A relatively disappointing jobs report has likely pushed back the Federal Reserve's timeline for tapering its $120 billion in monthly securities purchases, weighing down government bond yields and the U.S. dollar, analysts said.

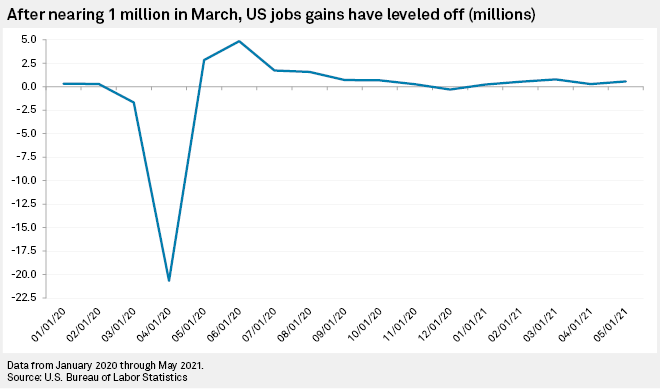

U.S. employers added 559,000 jobs in May from April, the U.S. Bureau of Labor Statistics reported June 4. The number was within many forecasts but was viewed by analysts as falling well shy of the Fed's broad labor goals.

"The lack of the 'wow' factor will probably reinforce the Fed's patient stance and push back the discussion of tapering until later this year," said Gennadiy Goldberg, a senior U.S. rates strategist with TD Securities, in an interview. "We think the Fed will only start to talk about talking about it in August or September, setting up for ongoing patience."

No string

In April, Fed Chairman Jerome Powell indicated that the Fed would need to see a "string of months" of roughly 1 million jobs gains in order to achieve its labor goals. The U.S. has yet to add 1 million new jobs in a single month so far in 2021 and employment remains 7.6 million jobs below where it was prior to the pandemic.

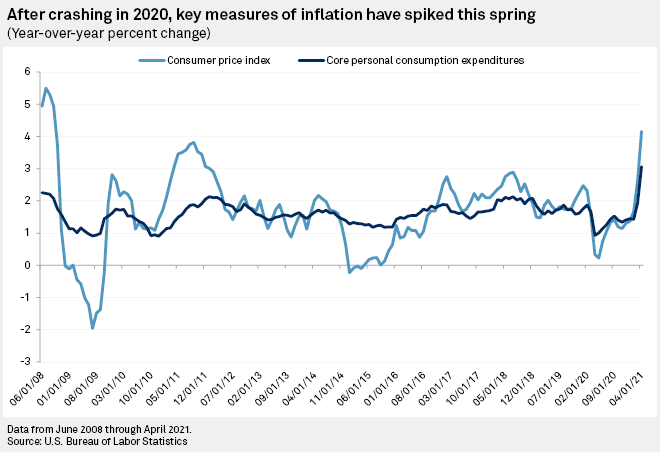

Powell has cautioned that the Fed will not consider tapering its $120 billion in purchases until its labor goals are met and inflation hits the central bank's target to run above 2% for "some time." The Fed has been intentionally vague in describing these goals in order to give itself more policy leeway.

The Bureau of Economic Analysis reported on May 28 that the core personal consumption expenditure price index hit 3.1% in April compared to a year ago. That figure, which strips food and energy prices from broader measures, is the Fed's preferred measure of inflation. The consumer price index, which includes food and energy prices and is the market's preferred measure, hit 4.2% in April. May's figure will be released June 10.

While Fed officials have depicted the rise in inflation as transitory, reflecting a sharp increase from a year earlier when the economy was fully under the effects of the global pandemic, analysts view the inflation goal as being close to, if not fully, achieved.

"The Fed can now rest easy about its inflation goal — indeed if anything many people are concerned that inflation may exceed its target," said Marshall Gittler, head of investment research at BDSwiss.

Weakening dollar

Several Fed governors have advocated for a start to tapering discussions and talks may begin in earnest when they meet June 15.

At the Fed's April meeting, some participants said "it might be appropriate at some point in upcoming meetings to begin discussing a plan for adjusting the pace of asset purchases," according to the minutes, which were released May 19.

But with May job gains falling well below the 1 million jobs-added metric, any substantial taper talk is unlikely at the next Federal Open Market Committee meeting and may be on hold until at least the Fed's annual economic policy symposium in late August, analysts said.

Antoine Bouvet, a senior rates strategist with ING, said he expected the Fed would announce its tapering plans during the August symposium.

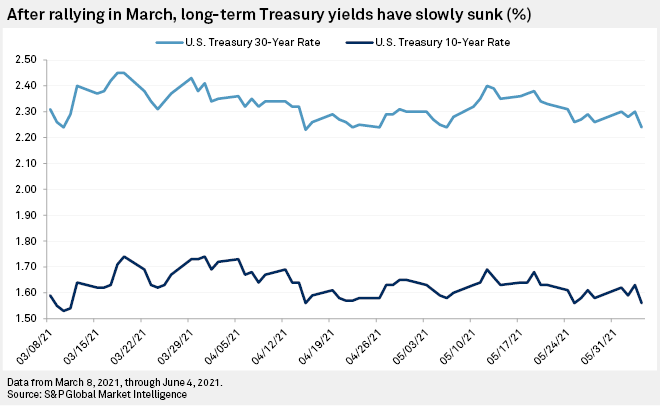

The likelihood of several more months of the Fed buying has sent bond yields and the U.S. dollar down. The U.S. dollar index was trading at 89.93 on June 7, down from 90.14 on June 4 and down from 96.62 a year earlier.

"The continuation of loose Fed policy leaves the U.S. dollar vulnerable to further weakness in the near term," said Lee Hardman, a currency economist with MUFG, in a June 7 note.

Meanwhile, the benchmark 10-year Treasury yield settled at 1.56% on June 4, down from 1.63% a day earlier. It matched the lowest settlement for the 10-year yield since spiking at 1.74% on March 31. The yield settled at 1.57% on June 7.

Fed bond purchases for the foreseeable future "should keep 10-year rates in a narrow 1.50-1.75% range for the time being and the [yield] curve steepening," said Goldberg with TD Securities, as shorter-term bond yields remain largely unmoved from current lows and longer-term Treasurys move slightly higher on worries over inflation and additional issuance.

Althea Spinozzi, a fixed-income strategist with Saxo Bank, said she expects the 10-year yield to hit 2% by this summer as the Fed moves to tighten its ultra-loose monetary policy. Bond yields move opposite to prices and a decision by the Fed to taper its $80 billion in monthly Treasury buys would likely push bond prices down, raising yields.

James Camp, managing director of strategic income at Eagle Asset Management, said he expects the 10-year yield to rise to 2.5% by the end of the year, reflecting a "sharp breakout" out of the current range after taper discussions become more public following the Fed's meeting in August.

Camp said the Fed was cautious of the risk tapering posed to all markets, not just government bonds, as it considers tightening policy.