Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

30 Aug, 2021

By Maera Tezuka and Annie Sabater

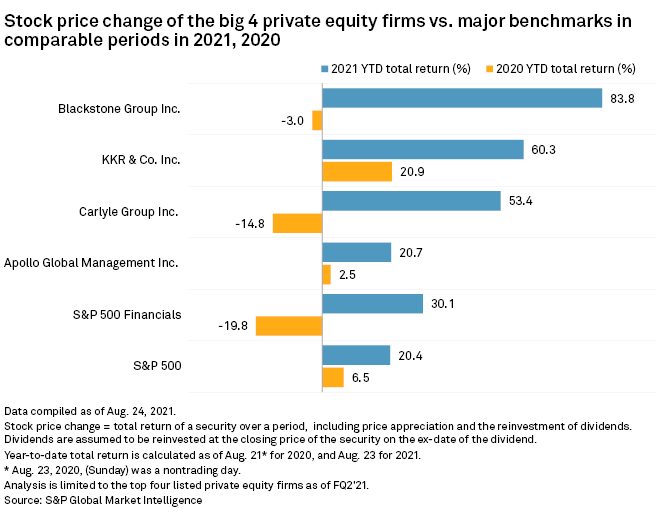

Blackstone Inc. reported an 83.8% year-to-date stock price appreciation, largely outperforming its peers and the S&P 500 and S&P 500 Financials stock market indices, according to S&P Global Market Intelligence data.

Four of the biggest publicly traded U.S. private equity firms — Blackstone, KKR & Co. Inc., The Carlyle Group Inc. and Apollo Global Management Inc. — converted to the traditional C-corp model over the past three years from a publicly traded partnership to tap into a larger pool of potential investors and to hike their share prices amid the new tax regime, under which the U.S. corporate tax rate was cut to 21% from 35%.

During the company's second-quarter conference call, Blackstone CFO Michael Chae attributed the boost in shareholder value to the firm's financial performance and the availability of its stock to a wider investor audience.

"We believe there is significant support to continue this momentum," he added.

Investors expect Blackstone's market share in the retail channel will bring "potentially higher and more durable organic growth versus peers," added Rufus Hone, an analyst at BMO Capital Markets, in an emailed comment.

Fee-related revenue drivers

Blackstone saw the highest asset management revenue at approximately $2.36 billion year-to-date. The fee-related earnings gain for the quarter is backed by the expansion of the firm's existing strategies, the scaling of news businesses and earnings from perpetual capital strategies, Chae said on the earnings call.

The firm is expected to generate approximately $150 million in fee revenues in 2022 from its announced partnership with American International Group Inc., in which Blackstone will acquire a 9.9% stake in the insurer's life and retirement business. The fee revenues are expected to increase by about $400 million after a six-year period, Chae added.

At Carlyle, a near-term increase in fee-related earnings will be spearheaded by its fundraising, capital markets activity and platform construction, Carlyle CFO Curtis Buser said on the company's recent earnings call.

The firm is also working on converting lower-value performance earnings into higher valued fee-related earnings by raising and co-investing into larger funds, seeding new products and providing capital to underwrite a growing capital markets business, Buser added.

KKR also reported record fee-related earnings during the second quarter, which were helped by a gain in the firm's management fees during the period, Craig Larson, the firm's partner and head of investor relations, said during KKR's earnings call.

Apollo, on the other hand, said fee-related earnings for the quarter appreciated due to higher advisory and transaction fees and management fees, which were partially offset by an uptick in noncompensation expenses.