election, winning the presidency and the Senate, which would allow President-elect Joe Biden to more easily launch a multi-trillion-dollar fiscal package to support the economy. But with the election results putting a Democratic takeover of the Senate in question, Wall Street now expects any fiscal package to be smaller and the Federal Reserve to provide any required stimulus as the number of daily new COVID-19 cases climbs toward 150,000.

"Investors decided to put their money at work in assets that will benefit the most from central bank policies. Because junk credit spreads trade rich compared to investment-grade bonds, with the unlimited support of the Fed, these are also the assets with the most significant upside," Althea Spinozzi, fixed income specialist at Saxo Bank, wrote in an email.

With the sharp drop in spread, the U.S. high-yield index has now unwound 91.1% of the widening experienced as a result of COVID-19.

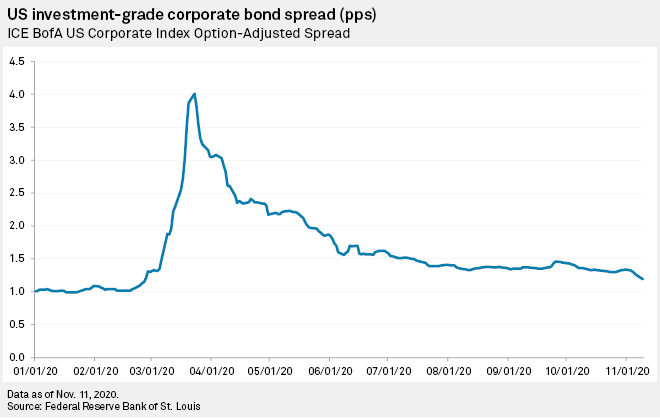

The expected Fed effect had a similar impact in other credit markets. The yield on the ICE Bank of America U.S. investment-grade corporate bond index tightened by 15 bps between Oct. 31 and Nov. 9, to 119 bps, the lowest since Feb. 26.

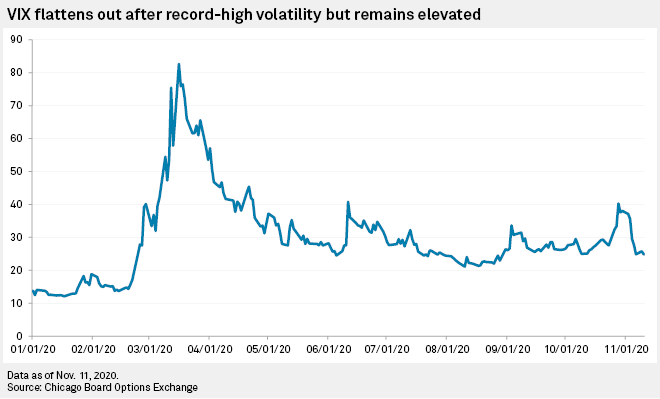

The risk-on sentiment was also apparent in U.S. equities as the CBOE Volatility Index fell from the historically high level of 35.6 on Nov. 3 to 24.8 by Nov. 10, the lowest since Aug. 28.

"As investors reposition following the resolution of a major point of uncertainty and unwind hedges, the VIX typically falls and equities rise. Longer term, the backdrop appears favorable as well, as the ongoing economic recovery should continue to drive corporate earnings in the years ahead," Jeff Schulze, investment strategist at ClearBridge Investments, wrote in a market outlook.

The emerging market corporate bond spread fared similarly to other credit markets, with the spread contracting to 318 bps on Nov. 9 from 346 bps on Oct. 31. However, the recovery in emerging markets lags the U.S., with the spread having unwound just 82.2% of the widening experienced in March.

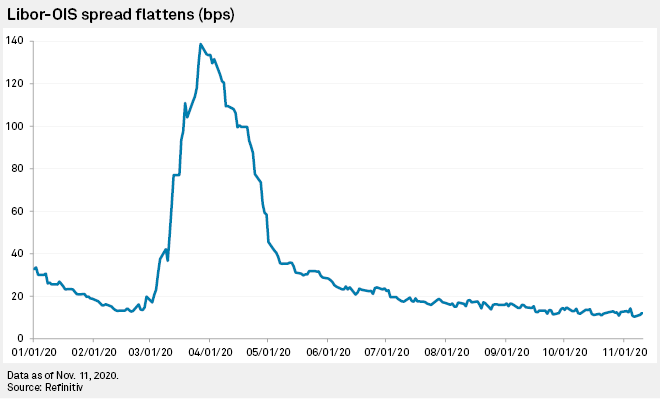

The Libor-OIS spread, a key risk indicator for the U.S. banking sector measuring the difference between the three-month dollar London interbank offered rate and the overnight indexed swap rate, was largely stable over the last week, edging down to 12.2 bps as of Nov. 10 from 12.5 bps on Nov. 3.

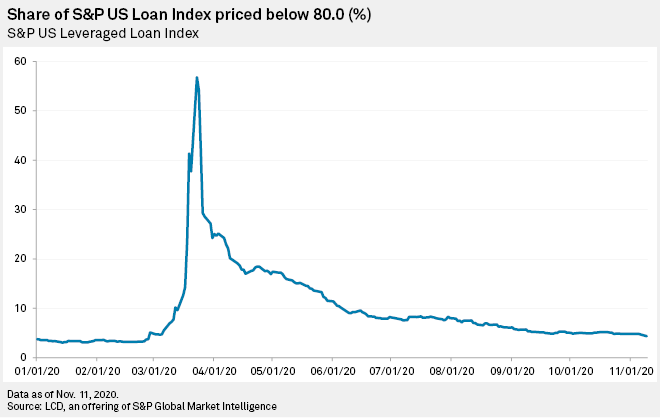

In the leveraged-loan market, the share of issues priced below 80 cents on the dollar, a closely watched indicator suggesting a company is more likely to default, fell to 4.35% on Nov. 9 from 4.85% on Nov. 3.