Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

9 Sep, 2021

By Yizhu Wang and Nathaniel Melican

U.S. banks are targeting growth in home-improvement financing through acquisitions, as they look to tap a market offering high returns, limited risks and a COVID-fueled demand boom.

Truist Financial Corp. boosted its presence in the sector last month with a $2 billion agreement to buy Service Finance Co. LLC, which offers point-of-sale financing at 13,000 dealers in the U.S. Regions Financial Corp. similarly announced the $960 million acquisition in June of EnerBank USA, another point-of-sale lender in the industry. Both companies work with retailers and suppliers to offer financing on home renovation and construction materials for projects taken on by contractors. That professional market is worth more than $150 billion, according to Regions, and the five largest lenders have a market share of only 9% combined.

Homeowners splurged on repairs and renovations during the coronavirus pandemic, and some 79% of consumers who planned to make home improvements in 2021 expected to spend more this year than in 2020, according to a February presentation given by Service Finance's parent company ECN Capital Corp. Home improvement financing has higher returns and lower credit risks than other specialty finance categories, bolstering the appeal of the sector to banks, which are struggling to balance surging deposits and lackluster loan growth.

"What you're striving for all the time, is to be there when the transaction occurs, so that you can lend money on the transaction," said Dick Bove, senior research analyst at Odeon Capital. If banks "find companies in the home improvement industry who are taking share, then they want to buy them — they want that business for themselves."

Banks like Truist have been buying loans originated from home improvement point-of-sales lenders in the past few years, including fintech GreenSky Inc. and Service Finance, which finances a wide range of renovation products from HVAC to windows and roofing materials. ECN Capital estimated in February that GreenSky would be the largest lender in the category in 2021 with $5 billion in originations, with Service Finance and EnerBank at $2.6 billion and $2.0 billion, respectively. Truist did not provide further comment on its strategy when reached.

Truist's acquired loans have generated 3% in return on assets and over 20% in return on equity, said a source familiar with Truist's strategy. That compares with a 1.28% annualized ROA and an 18.9% annualized return on tangible common equity across all of Truist as of July 15. Part of the loans' return is generated directly by the home improvement retailers, which are willing to pay the bank a small portion of the loan amount immediately, the source said. The person asked not to be named because he is not authorized to speak to press.

Scott Peters, head of the consumer banking group for Regions Bank, said in an emailed statement that the bank has invested more in mortgage and home equity origination capabilities that focus on making the borrowing process more convenient for homeowners.

"We believe the point-of-sale options delivered by EnerBank are the ideal complement to our investments," Peters said. "We see tremendous growth potential given EnerBank's strong performance through different economic cycles."

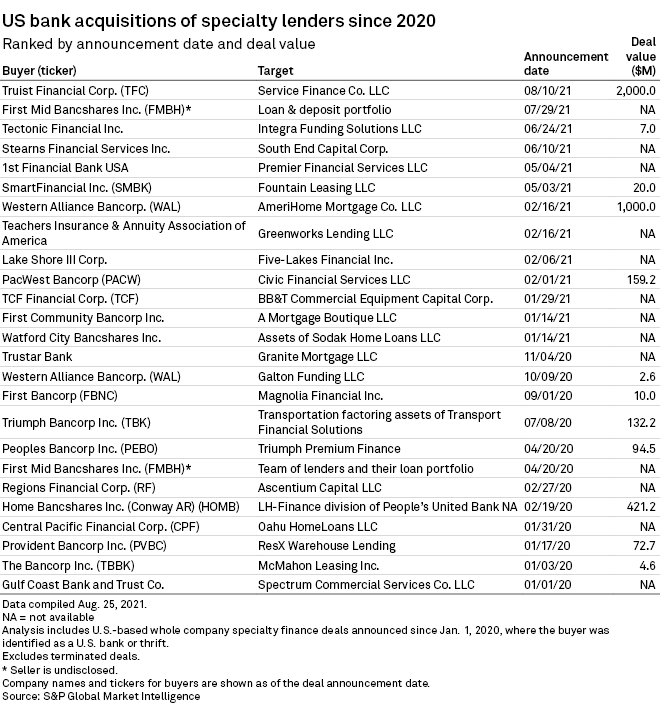

In 2021, U.S. banks have announced at least 13 acquisitions of specialty lenders, a broad industry that spans mortgages, business loans and consumer loans. Service Finance and EnerBank USA, which S&P Capital IQ Pro categorizes as a bank, are two of the largest deals.

Buy vs. partner

Soon after announcing the Service Finance deal, Truist said it is terminating its yearslong loan purchasing relationship with GreenSky, effective Nov. 9.

GreenSky said it does not expect Truist's departure to have a material impact on its business. The bank funded roughly 8% of its total transaction volume. GreenSky still has $2.5 billion in unused commitments from bank partners as of June 30, excluding Truist, according to a filing on Aug. 12. The company did not respond to a request for further comment.

Banks that own a loan origination platform rather than partner with one get more control over the loans, Donat said. GreenSky uses a "round-robin system" to allocate loans to its bank partners, where any bank partner could get the lowest-quality loans from time to time.

Service Finance, meanwhile, benefits from the deal by having access to Truist's deposits, which will be a cheaper source of funding loans than securing funding commitments from bank partners. Truist's ownership could also add a competitive edge to Service Finance because retailers like to have a guaranteed source of financing for customers, Donat said.

It would be a logical move for a bank to acquire a lender like GreenSky if it wants to get more involved with home improvement financing, Donat said. The Atlanta-based fintech company has an enterprise value about $1.77 billion and currently trades at 32.62x price to book value. That is far above the 1.44x industry median for U.S. banks' price to adjusted tangible book value as of July.