Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

21 Jun, 2022

By Vanya Damyanova and Cheska Lozano

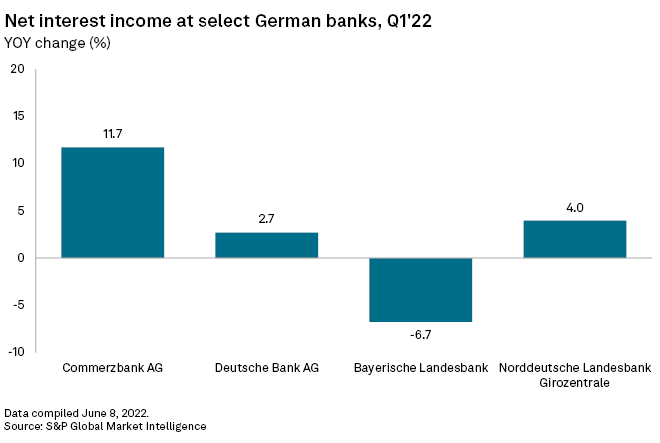

Some of Germany's largest banks expect this year's anticipated ECB interest rate hikes to boost revenues and income, alleviating the negative effects of the Ukraine war and the global economic slowdown.

The ECB said it would end its long-standing negative rate policy in July, and is expected to gradually increase its key deposit rate to zero by the end of 2022. The deposit rate moved into negative territory in June 2014 and has been at negative 0.5% since September 2019.

For Germany's largest bank, Deutsche Bank AG, the positive effect of higher rates on group revenues will be about €600 million in 2022, Deutsche Bank CFO James von Moltke told a financial conference June 9.

"We've now had such an extended time of very low, and in Europe negative, rates, that seeing the end of that is going to be helpful for the banking business," von Moltke said.

Germany's second-largest lender, Commerzbank AG, has already seen some upside. Markets have started pricing in the planned ECB rate hikes and forward money market interest rates have gone up, CFO Bettina Orlopp said at the June 9 conference.

The bank expects a positive rate hike-related effect of around €100 million on its NII in 2022, Orlopp said. The "real upside," however, will be seen when ECB rates reach positive territory, Orlopp said, referring to stronger NII growth prospects for 2023 and 2024.

Analysts expect both Deutsche Bank and Commerzbank to book higher NII in 2022. Deutsche Bank's NII is projected to rise to €11.47 billion in 2022 from €11.12 billion in 2021, and Commerzbank's to €5.42 billion from €4.85 billion, according to mean consensus analyst estimates collected by S&P Global Market Intelligence.

High NII, low costs

The picture is similar at Germany's federal state banks.

Markus Wiegelmann, CFO of Bayerische Landesbank, or BayernLB, said earlier this year the bank's NII could increase by an amount in the higher double-digit million euro range if the ECB deposit interest rate moves to zero from its negative 0.5% level. The bank reported a decline in NII in the first quarter, but this was because of a smaller benefit derived from the ECB's TLTRO III cheap money program, rather than a slowdown in operating activities, it said.

Norddeutsche Landesbank, or NordLB, has achieved a turnaround in both net interest income and net commission income, CEO Jörg Frischholz said in a first-quarter earnings statement May 31. NordLB has been engaged in a restructuring since its state-backed rescue in 2019. Despite reducing its balance sheet size, it was able to grow its first-quarter net interest income by 4% year over year.

BayernLB and NordLB did not respond to a request for additional comment when contacted by S&P Global Market Intelligence.

All four banks had reduced operating costs, while operating income grew at Deutsche Bank and Commerzbank, and fell at the two federal state banks. BayernLB and NordLB said bank levy payments and mandatory contributions to the public bank sector's deposit guarantee scheme impacted first-quarter earnings.

Provisions uptick

BayernLB also noted its prior-year results were boosted by a positive earnings contribution from loan loss provisions. The bank increased provisions in the first three months of 2022 mainly due to Russia's invasion of Ukraine and related market uncertainty. BayernLB has limited exposure to the Russian and Ukrainian markets but expects 2022 earnings to be affected by the war's impact on economic growth.

NordLB was the only bank to book provision releases in the first quarter of 2022, while those at all other banks increased year over year.

Both BayernLB and Commerzbank said they are taking a conservative approach with their 2022 risk provisioning because of potential second and third order effects related to the Ukraine war.

Commerzbank feels comfortable with its €1.2 billion loan loss provision target for 2022 provided the global situation does not deteriorate any further, CFO Orlopp said. "If we see a [Russian] gas stop or a recession ... that will be clearly different," she said.

Germany's dependence on Russian gas makes it vulnerable to potential further supply disruptions. Russia-based energy group Gazprom recently said it was cutting gas supply to Germany to under 70 million cubic meters per day in what was described as a political move by Germany's economy minister Robert Habeck, according to a BBC News report from June 16.