Facing reinvestment risk in their bond portfolios, banks reached further out of the yield curve in the first quarter to mitigate the headwind to earnings.

Long-term rates plunged below 1% late in the first quarter and have fallen even further in the second quarter as the Federal Reserve has sought to keep rates low through quantitative eassing. The yield on the 10-year Treasury averaged 1.37% in the first quarter, down 43 basis points from the prior quarter. The average yield on the benchmark 10-year has been nearly 70 basis points lower through mid-June, leaving bank managers with far lower yields to put cash to work.

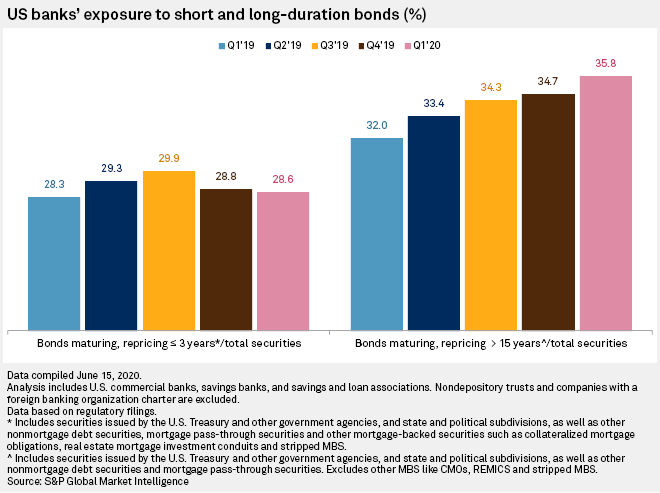

As rates reached historic lows, institutions took actions to combat the pressure of lower rates in the first quarter of 2020, adding exposure to the long end of the yield curve. Bonds expected to reprice or mature in more than 15 years represented 35.8% of bank-held securities at the end of the first quarter, up from 34.7% in the prior quarter and 32.0% in the year-ago period.

Over the last few years as long-term rates have decreased, banks steadily increased their exposure to the long end of the yield curve. Four years ago, securities expected to reprice or mature in more than 15 years equated to 26.4% of bank-held securities at the end of the first quarter of 2016.

READ MORE:

Banks that reached further out the curve more recently might be better positioned to soften the blow they will face over the next few quarters from having to reinvest cashflows from their portfolios and maturing bonds at lower rates. Long-term rates seem unlikely to rebound soon either, with the Fed indicating that it might use yield curve caps to keep rates low for the foreseeable future. In that scenario, the Fed would set a cap on the interest rate for Treasurys of certain maturities and then commit to purchasing any amount of the securities to maintain rates below the cap.

Rates began to plunge in February as the efforts to contain the coronavirus spurred a much more negative outlook for economic growth. The outlook for the economy soured considerably in the months that followed, and the National Bureau of Economic Research recently announced that the U.S. economy moved into a recession in February.

Persistently low rates will maintain pressure on net interest margins as many earning-asset yields decline, while banks work to cut their funding costs. Increased exposure to longer-dated bonds could help combat that risk, at least modestly.

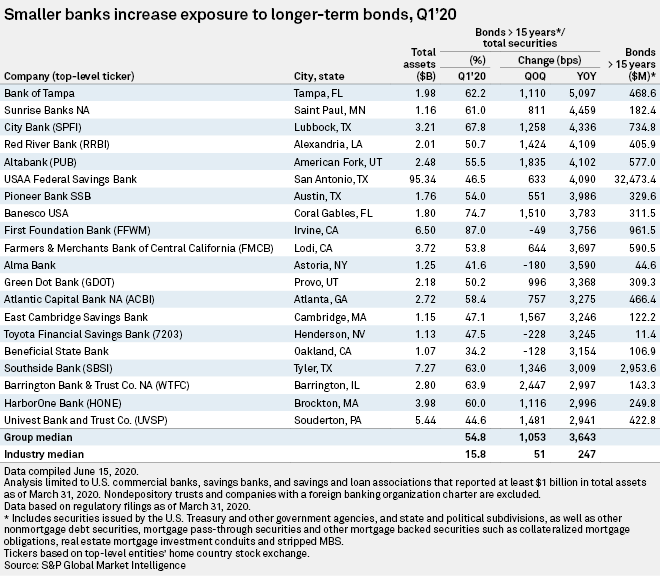

Most of the banks reporting the greatest year-over-year increase in exposure to longer-dated bonds in the first quarter were smaller institutions. Thirteen of the top 20 banks that reported the largest growth from year-ago levels had less than $3 billion in assets. Only one institution with more than $10 billion in assets — United Services Automobile Association's USAA Federal Savings Bank — was among the banks reporting the biggest year-over-year increase in longer-dated bonds.

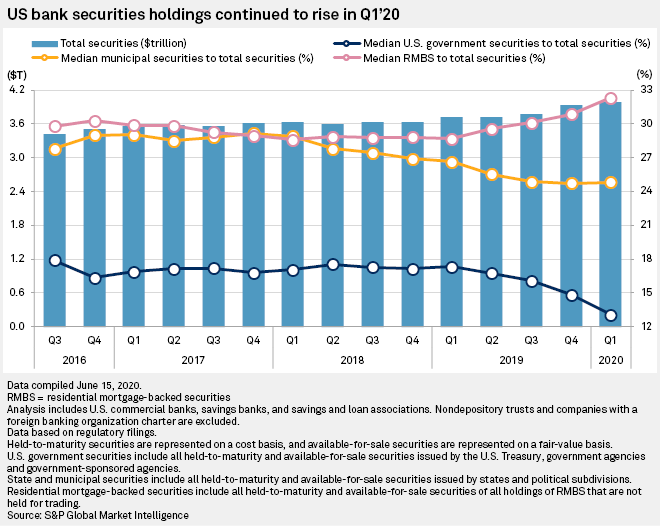

While institutions have reached further out the yield curve, they have increased their exposure to residential mortgage-backed securities. Those securities rose to a median of 32.3% of bank-held securities in the first quarter from 30.8% in the prior quarter and 28.7% a year ago. Prepayments in those securities have risen considerably in recent months, with lower rates sparking a refinancing boom in the mortgage market.

Meanwhile, as yields on U.S. government securities headed to record lows, banks significantly cut their exposures to the bonds, reducing them to a median of 13.1% of bank-held securities in the first quarter from 14.8% in the prior quarter and 17.3% a year ago.

The banking industry in aggregate slightly reduced its exposure to securities expected to mature or reprice in less than three years. Such bonds represented 28.6% of total securities held, down modestly from 28.8% in the prior quarter.

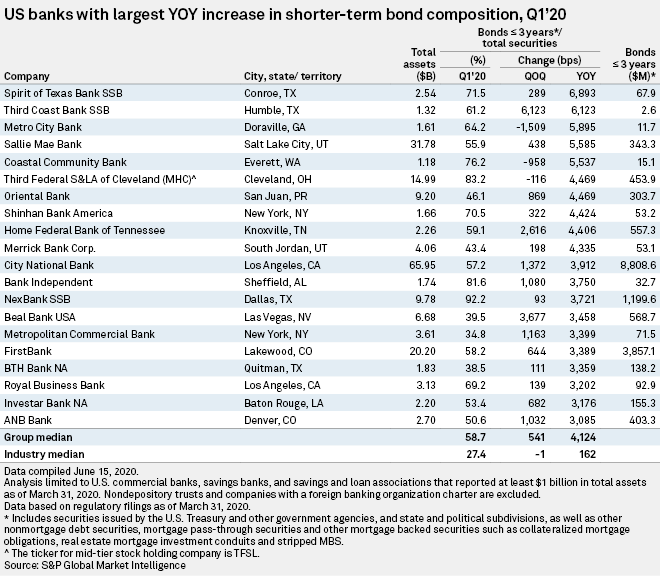

Some institutions increased those positions notably, particularly when compared with year-ago levels. At least 20 banks invested significant amounts of cash in shorter-term securities in the first quarter, with those exposures growing 30% or more of total securities when compared with the year-ago period. Any banks that increased exposure to shorter-term paper could feel greater pressure on their securities yields since they will likely have to put greater amounts of cash to work at the currently depressed market rates.