| Electric vehicle sales in the US soared 60% year over year in the first quarter, preliminary data from the International Energy Agency shows. Source: mladn61/Getty Images News via Getty Images |

Global oil demand is set to shrink by 5 million barrels a day by 2030 if the explosive growth in electric vehicle adoption continues, the International Energy Agency said April 26.

Within seven years, about 60% of all new light-duty vehicle sales in China, the European Union and the US — which combined account for more than 60% of global car sales — will be of an EV, the International Energy Agency (IEA) said in its annual Global Electric Vehicle Outlook.

The shift will have major implications for the electric grid as well as the energy industry, agency officials said. In 2022, all EVs combined worldwide displaced 700,000 barrels of oil per day, the report said. Electric sport utility vechicles alone accounted for more than 150,000 barrels of oil consumption avoided in 2022.

"Head-ups to the oil industry: When they are thinking of large-scale investments, it might be important to note the developments in road transportation," IEA Executive Director Fatih Birol said during a press briefing. "I think it's no exaggeration to say that the car industry is going through the biggest transformation since Henry Ford came up with the Model T in the early 20th century."

Road transportation today accounts for 40% of global oil demand. The IEA estimated earlier in April that daily global oil production in 2023 will reach 102 million barrels. It expects global oil-based fuels for cars, trucks and other vehicles to peak by 2025.

US EV market swings back

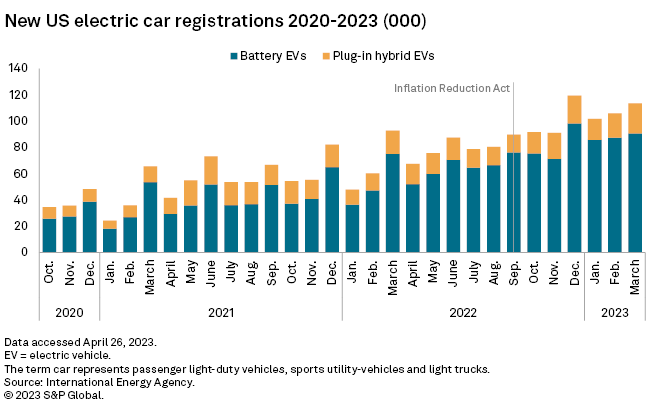

While the US continues to lag behind China and the European Union in EV car sales, American consumers are quickly warming up to plug-in hybrids and all-electric light-duty vehicles. EV sales in the US grew 55% in 2022 to reach 8% of all car purchases, the IEA reported.

US sales of electric cars in the first quarter rose an estimated 60% above the same period of 2022, Timur Gül, the IEA's head of energy technology policy, said during the press briefing.

The agency forecasts that growing consumer interest and major policy developments will bring the US near President Joe Biden's goal of a 50% EV market share by 2030. The Inflation Reduction Act, the multistate adoption of California's Advance Clean Cars rule and the US Environmental Protection Agency's proposed new standards for light-duty vehicles, if finalized, are key to meeting that goal, the IEA said.

Billions of dollars are also being spent on the infrastructure needed to support the growth of EVs. Under the 2021 bipartisan infrastructure law, the US earmarked $7.5 billion to build a national network of charging stations. The 2022 Inflation Reduction Act then expanded EV tax credits and established supply chain requirements focused on developing a domestic industry for clean cars and trucks.

With electric cars now on the cusp of a mass market, sales of heavy-duty electric vehicles lag far behind. While most new buses in nations such as Finland are now electric, uptake across other nations hovers near 5%. Only about 1% of heavy-duty trucks are electrified, the IEA reported.

"Trucks are very much the next frontier of road electrification," Gül said. "More electric truck models have become available in the last year than in all of the previous years combined ... indicating that truck manufacturers are increasingly gaining confidence in supplying larger and heavier zero-emission models with greater payloads."

The Biden administration has also proposed more stringent tailpipe emission standards for dump trucks, tractor-trailers, buses and other heavy-duty vehicles that will take another bite out of demand for oil-based fuels.

Some 220 new models of heavy-duty vehicle models entered the global market in 2022, the IEA reported.

S&P Global Commodity Insights produces content for distribution on S&P Capital IQ Pro.