A new generation of more ambitious blank-check companies is drawing interest as its credibility rises on Wall Street.

Special-purpose acquisition companies have emerged in recent years as an increasingly viable route through which private-market investors can take their portfolio companies public while avoiding the fees and uncertainties of a traditional initial public offering. Known as SPACs, these companies list on a major U.S. stock exchange with no business operations other than a plan to use their IPO proceeds to acquire a private company and fold it into their publicly traded structures.

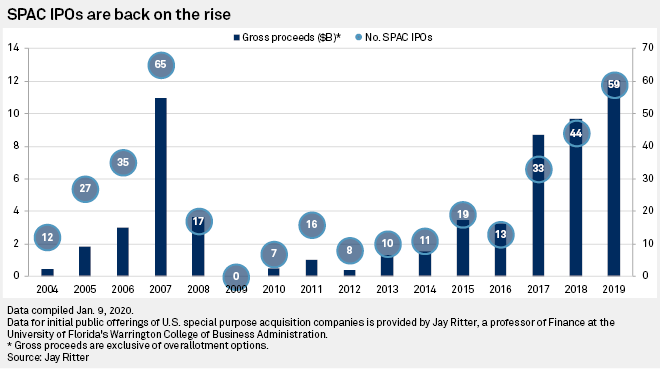

In 2019, SPACs flooded the public markets at levels not seen in more than a decade. The 59 SPAC IPOs that year represented about 25% of all public-market debuts in the U.S., according to data from University of Florida finance professor Jay Ritter. Proceeds from those offerings, not including overallotment options, hit an all-time high of more than $12 billion in 2019, Ritter's data show.

"It really is a mainstream way for companies to go public," David Batalion, head of SPACs at Cantor Fitzgerald & Co., said in an interview. Cantor Fitzgerald topped industry research provider SPACResearch.com's league tables for SPAC IPO underwriting in both 2018 and 2019.

Though SPACs were once viewed as a last-resort merger partner, the model is gaining prominence in both the private and public markets as a way for companies to become publicly traded. That is at least partly because Wall Street institutions and executives alike have been working throughout the post-financial crisis era to raise the legitimacy of the SPAC model, industry experts said.

"SPACs historically have been kind of like the horrible stepchild," said Sara Terheggen, founder of law firm NBD Group, in an interview. "There was this overtone that I think has completely gone away at this point."

Cantor Fitzgerald, Goldman Sachs Group Inc. and TPG Capital LP, among others, have all launched SPACs of their own in the last several years. Many of those companies have brought on well-established executives such as former New York Stock Exchange President Tom Farley and former Honeywell International Inc. CEO David Cote to lead their acquisition efforts.

Those companies have also begun targeting larger private entities capable of going public through an IPO, a strategy that represents a key distinction from the old SPAC model, David Ethridge, U.S. IPO services leader and managing director at PwC, said in an interview.

For example, Goldman Sachs-backed GS Acquisition Holdings Corp., which is led by Cote, agreed in late 2019 to acquire Vertiv Group Corp. for approximately $5.3 billion. Richard Branson's space tourism venture Virgin Galactic Holdings Inc. went public in 2019 after striking a deal with Social Capital Hedosophia Holdings Corp. And OneSpaWorld Holdings Ltd. made its public-market debut last year after it was sold in an $850.7 million deal to Haymaker Acquisition Corp.

Most recently, Third Point LLC-backed Far Point Acquisition Corp. struck a billion-dollar deal to bring the European e-commerce and payments company Global Blue public onto the NYSE. Far Point's president, Thomas Farley, was president at NYSE until May 2018.

"Previously, there wasn't a SPAC standing there with $500 million in equity offering a deal," said Ethridge, who previously worked as co-head of listings at the New York Stock Exchange. "You only had the IPO path."

Whether the spurt of SPAC-involved deals continues is unclear, though.

As SPACs rush into the public markets, there are concerns that the supply of suitable acquisition targets may not match the demand. A blank-check company usually has only a few years after its own IPO to pursue a deal before it has to give shareholders their capital back and liquidate.

The companies that do look to strike a deal with a SPAC may end up showing a preference for those with better-known backers and a more attractive structure, according to Cantor Fitzgerald's Batalion.

"SPACs are only as good as they get a deal done," NBD Group's Terheggen said. "Luckily, over the last three to five years, we've actually seen some success in SPACs getting deals done. But the reality is that of the many dollars raised in 2019, how many actually get a deal done?"