Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

15 Jul, 2022

|

The clock is ticking for two bills that seek to rein in the power of Big Tech companies. |

A bipartisan coalition of lawmakers is pushing Congressional leaders to vote on two bills meant to spur competition in the tech space, but analysts said the bills would have little impact on Big Tech companies and will prove difficult to enforce.

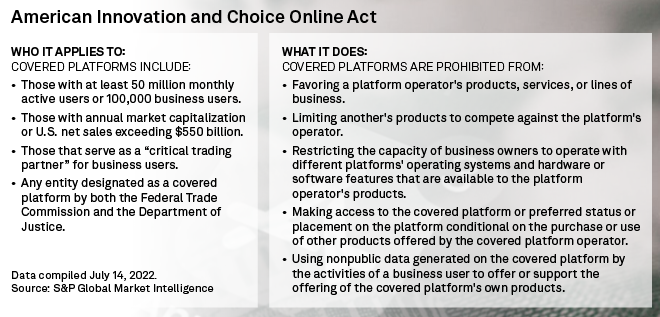

The American Innovation and Choice Online Act would prevent platforms from giving preferential treatment to their own products and offerings over third-party competitors. The Open App Markets Act would prevent app stores from requiring developers to directly use their in-app payment systems. It would also mandate fairer in-app pricing and reduced fees for developers.

The bills enjoy bipartisan and bicameral support, and Senate Majority Leader Chuck Schumer previously promised that at least the American Innovation and Choice Online Act would receive a Senate vote in early summer. Now, Congress is rapidly approaching the August recess and midterm elections, limiting time for a vote.

If the bills do manage to pass, Amazon.com Inc., Apple Inc., and Alphabet Inc.'s Google LLC are the tech giants most likely to be targeted, given their involvement in the e-commerce, online advertising and app store spaces. But considering all their offerings that stand outside the reach of the bills, such as cloud services and consumer electronics, analysts are not overly concerned.

"I see what Congress is trying to do," CFRA Research tech analyst Angelo Zino said in an interview. "Do I think it has significant implications to fundamentals like revenue growth? I personally do not."

Retail 101

The self-preferencing practices of the tech companies in question are not considered unusual, analysts said. Tom Forte, a senior technology analyst with financial services firm D.A. Davidson, equated Amazon's preferencing of Amazon Basics or Prime-eligible products to Walmart Inc. or Target Corp. selling their own private-label products in stores or online.

"If legislation passed tomorrow that forced Amazon to stop [self-preferencing], it would be a setback for Amazon, but it definitely wouldn't be fatal," Forte said.

Amazon's other business lines would insulate it from the legislation, Forte said, calling the company's consistent performance in cloud computing during the pandemic a tool that would blunt any losses the e-commerce giant might take from being unable to prioritize its private-label products under the bill.

Amazon's cloud unit generated $18.44 billion in net sales in the first quarter, representing 16% of total net sales within the company. Amazon made over $62 billion in cloud services revenue alone in 2021.

As for its e-commerce business, online stores net sales totaled $51.13 billion in the first quarter, representing 44% of total net sales. Notably, net sales from third-party seller services totaled $25.34 billion in the quarter. Given how much Amazon makes from third-party sellers already, Forte said the company would be "more than okay" if it is no longer able to highlight Amazon-backed products.

App store freedom

Zino gave a similar outlook for Google and Apple in regard to the Open App Markets Act.

While they may feel heat from the bills in regard to preferential treatment of home-grown apps or services, any damage dealt would not have material impact on metrics such as services revenue that account for much of the success the companies have seen in past quarters, Zino said.

The art of regulation

Even if the bills do not hurt tech stocks or bottom lines, the Federal Trade Commission should expect opposition when it comes enforcing the rules outlined in the bills, Futurum Research principle and founding partner Daniel Newman said.

Newman pointed to security and transparency concerns around sideloading, a practice permitted in the apps bill that allows consumers to download apps from third-party sites onto their phone. Apple CEO Tim Cook recently said, "We are deeply concerned about regulations that would undermine privacy and security in service of some other aim." Sideloading is permitted on Android operating systems.

There are ethical discussions around the app store environment too, Newman said. While most average consumers may be happy with availability in an app store, Newman acknowledged that current app store practices that require third-party developers to pay large fees to Apple and Google pose a risk to competition.

"The value that Apple has adopted says, 'If you want to use the platform, great. If you don't want to use the platform, then don't use it,'" Newman said. "But these companies don't survive if they're not going through Apple, and Apple knows that."

For every $1 million a developer makes in a year in Apple's app store, they must pay 30% to Apple, or 15% if they are considered a small developer. Google charges 15% for a developer's first $1 million in its Play Store.

Former FTC Chairman Bill Kovacic told Market Intelligence that the FTC will need a significant boost in expert resources in order to best implement rules and regulations, alongside high agency morale.

Bitter acrimony especially gets in the way, Kovacic said in an interview. "That diminishes the brand of the agency that's trying to gain acceptance and approval of judges and others."

The Partnership for Public Service and Boston Consulting Group published a July 13 report showing that the FTC's engagement and satisfaction score dropped about 24 points between 2020 and 2021, ranking the agency as the 22nd best midsize agency to work for out of approximately 25 other federal agencies.

Small developers at stake

All told, small tech company leaders hope that the bills, if passed, will make a lasting impact on their ability to thrive and provide competing services to customers.

"[Prospective customers] don't realize that a boutique company such as mine could actually bring them more value because they can directly talk to the CEO and directly to the CTO when they are programming and designing their outcome," said Jeannice Samani, managing director of small strategy and analytic consulting company Fairrer Samani Group.

Samani offers tools for smart city technologies and digital transformation services that could beat out similar offerings from Google or Apple, all other things being equal, Samani said.

It remains unclear when or if Schumer will schedule votes on the two bills. A recent survey of likely voters in 2022 Senate battleground states found that 72% of polled likely voters support the American Innovation and Choice Online Act and 79% support the Open App Markets Act, according to Kyle Plotkin, a partner at OnMessage Public Strategies, a Washington-based public affairs firm.

The survey was conducted by OnMessage and Lake Research Partners.