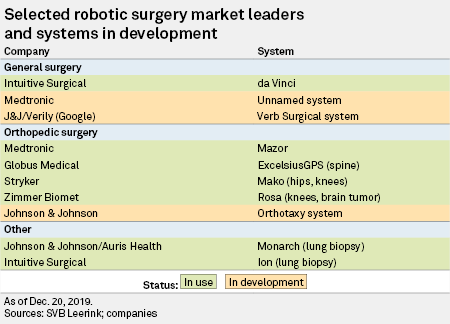

As the early days of robotic surgery give way to more precise control and better patient outcomes, early pioneers like Intuitive Surgical Inc. are seeing increased pressure from large companies like Johnson & Johnson and Medtronic PLC, which have made major M&A investments to crack into the market in recent years.

Intuitive's da Vinci system was first approved by the U.S. Food and Drug Administration in 2000 for urology. Since then, the number of companies staking their future on the growing space — either in general surgery or orthopedic — has only grown.

Intuitive Surgical's da Vinci system Source: Intuitive Surgical |

Analytics firm GlobalData reported in November 2019 that the surgical robot market is expected to reach $275 billion by 2025, almost tripling in size compared to 2018 when the market accounted for $98 billion.

"The reason for this incredible growth rate is that robotics can revolutionize almost any type of surgery, including cardiology, oncology and neurology," GlobalData Data Scientist James Spencer said. "It is just a matter of how the technologies can be applied."

Hospitals are adopting the surgical robots at increasing rates, with general surgery procedures using the da Vinci system rising 32% from 2017 to 2018. GlobalData said robotics is one of the most promising technologies changing the face of healthcare.

A representative from George Washington Hospital in Washington, D.C., told S&P Global Market Intelligence that surgeons there have performed more than 6,600 procedures in urology; colorectal; general surgery; gynecology; oncology; and ear, nose and throat. Companies that make these robots also make the implants and surgical tools that come with them.

According to an analysis in the journal the Annals of Laparoscopic and Endoscopic Surgery from May 2019, the da Vinci system costs hospitals between $500,000 and $2.5 million in up-front costs depending on the model, configuration and geographic location. Annual service contracts of $80,000 to $170,000 and accessory costs of $700 to $3,500 per procedure add to the costs. Instrument revenue for the system exceeded revenue from system sales at Intuitive in the third quarter of 2019.

"The recurring revenue per procedure is the biggest value creator for these companies," SVB Leerink analyst Richard Newitter said in an interview. "For Intuitive, it was always the view that you would see utilization per system increasing and then a growing install base that would then lead to accelerating revenue increases down the road — the robot is essentially like a Trojan horse."

Competition on the horizon

Intuitive CEO Gary Guthart acknowledged on the company's third-quarter earnings call held Oct. 17, 2019, that, although the company pioneered robotic surgery, competition will continue to take hold.

"The opportunity for computer-aided and robotically assisted surgery and acute intervention more broadly is clearly substantial and clearly durable," Guthart said. "And that's going to draw new entrants. ... Those new entrants will help accelerate broader adoption more generally — and customers will appreciate that choice."

|

In general surgery, J&J and Medtronic are both developing robots that will compete directly with Intuitive, but the da Vinci continues to hang on tight to the market it created. Intuitive this year launched its newest system, called Ion, which is designed for lung biopsies.

SVP Leerink analyst Richard Newitter predicts that the number of procedures using Intuitive's system will grow 17% year over year in 2020. Newitter also believes the entry of newer systems will serve as validation for robotic surgery as a whole, negating the zero-sum-game model of market share.

"Clearly, competitors will enter the market and make claims, and I guess what I would say for both customers and for shareholders, due diligence is really important," Guthart said. "It's really easy to make claims on trade show floors, and it's pretty hard to back them up in real life — and our experience in the world has been that there's a lot of noise in the beginning as those claims are made."

Auris' Monarch Platform for lung surgery Source: Auris Health |

M&A in robotic surgery

Although Intuitive grew its business organically, some of the biggest names in medical devices — J&J and Medtronic, as well as Stryker Corp. and Zimmer Biomet Holdings Inc. — have used their deep pockets to stake a claim in surgical robots by acquiring smaller companies with promising systems.

"Each one of these larger companies made a very specific bet on robotics and acquired the technology off of which they were going to grow their robotics initiatives," Newitter said.

J&J in April 2019 completed a $3.4 billion acquisition of surgical-robot maker Auris Health, which makes the Monarch platform for lung cancer diagnosis and treatment. The system, which received FDA approval before J&J's acquisition, comprises a flexible endoscope that can navigate the lungs when controlled by a surgeon.

With Auris, J&J picked up an already marketed system with a developed commercial team that could make for a tough competitor to Intuitive's newly launched Ion system, Leerink analyst Danielle Antallfy said when the deal was announced. The Ion and Monarch systems are intended for lung biopsy diagnostics.

Even before picking up a marketed product, J&J had dipped its toe into the market through a partnership with Alphabet Inc.'s Google on the Verb Surgical joint venture to develop a robot for general surgery. The healthcare giant bought out the remaining stake in that project at the end of 2019. J&J also in 2018 purchased France's Orthotaxy SAS and its prototype orthopedic surgery system. Both the Verb Surgical and Orthotaxy systems are in development.

Medtronic's Mazor X spinal surgery robot Source: Medtronic |

Similar to J&J, Medtronic entered the orthopedic robotic surgery space with the 2018 acquisition of Israel's Mazor Robotics, which executives have said is expected to contribute to revenues moving forward. Medtronic CEO Omar Ishrak said on the company's third-quarter earnings call in November 2019 that the Mazor X robot has contributed to growth not only in equipment sales, but also in spine implants.

Executives declined to provide specifics on Mazor placements in hospitals, but Medtronic President Geoffrey Martha said that over the past several quarters, the company has placed more systems than its competitors.

"When you stack quarter after quarter after quarter of meaningfully more placements than the competition, our installed base has gotten pretty big," Martha said. "We've got a lot of momentum here."

Also in orthopedic surgery, Zimmer bought the Rosa robotic surgery system through the acquisition of MedTech SA, while Stryker picked up Mako by buying the company of the same name. Both, along with Smith & Nephew PLC, are leaders in knee replacement surgery performed by robots, Newitter said.

Newitter said the number of Rosa systems installed in hospitals is set to rise significantly in the next few years. He modeled 39 installations in 2019 for $33 million, 66 units in 2020 for $56 million and 85 units in 2021 for $72 million.

Stryker, which sold 51 Mako robots globally during the third quarter, has almost 800 of the systems installed and performing more than 27,000 procedures. The company has also employed an M&A strategy to improve the Mako robot, picking up Mobius Imaging and sister company Cardan Robotics for $370 million in October 2019, offering new improvements to the system.

Into 2020 and beyond, Newitter sees robotic surgery advancing less in M&A deals and more in both technology and uses of the robots.

"None of the players or any of the new ones are sitting still," Newitter said. "Additional players are coming in because they see an underpenetrated, long-term opportunity that hasn't been guarded yet — and that just validates and expands the market."