S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

S&P Global Offerings

Featured Topics

Featured Products

Events

14 Sep, 2023

By Alex Graf and Syed Muhammad Ghaznavi

Big Poppy Holdings Inc. and Summit State Bank are duking it out over a potential hostile takeover — a rare occurrence in bankland.

Big Poppy has applied for a "change in control" from the Federal Reserve, though the company is not actually asking for a majority interest in Summit but only up to 24.99% of shares. The purchase could make an outright acquisition of Summit easier for Big Poppy in the future while discouraging other potential buyers from exploring a deal with Summit and drawing less scrutiny from regulators, industry lawyers said in interviews with S&P Global Market Intelligence.

Even so, sources said the company will face challenges such as a long timeline for regulatory approval, which could give Summit time to find a "white knight" buyer. Big Poppy also faces opposition from Summit itself, which is publicly pleading with the San Francisco Fed to not approve the application.

"You have to assume the reason they're engaging in a hostile takeover is that friendly attempts to buy all or a portion of the bank have been met with resistance," Ernie Panasci, counsel at Spierer Woodward Corbalis Goldberg, a law firm that advises financial institutions on M&A, said in an interview.

Big Poppy did not reply to a request for comment for this story, while Summit declined to comment beyond its public letter to the San Francisco Fed.

A long and public process

In the last 10 years, the only notable bank industry hostile takeover attempt was the failed effort by First Citizens BancShares Inc. to take over KS Bancorp Inc. Hostile takeovers in the bank industry are "extremely infrequent" due to regulatory concerns about the ramifications for customers and employees, Panasci said.

"It can be very disruptive," Panasci said.

Big Poppy owns about 4.9% of outstanding Summit shares, according to a news release from Summit. Before it can buy more than 5% of a bank with no holding company like Summit, it must get approval from the Federal Reserve.

By only requesting up to 24.99% of shares, Big Poppy might avoid more intense regulatory scrutiny that an application for a larger stake in Summit might arouse, and the company can always buy more shares down the line, Panasci said.

But the public and drawn-out nature of the regulatory approval process for a hostile bid, which can take six months or longer and allows a target to adopt defensive corporate measures in the interim, presents a challenge, Craig Miller, a financial services partner at Manatt, said in an interview.

"The timing imposed by the regulatory process is very challenging for an acquirer who's not been embraced by the target," Miller said. "That's really why you very rarely see these kinds of transactions."

Even so, unless regulators have a reason for rejecting a takeover, such as the buyer's financial conditions, they do not have a legal basis to stop one, Manatt corporate and finance partner Gordon Bava said in an interview.

"While they're unhappy, they will typically take a hands-off position and try to remain neutral and to encourage both sides to stop fighting and see if it can get resolved," Bava said.

In addition to the protracted approval process, buying 24.99% of shares after approval could take Big Poppy weeks unless the company goes directly to existing investors, Miller said. The Banc Funds Co. LLC owns a 6.5% stake and Vanguard Group Inc. owns a 4.1% stake.

Summit's average daily volume currently stands at 4,432, well under 1% of the company's 6.78 million outstanding shares, according to S&P Global Market Intelligence data.

Reasons for a hostile takeover

Even with the potential challenges, the hostile bid is attractive for many reasons, experts said. Big Poppy's move to build up ownership in Summit could make a full acquisition more tenable in the future in a more "amenable" M&A environment, Miller said.

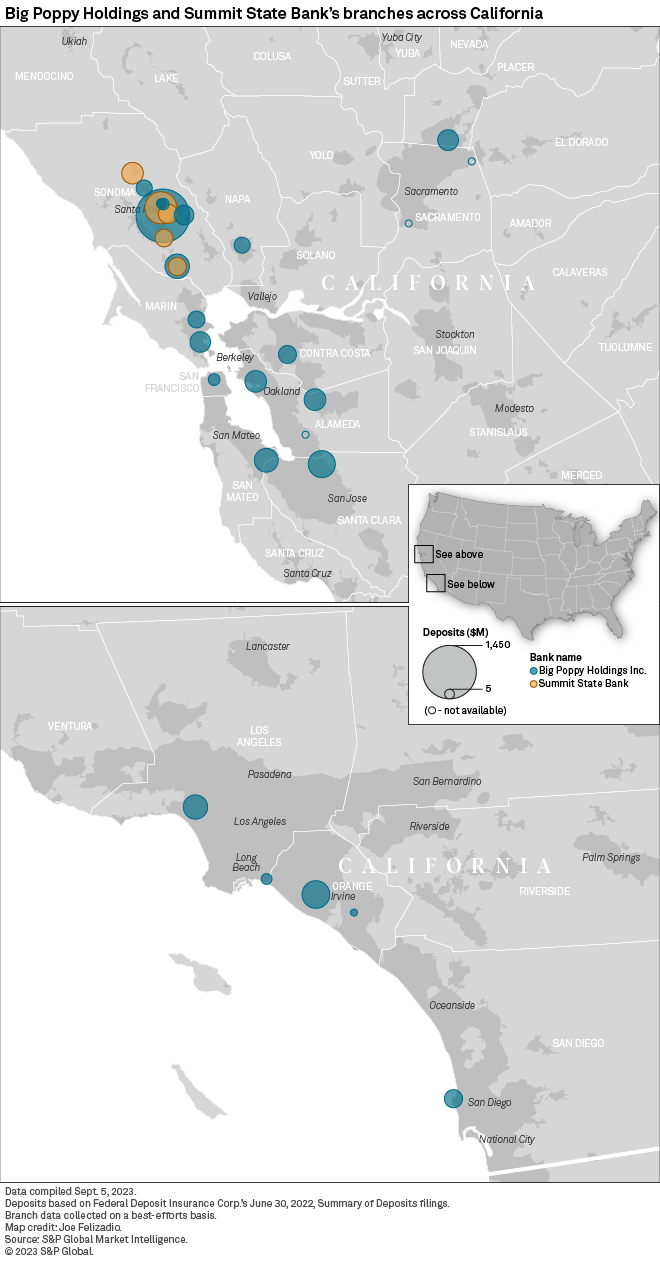

Big Poppy's status as a competitor with Summit in California's Santa Rosa market makes a tie-up with Summit economically compelling, Bava said.

"A lot of expenses can be eliminated in an in-market consolidation like this," Bava said. "They could make a strong case to the stockholders that their investment will be worth more in the near term."

In an interview with the North Bay Business Journal in July, Big Poppy President and CEO Khalid Acheckzai said he would not rule out an acquisition of Summit, though no M&A discussions have taken place.

If Summit is not open to a tie-up, a potential escape route for the bank would be to find a "white knight" buyer during the waiting period for approval, Bava said.

"A white knight could be identified maybe in the Sacramento area or kind of in that East Bay corridor," Bava said. "It's likely that a deal gets done, but not necessarily with Big Poppy."

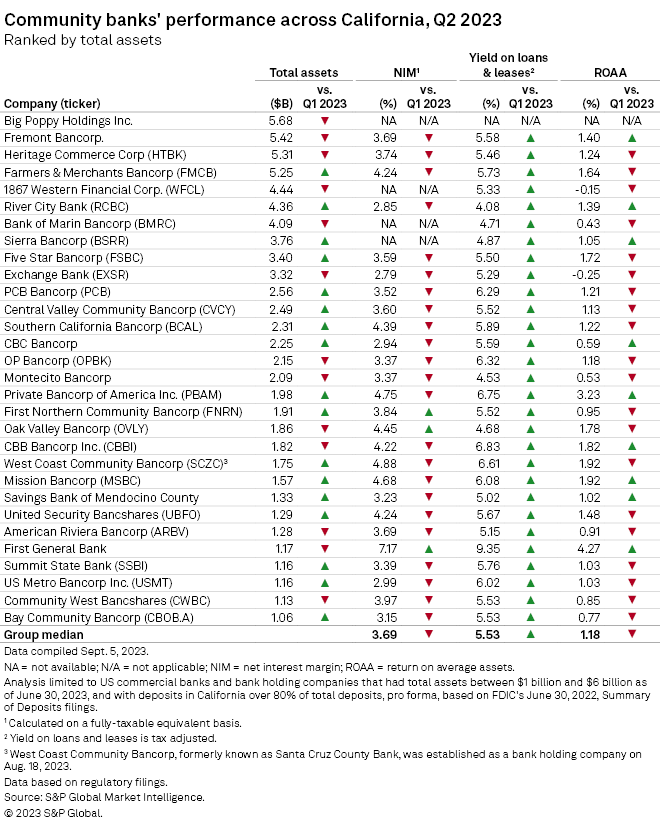

Summit holds just $1.16 billion in total assets, a digestible size for many banks in California, sources said. Banks in the state with $5 billion or more in assets would be the best candidates to buy Summit, according to Bava.

But Summit would need to move before potential regulatory approval for Big Poppy to acquire 24.99% of shares because as a significant shareholder, Big Poppy could make any strategic transactions with another party "much more difficult," Miller said.

"The path to getting approval from the remaining shareholders may be very challenging," Miller said. "This may be one way to get leverage for themselves to make a negotiated offer and also to discourage others from making negotiated offers for Summit."

Summit's defense

Summit is opposed to Big Poppy's goal of acquiring 24.99% of shares, arguing in its letter to the San Francisco Fed that approval would hurt the convenience and needs of the community and would adversely impact competition in the banks' California footprint. Summit also raised managerial concerns because Big Poppy did not conduct due diligence prior to submitting its application. In the letter, Summit claims it found out about the attempt from a newspaper.

Summit specifically drew attention to Big Poppy's bank subsidiary Poppy Bank's recent Community Reinvestment Act (CRA) evaluation, in which it received an overall "satisfactory" score but a "low satisfactory" score on the individual tests for investment and service.

Poppy Bank is "not fully satisfying" its CRA obligations, Summit President and CEO Brian Reed wrote in the letter. CRA compliance is a major focus among regulators right now and has been the culprit for some recent bank deal breakups.

However, while a bad CRA record can be an obstacle to regulatory approval, CRA is unlikely to present a hurdle to approval in this case because Big Poppy's overall score is "satisfactory," according to Panasci.

If the Fed does approve the application, Summit requested that the agency impose conditions of approval, including barring Big Poppy from seeking board representation, taking on management or executive roles, or controlling direct operations of the bank. Summit also requested that Big Poppy vote its shares in the same manner as the majority of shareholders and refrain from entering transactions with Summit.

In the letter, Summit also requested the Fed hold one or more public meetings regarding Big Poppy's application. In doing so, Summit is likely hoping to make getting approval as difficult as possible for Big Poppy, Miller said.

Even with Summit's attempts to thwart the hostile attempt and the various challenges that come with a change in control application, it is likely that Big Poppy eventually receives approval.

"On the basis of the regulatory filings, Summit may have a difficult time thwarting the attempt to get the approval," Panasci said.