Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

30 Apr, 2021

Spain's Banco Bilbao Vizcaya Argentaria SA does not feel obliged to pursue merger and acquisition opportunities despite ongoing consolidation in the Spanish market and the bank sitting on excess capital following the sale of its U.S. operations, according to CEO Onur Genç.

BBVA pulled out of a deal to buy Spanish peer Banco de Sabadell SA in November after the two parties failed to agree on a price. Recent M&A activity in Spain's banking sector has included deals between CaixaBank SA and Bankia SA, Unicaja Banco SA and Liberbank SA, and ABANCA Corporación Bancaria SA and Bankoa SA.

Speaking during a first-quarter 2021 earnings call, Genç said that M&A was just one option among many for BBVA as it considers the redeployment of capital following the $11.60 billion sale of its U.S. operations in November to The PNC Financial Services Group Inc. BBVA would not pursue M&A just because it has excess capital, Genç said.

'The market has to make sense'

"M&A has to make sense by itself, independent of whether you have excess capital or not," said Genç. "The M&A has to justify itself in terms of numbers. You have to come up with a value creation opportunity. The numbers have to say that this is a great opportunity."

Genç set out the criteria by which BBVA assesses M&A opportunities, with an emphasis on the right strategic fit for the company.

"The market has to make sense," said Genç, adding the internal rate of return, tangible book value and earnings per share accretion were among the metrics BBVA considered when assessing opportunities.

"For [those metrics] to make sense, you have to create value, so scale has to be coming in," Genç said. "That's why we [have repeatedly said] that it seems there's better value in our existing markets to create value."

BBVA recorded a €1.21 billion profit for the first quarter of 2021 compared to a €1.79 billion loss in the same period the previous year. The result was driven by a 10.0% year-over-year increase in net fees and commissions to €1.13 billion and a 16.1% year-over-year increase in net trading income to €581 million.

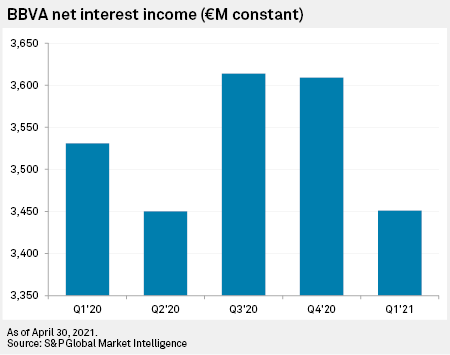

The bank saw net interest income fall year-over-year by 2.3% to €3.45 billion, which it attributed to the current interest rate environment, particularly in Turkey.

Turkey's central bank raised its benchmark interest rate by 200 basis points in March to 19% in a bid to stymie rising inflation. Days later Turkish President Recep Tayyip Erdoğan unexpectedly dismissed central bank Governor Naci Ağbal, but the benchmark rate has remained at 19% since.

The shifts in Turkish monetary policy have caused BBVA's customer spreads in Turkey to shrink to 2.76% in March from 4.77% in October 2020. BBVA expects spreads to improve in the coming quarters.

"The [net interest income] has been negatively affected in the first quarter because there have been significant policy rate rises in [Turkey]. But this is a short-term repricing impact that we see in the customer spread," said Genç.

"Banks' deposits [in Turkey] repriced much faster than the loans" following the interest rate hike, Genç added. "So there is a negative correlation of NII with increasing rates, especially in the time frames of three months and six months, with neutral impact in 12 months as the repricing of the loans catch up."

Long-term investor in Turkey

Asked by an analyst if the turbulence in Turkey would encourage BBVA to reassess its presence in the market, Genç said he wanted to repeat the message that BBVA is a "long-term investor in the countries that we are in."

Turkey's long-term fundamentals "are still positive," said Genç, among them "very low" household leverage compared to other emerging economies, an attractive demographic profile with an average age of 31 and an economy that acts as a manufacturing hub for Europe.

"We still believe in the long-term potential of the country," Genç added.

BBVA owns a 49.85% stake in Turkish lender Turkiye Garanti Bankasi AS. Turkey is the bank's third-largest market by gross income after Mexico and Spain, bringing in €834 million in the first quarter. Erdoğan's dismissal of the country's central bank governor in March prompted a more than 11% drop in BBVA's share price.

Genç said that currency risk posed the greatest threat to BBVA in terms of its Turkish operations, but that the bank has reduced its foreign exchange book by 40% in the last four years to manage this risk.

"We are very prudent in the hedging," said Genç. "We did know and we did realize the risk. And I think we are prepared as much as we can for that risk as well."