Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

23 Nov, 2022

By Brian Scheid

As the Federal Reserve increases its benchmark rate at the fastest pace in decades, debate has intensified over when the central bank might stop.

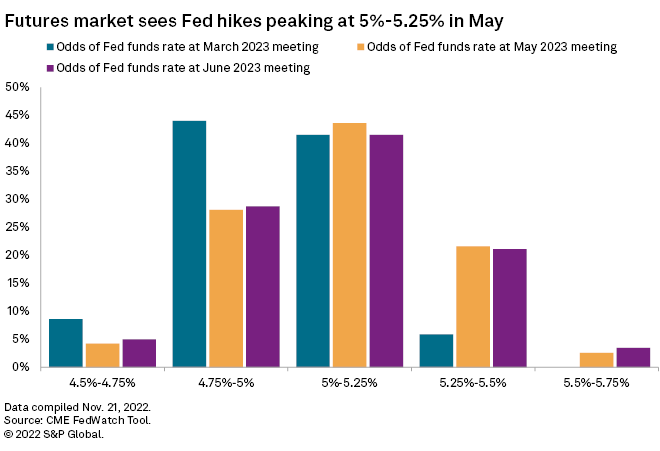

The Fed has raised the federal funds rate by 375 points since March after keeping it at near zero for two years in response to the COVID-19 pandemic. Futures market traders expect that rate will be above 5% at the May 2023 Federal Open Markets Committee. According to the CME FedWatch Tool, which measures investor sentiment in the Fed funds futures market, about 44% of the market is betting that rates will be between 5% and 5.25% by that meeting, while another 22% figure rates will sit between 5.25% and 5.50%.

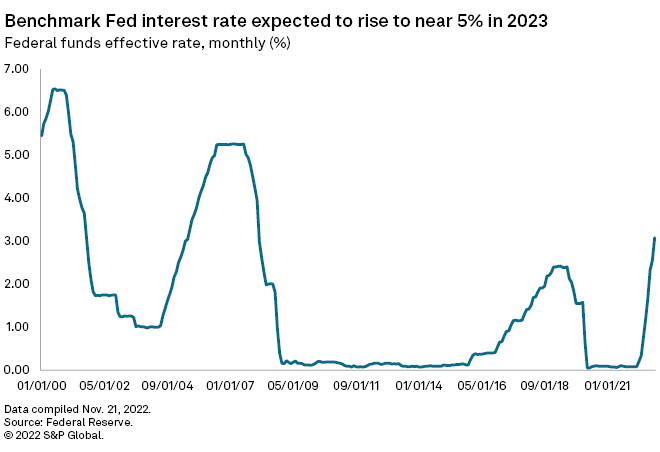

Interest rates have not been at those levels since 2007, but the Fed may not stop there. If inflation does not substantially cool soon the central bank could push its terminal rate, the point where it chooses to stop hiking, even higher.

Fed officials "don't want to run into this situation where they need to reverse course," said Michael Crook, chief investment officer at Mill Creek Capital Advisors. "They'll have to simply keep going."

No peak in sight

After raising rates by 75 basis points at each of their last four meetings, Fed officials are expected to hike by a more modest 50 basis points at the December meeting.

Rate decisions made at each meeting are of less consequence than where the central bank ultimately stops raising rates, Fed Chairman Jerome Powell said at a Nov. 2 press conference.

"The question of when to moderate the pace of increases is now much less important than the question of how high to raise rates and how long to keep monetary policy restricted, which really will be our principal focus," Powell said.

The Fed's chairman has given no indication of where he believes that terminal rate will end up. Other top Fed officials have offered little information beyond stating that more rate hikes are needed to curb persistently high inflation.

Varied views on terminal rate

The terminal rate could surge to 6% if inflation does not cool soon, according to Mill Creek Capital's Crook.

If rate increases this year cause the economy to slow in early 2023, however, the terminal rate could be 4.5% to 4.75%, said Michael O'Rourke, chief market strategist with JonesTrading. While lower than current expectations, a benchmark interest rate of 4.5% is well above the 1.3% average over the past 20 years.

"It simply needs time to work through the economy," O'Rourke said of rate increases.

Kathy Jones, managing director and chief fixed income strategist for the Schwab Center for Financial Research, said the central bank is sending signals that the fed funds rate will peak at 5%.

Inflation questions

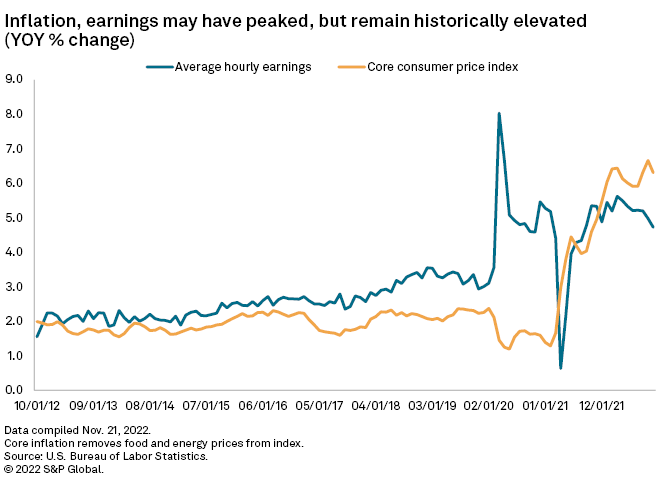

The Fed will likely continue to press toward a 5% terminal rate unless a significant change in the inflation and employment outlook occurs, Jones said. Such a peak would probably be too high than what is warranted, according to Jones, as the economy is "only beginning to feel the impact of the tightening."

"There's a good chance that the Fed is going to overshoot," Jones said.

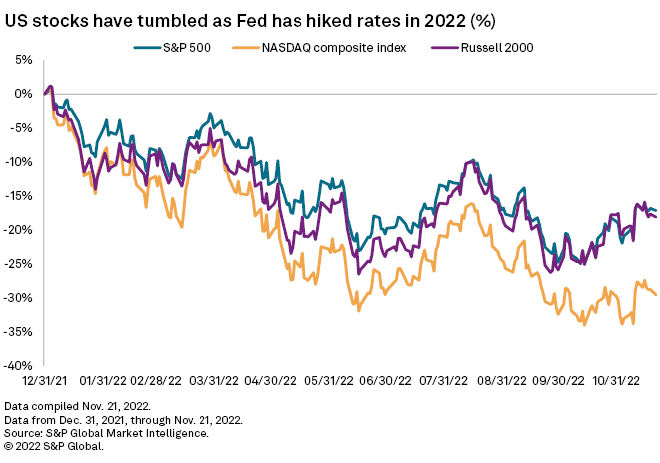

Higher interest rates, aimed at boosting borrowing costs and slowing the economy, will be an "ongoing negative for risk assets," particularly stocks, Jones said.

The Fed's shift to tighten monetary policy clearly has impacted housing, where mortgage applications have plunged in response to some of the highest mortgage rates in two decades. However, rate hikes have yet to significantly slow wage growth or curb consumer demand. That could change as the Fed looks to tighten more into early 2023, said Larry Meyer, CEO of Monetary Policy Analytics and a former Fed governor.

"Every step they take brings them closer to high enough to be able to precipitate a recession," Meyer said. "They have to tiptoe a little bit more at this point, be a little bit more cautious."