| U.S. President Joe Biden participates in a virtual meeting about mineral supply chains and clean energy manufacturing in the South Court Auditorium of the White House complex on Feb. 22, 2022, in Washington, D.C. Source: Drew Angerer/Getty Images News via Getty Images |

The Biden administration's efforts to stimulate domestic critical mineral supply chains are scoring early successes as companies accelerate their plans to extract and refine clean energy metals inside the U.S.

One year after signing an executive order to shore up U.S. critical mineral supply chains, the administration has marshaled

Critical minerals will likely be important to decarbonizing the energy and transportation sectors, and demand for several of the minerals is expected to balloon. For example, by 2040, demand for rare earth elements could be three to seven times the current levels, according to the International Energy Agency. The market value of magnet rare earths could also increase almost fivefold by 2030 to $15.65 billion from $2.98 billion, according to Adamas Intelligence.

As part of its larger agenda to combat climate change and to support the blue-collar workers who make up a key part of its coalition, the Biden administration chose to fund the research and development of low-carbon technologies to produce minerals essential to the energy transition in the U.S. while also taking steps to build up the country's ailing mineral production base.

Biden gets to work

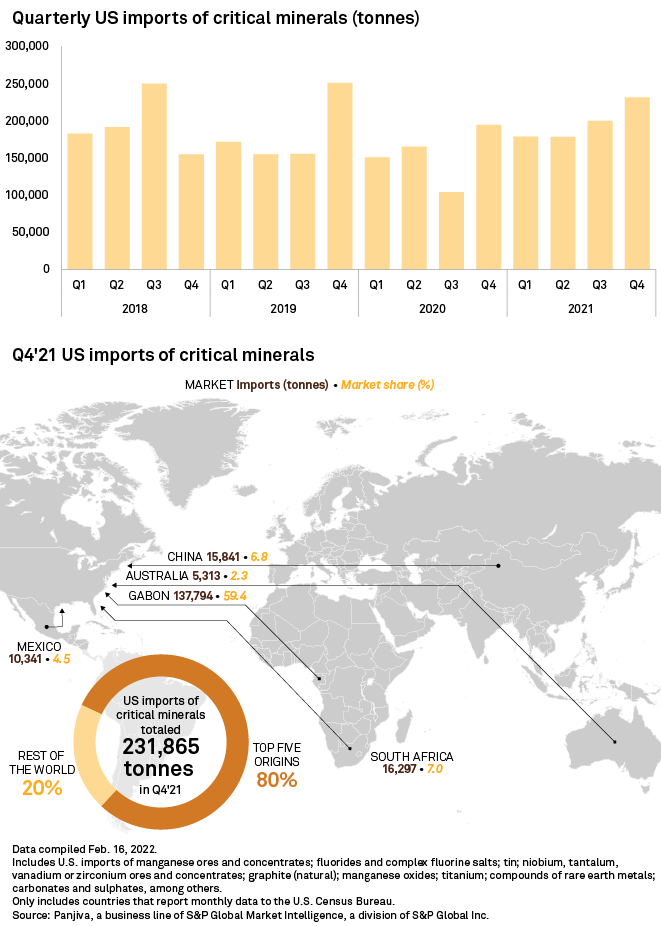

The Biden administration would like to break U.S. dependence on China — which processes 90% of the world's rare earth elements as well as 50% to 70% of lithium and cobalt, according to the IEA — and shore up the U.S.' weak midstream supply chain for processing elements like lithium into useful compounds.

The administration has tried to bring to bear all of the authority it can to facilitate a domestic, clean energy supply chain without the aid of Congress, which has not been able to pass its ambitious clean energy agenda beyond the infrastructure bill.

While the U.S. will not surpass China any time soon when it comes to producing critical minerals, and while it must still cope with lengthy bureaucratic delays that confront new developments, the administration's steps have generated optimism and attracted investment dollars to the nation's mining industry.

The National Mining Association commended the Biden administration's "all-of-government" approach to address the shortage of U.S. critical minerals, citing the passage of a bipartisan infrastructure package along with U.S. Energy Department investments in the production and processing of critical minerals, among other examples.

In 2021 and 2022, the administration rolled out one of the most comprehensive strategies on critical mineral supply chains to date, according to Jane Nakano, a senior fellow specializing in energy security and climate change at the Center for Strategic and International Studies.

"The administration's latest step is an important one in that there is actually now money being spent to [learn] how to extract these important critical minerals in a sustainable way," Nakano said.

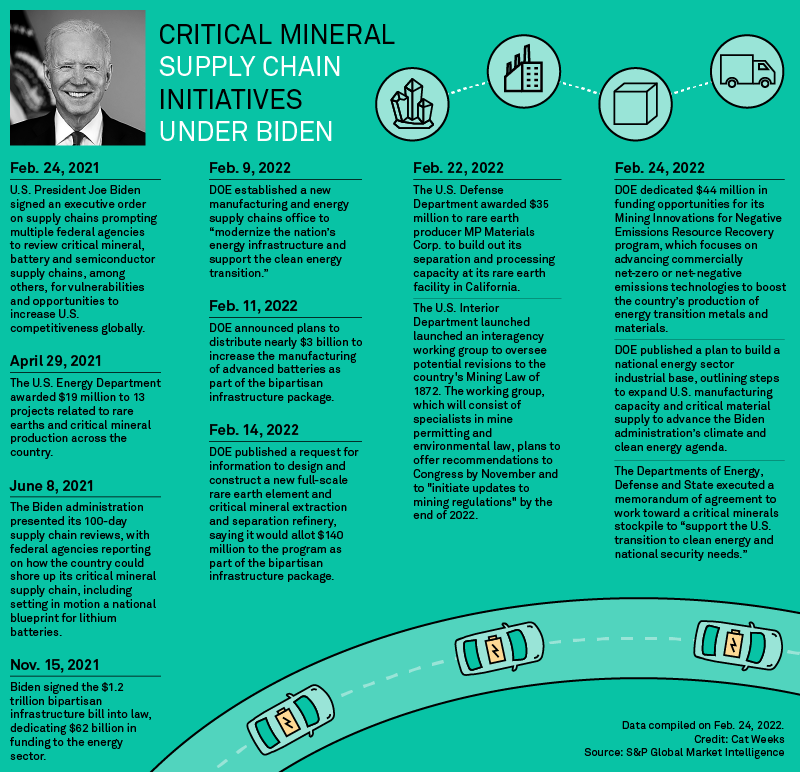

In February 2021, Biden signed an executive order on supply chains prompting multiple federal agencies to review critical mineral, battery and semiconductor supply chains, following up on a campaign promise to bring the clean energy supply chain home to the U.S. Since then, the administration has announced more plans to support its supply chain agenda, including setting in motion nearly $3 billion in funding to increase the manufacturing of advanced batteries as part of the bipartisan infrastructure package.

"I've seen nascent efforts that they are starting to help minerals and rare earth companies," Drew Horn, CEO and co-founder of the asset development firm Greentech Minerals Holdings, said of the Biden administration's supply chain policy. Horn also was a senior defense and energy department official under the previous administration. "The biggest thing is to view them for what they truly can be, which is not all-encompassing solutions in themselves but de-risking tools to get the capital markets more heavily involved."

The Biden administration has also been using its grantmaking authority to help jump-start the domestic supply chain. The DOE opened up $44 million in funding opportunities to advance commercially net-zero or net-negative emissions technologies to boost the country's production of energy transition metals and materials.

On Feb. 22, the U.S. Defense Department awarded $35 million to MP Materials Corp. to develop its separation and processing capacity at its rare earth facility in Mountain Pass, Calif. The company plans to provide the country with a domestic source of permanent magnets, a product made out of rare earth elements.

On the regulatory front, the U.S. Interior Department launched an interagency working group Feb. 22 to oversee potential revisions to the country's Mining Law of 1872, which has been

"Taking bold action to invest in our supply chains means America will reap the tremendous opportunities that tackling climate change presents to kickstart domestic manufacturing and help secure our national, economic and energy security," U.S. Energy Secretary Jennifer Granholm said in a Feb. 24 statement. The DOE did not respond to a request for additional comment.

Companies revving their engines

A growing wave of companies is forging ahead with existing plans to develop supply chain infrastructure in the U.S., riding the momentum sparked by the Biden administration's executive actions.

BHE Renewables LLC plans to start building a demonstration site in Imperial County, Calif. to test out extracting lithium from geothermal brine. If commercially feasible, the company plans to produce about 90,000 tonnes of lithium annually by 2026.

U.S. automaker Ford Motor Co. and Nevada-based battery recycling company Redwood Materials Inc. plan to create a "closed-loop battery recycling system" to localize the supply chain for Ford's battery materials. And electric vehicle giant Tesla Inc. has taken steps to source some of its battery metals from companies operating in the U.S., including graphite from Australian miner Syrah Resources Ltd.'s planned processing facility in Louisiana and nickel from Talon Metals Corp. in Minnesota. On Feb. 14, the DOE awarded Talon $2.2 million to explore, research and develop carbon storage at its Tamarack nickel project.

Lithium Americas Corp. CEO and President Jon Evans said the company "couldn't agree more" with Biden's "clear commitment to domestic supply chains" in a March 1 Twitter post. Vancouver, British Columbia-based Lithium Americas secured three state permits for its Thacker Pass lithium project in Nevada on Feb. 25 and expects a final decision on its federal permits by the third quarter of 2022. The company also submitted a draft loan application to the DOE in February for funding to advance its Thacker Pass project.

"The project is aligned with the national agenda to enhance domestic supply of critical minerals and has the potential to be a leading near-term source of lithium for the U.S. battery supply chain," Evans said of the Thacker Pass project in a Feb. 28 comment.

Big hurdles remain

Despite the Biden administration's call to build out the country's supply of domestically mined battery materials, bringing new mines online in the U.S. has been largely an uphill battle. Several mining companies have faced hefty regulatory and permitting requirements in addition to local opposition on environmental grounds.

On Jan. 26, the Interior Department canceled a pair of hardrock mining leases held by U.K.-headquartered mining company Antofagasta PLC's Twin Metals Minnesota LLC on grounds that the leases were "improperly renewed," effectively blocking the development of the $1.7 billion Twin Metals copper-nickel project near the Boundary Waters Canoe Area Wilderness in northeastern Minnesota.

Funding for research and development, while important, does not always translate into commercially-scalable operations.

"We like innovating. But a question could be: What has that gotten us?" said Ian Lange, associate professor of economics and business at the Colorado School of Mines. "You have these demonstration projects, and they are positive for sure. Is it clear that we're making a dent or clear we're moving the needle? I would say no. Not yet."

But the administration is just into its second year in office, and it is still putting Biden's plan into motion.

"There's just so much work [to do] once an executive order is unveiled," former defense and energy official Horn said. "I think all of these are great steps in the right direction. They just need a little bit more time to hit full stride."

S&P Global Commodity Insights produces content for distribution on S&P Capital IQ Pro.