The deep freeze that gripped credit markets in the second quarter depressed volumes and values of loans in the portfolios of business development companies, cutting across both syndicated and nonsyndicated structures, LCD data shows.

As pandemic lockdowns arrested economic activity in the second half of March, deal flow dropped off. The slowdown in new loan transactions dominated the second quarter, ending the buoyant, borrower-friendly market conditions that ushered in 2020.

Business development company, or BDC, portfolios felt the impact of this sea change. Repayments, meanwhile, did not take a break. With few new loans to add to portfolios, the volume of both broadly syndicated loan, or BSL, assets and non-BSL assets declined, based on par amount, LCD data showed. LCD tracks the portfolio holdings of 68 publicly traded and private BDCs.

|

For comparison, the volume of nonsyndicated loans in BDC portfolios reached an all-time high in the first quarter of 2020, as the COVID-19 pandemic began, continuing a trend toward more single-lender and club deals.

In the first quarter of 2016, the share of non-BSL and BSL assets in BDC portfolios (based on par amount) was split roughly evenly. Since then, non-BSL assets in BDC portfolios have risen, as midsize borrowers increasingly turn to private credit markets for financing. The share of non-BSL assets in BDC portfolios (based on par amount) climbed to nearly 70% in the second quarter of 2020, compared to 46% in the fourth quarter of 2014.

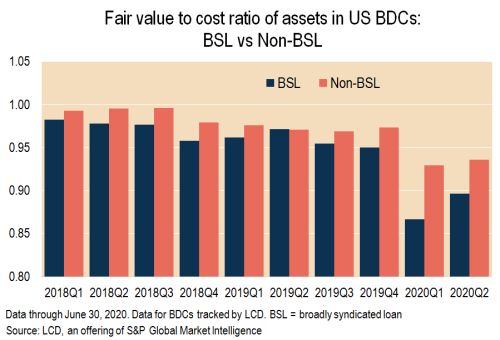

One difference between BSL and non-BSL holdings is seen in changes to fair value quarter on quarter. Unlike syndicated loans, non-BSLs rarely trade. Lenders typically hold them to maturity or repayment. This provides fewer data points for assessing the fair value of these nontraded, nonsyndicated loan assets, away from the quarterly performance data of a borrower company. More extreme price swings in BSLs, particularly in the unprecedented months of the COVID-19 pandemic, are apparent.

|

Private debt providers have turned to direct lending for the more attractive yields that directly originating loans to small and midsize companies can offer. Banks have moved away from this type of lending since the credit crisis as regulations tightened. Many of these private loans have ended up in BDCs. BDC portfolio data offers a lens into credit market trends.

|

Pandemic-related volatility has raised the expectation of consolidation in the market among BDCs. M&A activity is likely, as well as sales of whole portfolios, market sources say.

This month, affiliates of Medley Capital Corp. announced the sale of interests in a senior loan joint venture to a fund of Golub Capital LLC for $156 million, using proceeds to repay revolver debt. Medley Capital is a closed-end, externally managed BDC.

In June, Medley Capital announced it would commence a strategic review process to explore alternatives "to maximize shareholder value." That announcement came on the heels of news in May that Sierra Income Corp., a non-traded BDC, had terminated a planned merger with Medley Capital.

In another deal, MVC Capital Inc. and Barings BDC Inc. announced in August plans to merge, in a transaction expected to close in the fourth quarter.

Also in August, Barings BDC received a commitment for a $100 million private placement of unsecured debt that it plans to draw over the next 12 months. Barings BDC also said it would transition away from broadly syndicated loans toward direct lending over the next several quarters.

Last week, Canadian insurer Sun Life Financial Inc. said it would acquire a majority stake in Los Angeles-based Crescent Capital Group LP, confirming earlier reports that the two entities were in deal talks. Sun Life will acquire a 51% interest in the global alternative credit investment manager for up to $338 million.

That transaction is expected to close this year. Crescent is the investment adviser of Crescent Capital BDC Inc. Crescent will become a subsidiary of SLC Management, Sun Life's alternatives asset management business, through the transaction. Subject to approval of Crescent BDC's shareholders, Crescent will remain investment adviser of Crescent BDC. It will continue to operate as an independent company.